Weekly Energy Update (March 24, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After falling last week, oil prices have moved steadily higher on continued tensions in Ukraine.

(Source: Barchart.com)

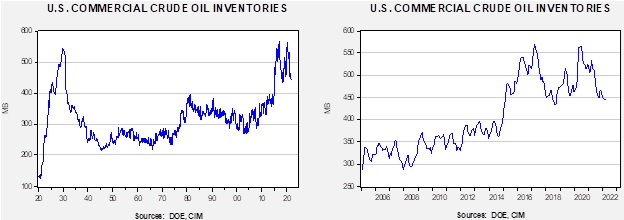

Crude oil inventories fell 2.5 mb compared to a 0.5 mb draw forecast. The SPR declined 4.2 mb, meaning the net draw was 6.7 mb. The withdrawal from the SPR was near the surge maximum of 4.4 mbpd, which suggests the government is moving aggressively to lower oil prices.

In the details, U.S. crude oil production was unchanged at 11.6 mbpd. Exports rose 0.9 mbpd, while imports rose 0.1 mb. Refining activity rose 0.7% and is now 91.1% of capacity.

(Sources: DOE, CIM)

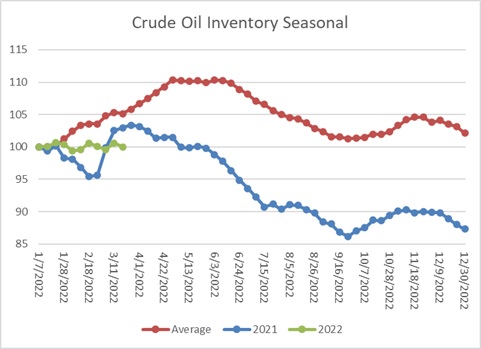

This chart shows the seasonal pattern for crude oil inventories. We are seeing inventories continue to diverge from the usual seasonal pattern.

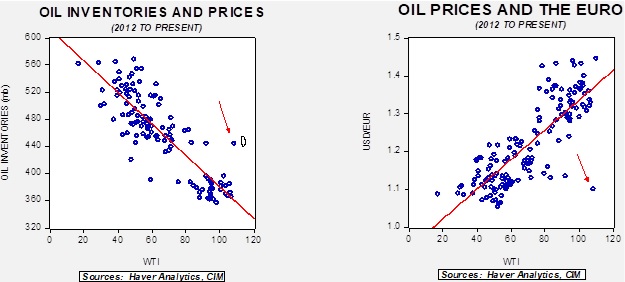

These charts make evident that the normal relationships between the dollar, inventory, and oil prices are currently broken. However, the chart on the left indicates the degree of overvaluation has narrowed. The first report after the war started is represented by the circle; we have seen prices move in (the average daily price during the month of March is used for this dot). Overall, the market is consolidating after the major war spike. We look for continued consolidation, although we note that the situation with Ukraine remains fluid, and prices could move strongly in either direction on war news.

Market news:

- The Dallas FRB has published a good primer on the impact of the Russian oil situation. The same source is trying to quash the idea that banning crude oil exports would not significantly reduce U.S. oil prices. We have been hearing rumors that the Biden administration is considering such measures. For this to work, the U.S. would likely have to ban product exports, which would likely lead to other nations doing the same.

- As we discussed in a recent Bi-Weekly Geopolitical Report, sanctions placed on Russia’s central bank have rendered most of Russia’s foreign reserves valueless. However, in a new twist on payment systems, Russia is now demanding that “hostile states” pay for natural gas in RUB. This announcement has sent European gas prices higher and has led to a modest appreciation of the RUB. It isn’t clear how European buyers will acquire RUB. Obviously, Russian banks would likely be happy to sell them RUB, but sanctions may make the transaction difficult. In any case, the announcement will likely lead to a reduced supply of gas in Europe.

- Storms around the Caspian Sea have reduced oil flows from the region.

- There is an old adage in commodity markets that “nothing cures high prices like high prices.” The basic idea is that high prices send signals to both consumers and producers to change behavior. Producers are told to raise production; consumers are told to conserve. However, as we have reported for the past months, ESG has reduced the producer side of the equation’s ability to react. The usual supply response has been, thus far, moderate.

- In addition to funding constraints, domestic producers are facing other hurdles. The labor markets are tight, which means finding workers is difficult. Pay for oil workers hasn’t risen much, meaning workers are finding higher-paying jobs in other industries. There are also reports of oil worker strikes. Diesel markets are also tight, and drilling equipment is usually moved to sites by this fuel. Fracking sand prices are up 185% from last year due to tight supplies and transportation bottlenecks. Rig counts are rising, but so far, S. production growth has been flat. The lack of supply response has been a political issue; we note the Biden administration considered issuing gas cards as a way to dampen the political fallout from high gasoline prices but rejected the idea as unworkable. We expect production to rise over time. In the U.S., smaller producers are starting to ramp up, while the KSA is also considering new investment (although, as we note below, there is a geopolitical element to Saudi Arabia’s production policy).

- At the same time, high prices and the prospect for fewer Russian supplies are starting to trigger investment activity. An Indonesian firm, Pacific Energy Corp, has expressed interest in expanding LNG production in Canada.

- On the demand side, high prices would usually move consumers to reduce demand. However, oil and gas demand, in the short run, is price inelastic, meaning that there is an insensitive reaction to price changes. Why? Mainly because there are few substitutes for energy. This condition also means that rising energy prices hurt consumers. Governments are trying to reduce the pain for households, but by doing so, they also dampen the adjustment process. After all, if households don’t feel the sting of higher prices, there is little incentive to change behavior, which does occur over time. The IEA recently published a report on how households can respond to high energy prices; all of them require changes in behavior that, if popular, would have already been in place. The political class is facing an angry electorate over gasoline prices, and there isn’t much that can be done.

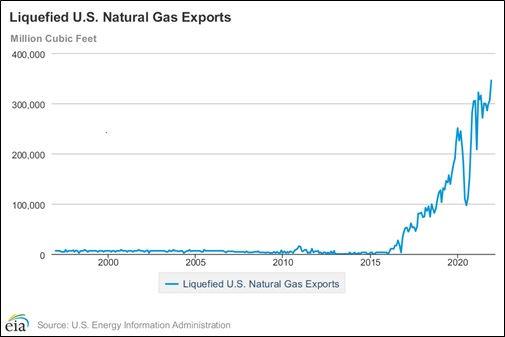

- Europe is trying to figure out how to reduce its dependence on Russian natural gas. This goal is daunting, but some progress is being made. Germany is trying to secure LNG supplies; it has made a deal with Qatar, which should increase gas supplies from the Middle East over time. In the short run, Europe will be scrambling to secure supplies. For one thing, natural gas storage levels are very low. S. LNG exports have been rising rapidly in recent years.

But not all of this gas will go to Europe unless pricing supports those flows. Recent pricing has been supportive of flows going to Europe, but that may change if Asia also tries to lift inventories. The U.S. has relaxed some trading rules recently that may help lift LNG exports to the EU. But, there is one problem looming in this scenario; it appears we will have a “back-to-back” la Niña, which raises the chances for extended drought and a hotter-than-normal summer. The last time this sort of event occurred was in 2012. The summer of that year, for the region east of the Rockies, was quite hot. July of that year was the second hottest on record in terms of population-weighted degree days, and June was the 12th hottest. If the U.S. has a hot summer, it may not be possible for America to boost LNG supplies to Europe.

- We continue to closely monitor the financial liquidity situation in the commodity markets. When producers hedge, they are trading price risk for liquidity risk. The hedge margin has to be paid today for production that might not occur for months. The jump in volatility is playing havoc on firms’ liquidity situations, and they are asking for help. Even coal producers are suffering. If financing isn’t available, supply availability will likely fall.

- There are reports that Russia is able to trade oil through private channels. These transactions are not sold to the highest bidder but to whoever will engage in the business. That likely means lower prices.

- The IEA, EIA, and OPEC have sharp disagreements on the outcome of the current crisis. This divergence creates problems for policymakers because it may lead them to over-or underreact.

Geopolitical news:

- The war in Ukraine continues, as do the sanctions. The EU is considering an oil embargo against Russia, but so far, the group has been unable to decide for sure if it will take such action. President Biden is on his way to Europe and has announced direct sanctions on hundreds of Russian lawmakers. Poland has expelled 45 Russians “pretending to be diplomats.” Meanwhile, major oil service companies are pulling out of Russia, which could have serious negative effects on oil production. The U.S. claims the sanctions are reducing oil sales and revenue to Moscow. At the same time, note that Iran was able to evade sanctions over time.

- German regulators warn that energy rationing may be necessary next year.

- Self-sanctioning continues, with TotalEnergy (TTE, USD, 51.07) announcing it will stop buying Russian oil by year’s end.

- Although the U.S. has not returned to the JCPOA quite yet, it appears the deal will resume at some point. Russia was able to build in a carveout of current sanctions to build nuclear power facilities in Iran.

- Since the end of WWII, the U.S. and the KSA have had a mostly stable relationship. There were occasional differences. The 1973 Arab Oil Embargo was a reaction to dollar policy and the support of Israel in the Yom Kippur War. And clearly, 9/11 was a problem. We are currently in another “spat.” President Biden has taken a dim view of Crown Prince Salman, and the Saudi leader has been reluctant to support higher oil production and lower prices. In addition, the KSA is entertaining the accepting CNY for China’s oil sales. At the same time, the KSA remains dependent on the U.S. for defense; recently, the U.S. sent Patriot missile systems to Saudi Arabia to protect it from Houthi drone attacks. We also note that the KSA, likely to garner support for its involvement in the Yemen war, is warning that it may not be able to meet the demand for its oil if it comes under attack from the Iranian-backed Houthis. PM Johnson recently visited the KSA and UAE, probably acting as an emissary for the West. At some point, we expect the U.S. to patch up relations with Riyadh, but it will likely take a direct outreach from President Biden.

Alternative energy/policy news:

- As oil prices rise, interest in EVs is rising. However, battery production is dependent on several key metals, which are increasing in price. Volkswagen (VWAGY, USD, 24.32) is working to secure battery supplies from Asia.

- China is resurrecting the idea of battery swapping for cars. Doing so extends the range and, in theory, reduces wait times.

- We have been reporting for some time about nuclear power. The Ukraine War may undermine the move to nuclear power, as Russia is a major supplier of uranium. Moscow is proposing a ban on uranium exports, and U.S. regulators are considering measures to boost domestic production.

- Fears of a Russian ban are undermining fusion as well.

- As oil and gas prices rise, environmental concerns struggle to gain attention. However, there is a proposal that the SEC will start requiring publicly traded firms to make climate disclosures.

- Last week, we reported on geothermal power, which may become even more attractive due to the current geopolitical turmoil.

- Norway is investing in green hydrogen. Recent studies hold the promise of low-cost hydrogen from electrolysis.

- An overlooked part of alternative energy is efficiency. Staxxon, a privately held company, is perfecting a foldable storage container that would improve shipping efficiency.