Weekly Energy Update (May 5, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

It appears oil prices are attempting to create a trading range between $105 to $95 per barrel. That may hold until the SPR release is complete.

(Source: Barchart.com)

Crude oil inventories unexpectedly rose 1.3 mb compared to a 0.2 mb draw forecast. The SPR declined 3.1 mb, meaning the net draw was 1.8 mb.

In the details, U.S. crude oil production was unchanged at 11.9 mbpd. Exports fell 0.1 mbpd, while imports rose 0.4 mbpd. Refining activity slipped 1.9% to 88.4% of capacity. The decline in refinery operations is a surprise and will likely be reversed in the coming weeks.

(Sources: DOE, CIM)

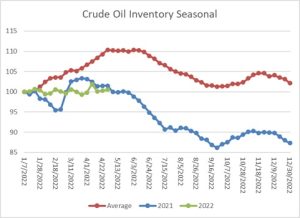

This chart shows the seasonal pattern for crude oil inventories. This week’s report is consistent with last year. Also, note that in the average data, we are at the point where the seasonal build period has ended. Over the next few weeks, we will see if we follow the average path or track last year.

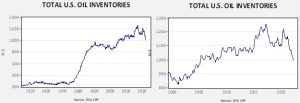

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in late 2008. Using total stocks since 2015, fair value is $85.90.

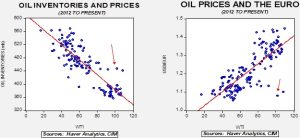

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

Market news:

- The EU is moving closer to a full embargo on Russian oil. It will likely be phased in, with Hungary and Slovakia getting an entire year to implement the plan. Oil prices have increased on the news.

- The EU is also looking at making it impossible for Russia to ensure oil shipments, which would severely hamper its ability to sell oil. Moscow could self-insure, but if a shipment is lost, Russia would be responsible for replacing the loss.

- As the two points above show, there is a clear goal among EU nations to reduce the group’s dependence on Russian energy. But the method to achieve this goal is important. Embargos reduce available supply. If the demand curve is inelastic (price-insensitive), revenue rises (price x quantity), and the supplier usually benefits. Ricardo Hausmann argues that while EU oil demand is inelastic, demand for crude oil from Russia doesn’t necessarily have that characteristic. Thus, instead of an embargo, Hausmann argues the EU should apply a high tariff on Russian oil. The higher price of Russian oil from the tariff would mostly go to the Treasuries of EU nations, denying the revenue to Russia. More complicated embargo programs that include escrow accounts and a “demand cartel” are also being floated, which would endanger Russia’s cash flow from energy. Targeting tankers is another way to reduce Russian oil sales.

- We are seeing some elements of this disruption in supply chains. Both China and India are buying Russian oil but at deep discounts.

- The EU is making progress on reducing its consumption of Russian energy, but a sudden break would likely lead to a wrenching recession.

- The Russian gas cutoff we reported last week is yet another example of the breakdown of globalization in commodity markets. This breakdown will tend to bring supply shocks and inflation.

- Although high commodity prices and a widening of destination spreads offer opportunities for commodity trading firms, price volatility increases the financial risk for these firms. We recommend this podcast for a deeper dive into this issue.

- A late spring snowstorm has reduced natural gas output from North Dakota. However, the three largest areas of U.S. natural gas production were mostly unaffected.

- The Calcasieu Pass LNG terminal has started production. Also, France has decided to enter into a long-term LNG contract with NextDecade (NEXT, USD, 6.31) to provide natural gas.

- Despite high oil prices, the latest read on U.S. oil production shows a modest decline. The monthly data is considered the official report compared to the weekly data that is released. February production was 11.3 mbpd; the estimated output from the weekly data in February was 11.6 mbpd. Still, the general expectation is that U.S. oil production will rise in the coming months.

- With energy companies reporting strong earnings, the idea of a “windfall profits tax” is being floated. In general, economists tend to oppose such measures, fearing that the announcement of a tax will thwart what the market really needs, which is more supply. Raising taxes would likely lead to less investment. The oil companies may find they can avoid these taxes only by promising to boost investment.

Geopolitical news:

- The EU has realized its dependence on Russian oil and gas was a mistake. Over time, LNG, piped gas from North Africa, and the development of natural gas from the eastern Mediterranean will ease supply issues. But, as noted above, immediate loss of Russian gas would be problematic.

- India has rather close relations with Russia. During the Cold War, India was a major buyer of Soviet military equipment that has continued in its aftermath. But the war in Ukraine has made the Modi government uncomfortable. Watching an authoritarian regime invade a democracy is difficult for the world’s largest democracy. So, we are starting to see some degree of “pushback” from India. Steelmakers are shunning Russian coal. At the same time, however, Indian state firms are considering buying Russian oil assets.

- There are reports that President Putin is going to undergo surgery for cancer

- Efforts to revive the Iran nuclear deal continue, although we still think the odds of an agreement are low. The EU would like to see a deal go through with the hopes of tapping Iranian oil and, at some point, its natural gas too. Iranian oil exports, despite sanctions, have been rising.

- CIA Director William Burns made a surprise trip to the KSA last month. Relations with the kingdom have been strained during the Biden presidency, and we suspect the visit was an attempt to repair the breach.

- The U.S. has made overtures to Venezuela as well, but Caracas’s support of terrorist groups will make the easing of sanctions difficult.

- As the Ukraine War raises commodity prices, a new bout of Arab unrest is possible.

- Tensions between Turkey and the KSA are rapidly easing as the former looks for economic support.

Alternative energy/policy news:

- Nuclear power has a bad reputation. Three disasters—Chernobyl, Three Mile Island, and Fukushima—have made nuclear power unpopular. Despite this reputation, it is undisputable; nuclear power emits no greenhouse gases. Environmentalists are noticing that when nuclear power plants close, they tend to be replaced with “dirty” fuels. We note Gov. Newsom (D-CA) is apparently “reconsidering” closing the Diablo Canyon nuclear plant, scheduled for closure in 2025.

- If nuclear power is going to make a resurgence, uranium from Russia probably won’t be in the mix. The idea that U.S. output may rise has raised worries in the American West.

- Europe needs to acquire key metals to make the energy transition.

- In China, we are seeing a resurgence in coal consumption and plans for nuclear power expansion. The country is also the world’s largest importer of LNG. Solar installations appear to be lagging.

- Temperatures in India have been reaching unbearable levels, triggering rising electricity demand. This factor is lifting the demand for coal.

- Hydrogen has been something of the “Holy Grail” of clean fuels. Having no carbon associated with the gas, it is very clean and efficient. Nevertheless, producing it can be problematic. “Green” hydrogen is usually made from electrolysis from clean energy, e.g., solar or wind. “Blue” hydrogen is usually derived from natural gas. “Gray” hydrogen comes from using electrolysis from conventional electricity. However, less talked about is the lowest cost “gold” hydrogen. This gas occurs naturally and can be captured similarly to natural gas. It isn’t clear how much gold hydrogen is available, but exploration efforts are beginning.

- The major U.S. political parties are forced coalitions. They house disparate groups that may not have many characteristics in common. The GOP is generally considered more friendly to extractive industries, but there is an emerging Conservative Climate Caucus that wants to modify the perception of Republicans on environmental issues. Some of this new group could be based on age; younger voters tend to be more supportive of climate issues.

- In something of a surprise, DeSantis (R-FL) vetoed a utility-supported measure to reduce the attractiveness of home solar installations.

- Rising input costs are hurting the earnings of battery manufacturers.

- The U.S. solar power industry is divided between manufacturers, who want tariffs on Chinese imports, and installers, who want to have the foreign product available. The lack of policy clarity is “freezing” the industry. A number of senators are calling for an end to the solar study.

- Fidelity (FNF, USD, 39.29) has decided to support bitcoin in 401(k) accounts. The company faces criticism due to the massive energy consumption that occurs in the mining process.

- Although ethanol is considered “green” because it is made from renewable inputs, the process of fermentation creates a surprising level of CO2. This report discusses efforts to capture the gas and pipeline it to disposal sites. Interestingly enough, plans to build pipelines for the gas have struggled to get approved.

- The Niskanen Center argues that tax credits for EVs are targeting the wrong drivers. Instead of a system that seems to be attractive to higher-income drivers (who tend to opt for greater fuel efficiency anyway), the think tank argues the incentive should target high-mileage drivers. In other words, the EV credits should go to drivers who have long commutes.

- Volkswagen (VWAGY, USD, 21.54) announced its EVs are “sold out.”

- Manchin (D-WV) is considering supporting carbon tariffs on high carbon imports.

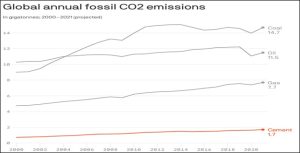

- Entrepreneurs are working on “green” cement. Cement is a surprisingly high contributor to greenhouse gases.

(Source: Axios)