Weekly Energy Update (March 30, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil decisively broke its recent $72-$82 per barrel trading range. Recent weakness was exacerbated by funds that sold out of long crude oil positions. Prices have recovered to the lower end of the previous trading range. We will see if this acts as resistance.

(Source: Barchart.com)

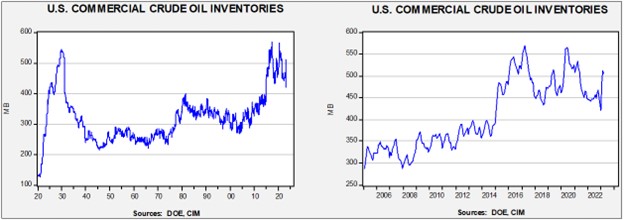

Crude oil inventories plunged 7.5 mb compared to the forecast of a 1.5 mb build. The SPR was unchanged.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.2 mbpd. Exports fell 0.3 mbpd, while imports dropped 0.8 mbpd. Refining activity jumped 1.7% to 90.3% of capacity.

(Sources: DOE, CIM)

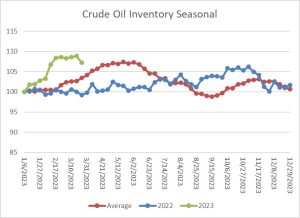

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and then declined this week due to the rise in refinery activity. Levels are nearing seasonal norms, which should relieve the bearish pressure on the market.

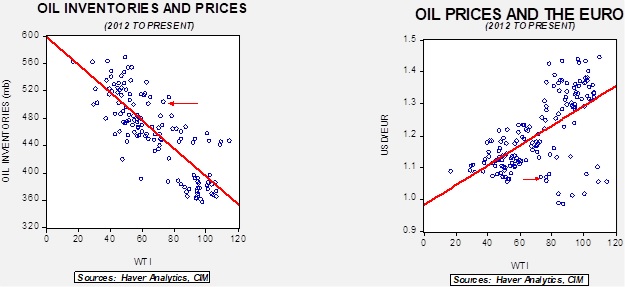

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $54.26. Although we think there is enough geopolitical risk in the world to prevent a decline to this level, it does suggest that the oil market is dealing with rather weak fundamentals.

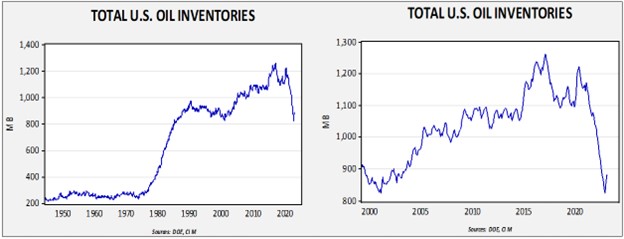

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $93.58.

Market News:

- We have held a generally bullish position on oil and gas because of persistent underinvestment. The ESG movement has raised concerns that long-term demand will fall, and since many projects have long lead times, investment has been discouraged. When investors buy into a “sunset” industry, they don’t expect growth but instead demand high current returns in the form of high dividends and stock buybacks. Investment, which reduces current returns, tends to be frowned upon. The outcome is that oil and gas prices will likely remain elevated until energy alternatives grow enough to render oil and gas irrelevant. That might take a long time.

- Drillers have gone into this year with reduced hedges and are therefore vulnerable to price declines. This fact might make oil equities more sensitive to falling prices.

- The Ukraine war has led to a major restructuring of global oil and gas flows. As Russian oil is increasingly sold to China and India, the U.S. has become a key exporter to the EU. Similar patterns are emerging for LNG. As we noted last week, Russia has replaced the Saudis as the lead supplier to China. China and India are taking advantage of this restructuring by purchasing Russian oil at lower prices.

- China’s recovery from its Zero-COVID policy is expected to lift oil demand. Forecasters expect that this recovery will account for 40% of this year’s growth in demand.

- The Chamber of Commerce is pressing to speed up permitting for energy projects. Interestingly enough, it’s not just oil and gas companies that are supporting the effort.

- Western sanctions have changed global oil flows. One result of this rerouting is a glut of diesel fuel in Asia.

- Despite promises, the Biden administration continues to delay the rebuilding of the SPR. Our position is that these delays will become permanent.

Geopolitical News:

- Last week, there was an attack on a U.S. military post in eastern Syria. Iranian-backed militants were involved, and the U.S. has retaliated with air strikes. Although the U.S.’s commitment to the region is being questioned, it is important to remember that the American military footprint in the Middle East is still substantial. The attacks have increased tensions between the U.S. and Iran. It is arguable that Iran is using such attacks to encourage the continued withdrawal of the U.S. from the region. Meanwhile, the administration is trying to avoid escalation while also maintaining a presence in Syria.

- Internal tensions within Iran remain elevated. The leadership is trying to decide if its harsh response should be adjusted.

- Oil exports from the Kurdish region of Iraq have been halted as Iraq has won an arbitration ruling concerning the control of oil flows from the area. The news was offered as the reason for this week’s bounce in crude oil prices, although we suspect that technical selling had been exhausted.

- Russia has become a major investor in Iran. We are seeing a China/Russia/Iran bloc emerge fostered by Western sanctions.

- The U.S. has added sanctions on firms involved in the Iranian drone supply chain.

- Russia is supplying Iran with cyberweapons.

- Russia is working to restore relations between the Assad regime in Syria and the Kingdom of Saudi Arabia (KSA).

- Although Russia was unable to get the UN to investigate the Nord Stream pipeline explosions, Moscow says it will continue to call for international investigations.

- Russia has cobbled together an aging fleet of oil tankers to evade Western sanctions. There are growing concerns that the state of these vessels could trigger an environmental incident.

- Although Russia was initially able to evade sanctions and benefit from high oil prices, as the war grinds on, there is growing evidence that the Russian economy is starting to topple. There are increasing reports of labor shortages, caused by military recruitment and draft avoidance, and the lack of Western investment is beginning to take a toll. If this continues, it could lead to less oil being available on world markets.

- We have been monitoring the rapidly evolving diplomatic situation in the Middle East. One element of that change was China’s involvement in fostering a détente between Iran and the KSA. This change has somewhat isolated Israel, and we note that the Israelis, who view Iran’s nuclear program as an existential threat, are warning that uranium enrichment above 60% may trigger a military response.

- The KSA announced it will invest and participate in the construction of a new refinery in China. The Saudis have agreed to store oil in China as well.

- The KSA has formally joined the Shanghai Cooperation Organization, a China-led group of like-minded nations. This action is further confirmation of the KSA’s drift toward Beijing.

- The biggest prize in the region, in terms of oil production, might be Iraq. The country produces about 4.5 mbpd, but some analysts believe it could lift production to rival the KSA. With 20-year retrospectives being made on the U.S. invasion of Iraq, one unfortunate consequence is that Iraq has never developed a working government. For the most part, governments have been riven by religious and ethnic strife, and corruption is endemic. As we noted in a recent Bi-Weekly Geopolitical Report, China viewed the Iraq invasion as evidence that the U.S. was trying to secure oil supplies. Although events tend to discount that take, as we note in the report, Beijing’s opinion on the matter hasn’t changed. As a result, China has been encroaching on the region to secure oil flows. We could see Beijing try to bring order and investment to Iraq; however, as the U.S.’s experience has shown, it can be hard to manage the divisions in the region.

- Mexican President AMLO has generally pined for a return to the 1930s when the Institutional Revolutionary Party (PRI) created its political monopoly. One of its tools was the nationalization of the Mexican oil industry. In recent years, Mexico has gradually opened its oil industry to foreign investors in a bid to lift production. AMLO has aimed to reverse that opening but has generally found it impossible to do so without declines in production. Thus, we are seeing a reopening of Mexico’s oil industry to foreign companies.

- Venezuela has arrested 21 people connected to a corruption scandal tied to PDVSA, the state oil company. Oil exports have been curtailed due to various investigations.

Alternative Energy/Policy News:

- This week, the Biden administration is expected to issue rules on what exactly will qualify for the green subsidies associated with EVs. Trade negotiators are actively trying to shape the outcome.

- Change creates winners and losers. Although there is the rare circumstance of a win/win scenario, we find that such an outcome is exceedingly rare in real life. Geothermal energy may be about as close as we can get to clean, low-cost power with seemingly few “losers.” Japan has great geothermal potential as it rests on the ring of fire, a region of the world where volcanic activity is near the surface, meaning that tapping the planet’s inner heat is easy. Yet, Japan has been slow to exploit this power source, which is a bit shocking given that the island nation is notoriously energy deficient. Why? Japan is famous for its hot springs and the owners of these springs fear that tapping this resource will harm the springs and end their livelihood.

- As cities implement regulations to curb greenhouse gases from buildings, direct geothermal power is one alternative that might help buildings meet the new rules.

- Europe continues to expand its solar power but is increasingly beholden to China for raw materials and technology. This is a vulnerability the EU feels it must address (see below).

- The U.S. and Japan have entered a narrow trade agreement on critical minerals. The U.S. is moving away from large, multilateral trade arrangements, but narrowly focused ones are getting done. We note that it looks increasingly likely that the EU will join the U.S. and Japan in this effort.

- As we noted last week, carbon capture technology will likely be critical in curbing the effects of greenhouse gases, and the field is rapidly evolving. This database from the IEA shows all the global projects underway.

- Researchers have successfully created “green” hydrogen from seawater. If this process is scalable and economical, it could provide an alternative to electrification for transportation.