Weekly Energy Update (May 12, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices have been volatile over the past few days. A number of factors have been at play. However, the chart suggests a price range is developing between $100 to $110 per barrel.

(Source: Barchart.com)

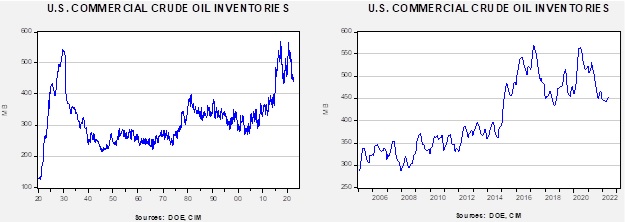

Crude oil inventories unexpectedly rose 8.5 mb compared to a 1.0 mb draw forecast. The SPR declined 7.0 mb, meaning the net build was 1.5 mb. This draw from the SPR is the largest single-week withdrawal in history.

In the details, U.S. crude oil production fell 0.1 mbpd to 11.8 mbpd, although the decline is somewhat exaggerated due to rounding. Exports fell 0.1 mbpd, while imports declined 0.7 mbpd. Refining activity rose 1.6% to 90.0% of capacity.

(Sources: DOE, CIM)

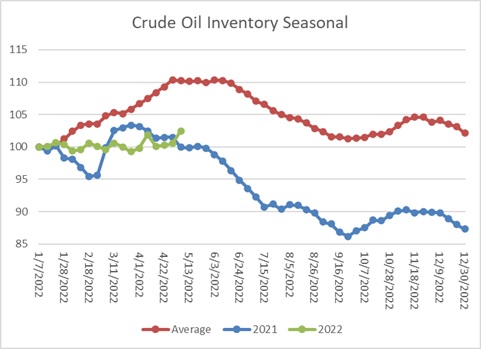

The above chart shows the seasonal pattern for crude oil inventories. This week’s report shows a sharp rise, reflecting the large draw in the SPR. As refining operations expand, the SPR sales should prevent a large draw in commercial stocks. Seasonally, the draw begins in earnest in June.

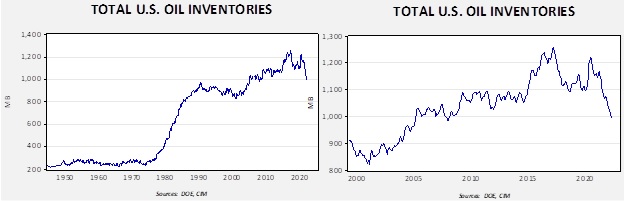

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in late 2008. Using total stocks since 2015, fair value is $87.23.

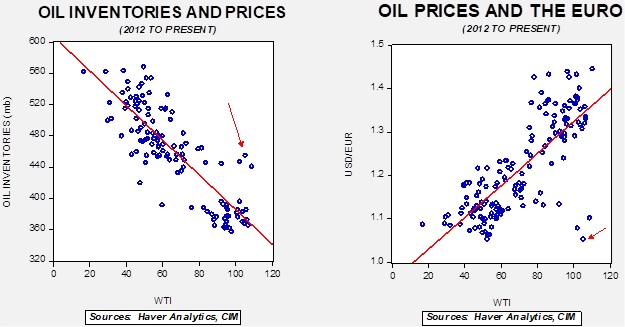

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

Market news:

- Despite high prices and requests from the U.S. to lift output, OPEC is maintaining its modest production increases. Why OPEC isn’t increasing output is unclear. One reason is that relations between the KSA and the U.S. have become strained, and Riyadh may purposely be keeping supplies tight. It is also possible the KSA may not have the capacity it claims and may not be able to lift production.

- Natural gas prices are rising on reports that Ukraine may close parts of the pipeline network that moves gas from Russia to Europe. Germany is reportedly preparing for sudden disruptions of Russian gas flows. All this news will tend to increase prices.

- Even with higher prices, U.S. drillers remain reluctant to boost supplies. Investor demands for capital discipline and rising costs dampen the attractiveness of expanding output.

- Rising natural gas prices are boosting ammonia prices as well; ammonia is a primary feedstock for nitrogen fertilizer.

- U.S. utilities warn that electricity shortages may develop this summer. Tight natural gas supplies and less available coal generation, along with transmission bottlenecks, could lead to blackouts this summer. The expansion of electric vehicles is adding to demand, exacerbating the supply crunch.

- The SPR release (which was apparently a surprise to Europe) has increased the supply of crude oil. However, with a few exceptions, most consumers can’t directly use crude oil. Thus, the oversupply of crude oil relative to product has created favorable conditions for refiners. On the futures market, the nearest 3-2-1 crack spread[1] has soared to record levels.

(Source: Bloomberg)

Complicating matters further is that product demand has been robust as much of the developed world emerges from the COVID-19 pandemic. High gasoline prices are a politically sensitive issue. This report is a primer on the gasoline market and why efforts to bring prices down will likely be less effective than hoped.

- Part of the goal of the SPR release was to boost oil exports to support EU efforts to curtail Russian imports. However, the U.S. export infrastructure is being stretched by the surge in supply.

- Last week, the Biden administration surprised the market by announcing a plan to refill the SPR. The DOE has released some details on the refill plan. We still harbor doubts this oil will ever be restored.

- Although Europe is still struggling to create a unified policy concerning Russian oil and gas (see below), the expected demand for U.S. LNG has boosted American natural gas prices. We are in a “shoulder period” for demand; as summer temps rise, demand for natural gas generated electricity will rise. The fact that prices are high now is not a good sign for consumers.

- Higher natural gas prices have boosted the demand for coal.

- The restrictions on Russian oil flows are starting to affect production. Russia has limited ability to store oil, and once there is no room to ship, wells will be shut in. In many cases, these wells will never be reopened. Russia is attempting to reorient oil exports away from the EU (India is a favored destination), but, of course, these other destinations lack the pipeline infrastructure that has been constructed in Europe.

- German/Qatar talks on boosting LNG supplies have become strained. Germany is demanding long-term contracts, while Qatar, wanting to take advantage of favorable market conditions, is balking at this idea.

- China’s COVID-19 lockdowns have weakened energy demand.

- Fuel shortages have led Nigeria to ground flights.

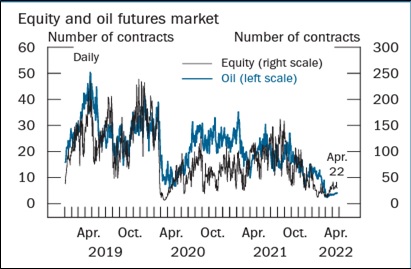

- One area of concern has been the financing of oil and gas production and shipping. Reports suggest energy hedgers face massive trading losses due to market volatility. Some of these losses will probably be recouped in the future, but the immediate need for cash could crimp available supplies. There is also evidence suggesting market depth in oil futures is under strain due to price volatility.

(Source: Federal Reserve)

Geopolitical news:

- The EU is failing to formulate a plan to embargo Russian oil and gas. The EU structure requires unanimous approval for most measures, and Hungary has objected to sanctioning Russian oil. Although we expect some sort of restrictions to be developed, it isn’t going to occur in the near term. A plan to effectively ban Russian oil shipments by denying tankers insurance has also failed due to objections from Greece.

- It should be noted that bans would adversely impact Europe. Germany could see a 12% decline in GDP if Russian natural gas is banned.

- The odds of an Iran deal appear to be lengthening. There is rising pressure in Congress to raise obstacles to an agreement, and the overall political costs are increasing. In addition, the benefits of a thaw are falling; more Iranian crude oil is leaking into the global economy as India and China increase purchases. Our position has been that a deal would never occur. Increasingly, it appears one won’t.

- Iranian President Raisi has announced subsidy cuts on bread. As wheat prices have risen, the costs of subsidies have soared. However, such cuts are risky. Most of these subsidies offer sustenance to the poor. Cutting subsidies could trigger civil unrest if inflation rises further.

Alternative energy/policy news:

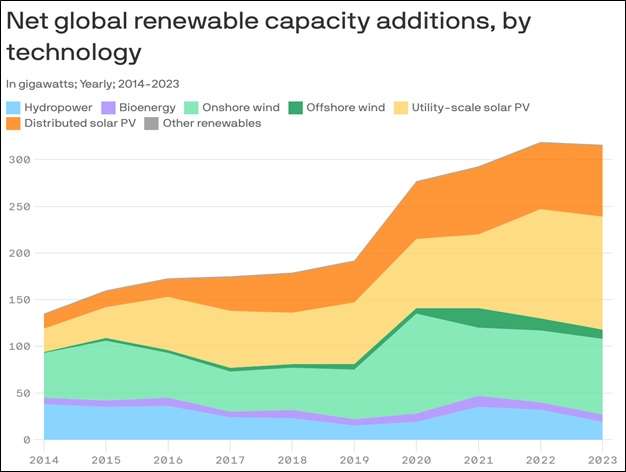

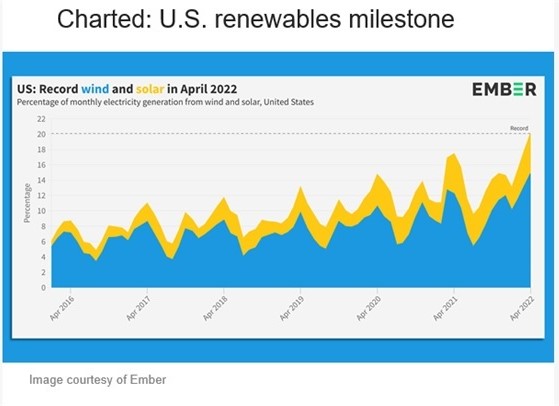

- Renewable energy output continues to expand. A recent IEA report shows how renewables are slowly offsetting conventional energy.

(Source: Axios)

- It is becoming increasingly evident that the world won’t be able to reduce carbon emissions fast enough to meet temperature goals. We are seeing increased interest in atmospheric carbon capture. The key to progress will be pricing carbon in such a way as to foster a return on investment.

- One challenge of renewable electricity is that it is intermittent. When the sun doesn’t shine or the wind doesn’t blow, electricity isn’t generated. Creating storage for electricity will be necessary for renewables to replace conventional energy supplies. Although batteries are one answer, creating gravity storage, such as lakes that move water up during the day, and allow it to flow through turbines at night, is another. A third option is to create kinetic systems that allow electricity to be generated. China is building a commercial gravity project to store wind power.

- On the topic of batteries, a number of new technologies are being tested. These include molten salt, among other materials. China’s Contemporary Amperex Technology (CATL, CNY, 379.17) is looking to build a battery production facility in the U.S.

- Since the Fukushima tragedy, sentiment toward nuclear power has been negative. However, fuel shortages and higher prices appear to have changed that opinion, and for the first time since the accident, a majority now supports nuclear power. The government plans to restart nuclear facilities to reduce the dependence on Russian natural gas.

- Miners are starting to use hydrogen in their trucks.

- The battle between solar panel installers and producers continues.

- The U.S. is starting to mine lithium to meet the demand for EVs. Needless to say, those affected near mining sites are generally opposed.

[1] This spread is (2 gasoline * 42 + 1 heating oil * 42)- 3 crude oil. Multiplying by 42 converts the gallon price to a barrel. This spread roughly mimics the output of a U.S. refinery.