Weekly Energy Update (March 2, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil remains in a trading range between $72-$82 per barrel.

(Source: Barchart.com)

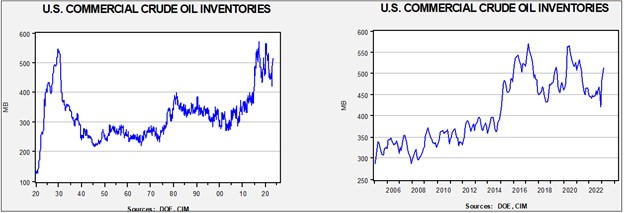

Crude oil inventories rose 1.2 mb compared to a 1.8 mb build forecast. The SPR was unchanged.

In the details, U.S. crude oil production was unchanged at 12.3 mbpd. Exports rose 1.0 mbpd, while imports fell 0.1 mbpd. Refining activity fell 0.1% to 85.8% of capacity.

(Sources: DOE, CIM)

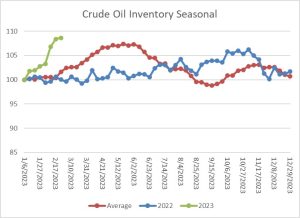

The above chart shows the seasonal pattern for crude oil inventories. We have been accumulating oil inventory at a rapid pace, even without SPR sales. The primary culprit is low refining activity, which should pick up later this year. The rapid rise in stockpiles is a bearish factor for oil, and current stockpiles have already exceeded the five-year average peak normally seen in early summer.

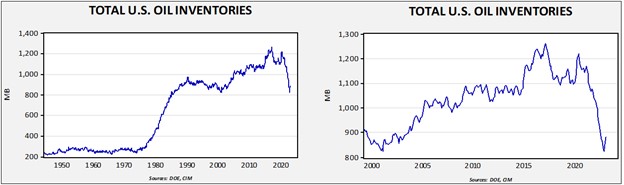

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

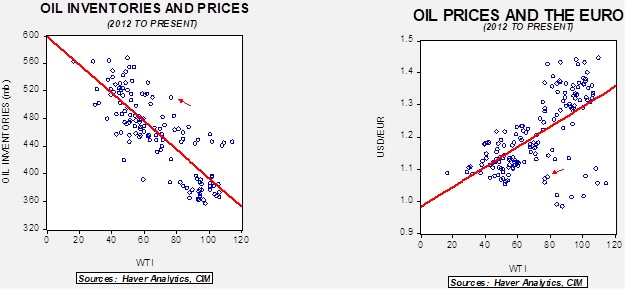

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $94.18.

Natural Gas Update:

Natural gas prices have been under pressure this winter, mostly due to mild temperatures.

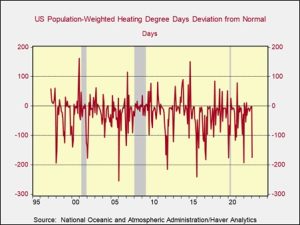

This chart shows the deviation of population-weighted heating degree days[1] for the U.S. compared to the average from 1981 through 2010. A negative reading suggests warmer-than-normal temperatures, meaning fewer heating degree days. Although this January was not the mildest on record, heating degree days were clearly below normal.

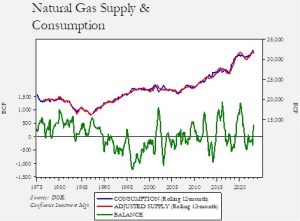

In looking at the trend of supply and consumption, currently the market is oversupplied (indicated by the balance variable being greater than zero). Interestingly enough, consumption remains robust but so does supply growth.

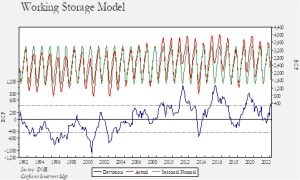

Because of the warm winter, current inventories are above normal.

The previous chart shows seasonally adjusted working natural gas storage. As the deviation line shows, stockpiles are above normal. We have one more month of storage withdrawals. In April, the inventory injection season begins.

Market News:

- As Russian oil flows to Europe decline, we are seeing the U.S. gain market share. Throughout history, the U.S. has, at times, been a major supplier of oil to Europe. Often, these flows have occurred due to wars or other such events. History seems to be repeating itself.

- Reports suggest that Venezuelan crude is also going to Europe.

- Meanwhile, China has been an aggressive buyer of U.S. crude oil as well.

- Last month, the Europeans ended the purchase of Russian oil products, and it appears that these products are now flowing to North Africa. It is not out of the question to assume that some of these products may “leak” to Europe.

- Russia has halted oil flows to Poland.

- Platts (SPGI, $341.51) announced it will include WTI in its Brent basket for calculating prices. This decision may narrow the Brent/WTI spread.

- OPEC February production rose 150 kbpd. Two-thirds of this rise came from Nigeria.

- The IEA has released its annual natural gas report. One key finding is that Europe is rapidly building out LNG receiving capacity.

- Despite the recent decline in EU natural gas prices, chemical firms continue to exit Germany due to high costs.

- Saudi Aramco (2222, SAR, 31.55) is considering an investment in a foreign LNG plant as demand surges.

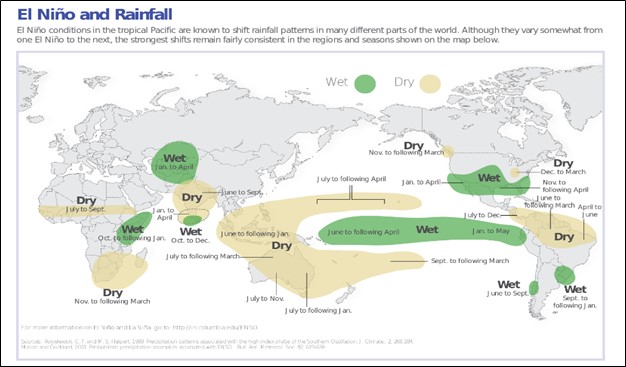

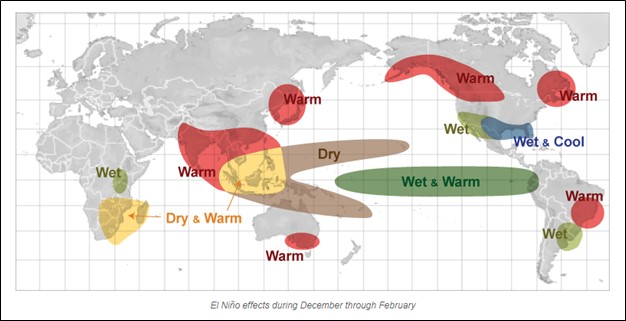

- After three consecutive La Niña events, the World Meteorological Organization says the odds of an El Niño in 2023 are elevated. The following maps show the possible global impact on temperatures and precipitation.

(Source: NOAA)

The below map shows likely winter temperature effects from El Niño.

(Source: weather.gov)

- Although strong pricing of oil should support increased drilling activity, shale producers have been raising output slowly. Rising production costs and less attractive fields are capping production growth.

- After more than 70 years, BP (BP, $39.87) announced that it will cease publishing its Statistical Review of World Energy. The report will now be compiled by the Energy Institute.

Geopolitical News:

- After a couple months of operating the price cap on Russian oil sales, the data suggests that the cap hasn’t led to lower prices but has succeeded in fragmenting the global oil market. That doesn’t mean the cap will never work, but as of now, the cap hasn’t affected prices. In the wake of this research, there are calls for tighter sanctions. The problem with this approach is that consumers must accept the tradeoff of higher prices.

- Indian buyers report that complying with G-7 sanctions has become complicated and burdensome and may lead to less Russian oil imports.

- Sanctions are degrading Russia’s refining industry. Some sanctions ban purchases of Russia’s refined products, but problems go beyond just the loss of market access. Personnel losses due to the war or emigration are also having an adverse impact.

- Two weeks ago, we discussed the report from Seymour Hersh that accused the U.S. of attacking the Nord Stream pipelines. We note that even before the sabotage, natural gas flows had been interrupted on several occasions. It appears that German firms are beginning to take legal action against Russian firms for failing to meet their contractual obligations.

- In the wake of the Nord Stream attacks, we are hearing of increased Russian activity in the North Sea. This region is not only an active oil and gas region, but it is also laced with fiber optic cables that could be severed. The fear is that Russia may begin its own sabotage operations in the area.

- Iran appears to be preparing for a broader rupture with the West over uranium enrichment. Meanwhile, the Iranian rial (IRR) is depreciating rapidly; it is reportedly trading at IRR 575,000/USD 1. An iPhone now costs over one billion IRR.

- General Hossein Salami, the commander of Iran’s Islamic Revolutionary Guard Corps, claims that Iran is “at war” with Europe. It’s not clear what triggered this statement, but one likely reason was the EU’s reluctance to break with the U.S. over the JCPOA.

- Iran is claiming it has a hypersonic missile, and the country is working to expand its footprint in space by collaborating with Russia. Russia is also helping improve Iran’s missile program.

- Brazil allowed two Iranian naval vessels to make a port of call despite U.S. objections. The “global south” is increasingly opposing U.S. and European policy goals.

Alternative Energy/Policy News:

- China has been able to expand its mining and processing of rare earths and other minerals by accepting lower environmental standards. However, Beijing has been steadily implementing stricter environmental standards in recent years. It appears this rolling crackdown may reduce lithium by as much as 10% of global supplies. We do note that production appears to have resumed, but the fact that it can be closed quickly will likely lead EV producers to hold more inventory.

- China is looking to invest in Bolivia’s troubled lithium industry.

- Chinese auto battery makers are reducing costs to their domestic EV industry, which could give them an advantage in the global EV market. Among other EV producers, there is a clear attempt to vertically integrate to secure supply chains.

- Lithium prices are falling due to declining battery prices in China.

- Auto unions are beginning to realize that the shift to EVs will mean fewer jobs.

- China is reportedly boosting its wind energy capacity.

- One, albeit controversial, way to address climate change is with geoengineering. Geoengineering encompasses a wide range of interventions designed to cool the planet. One idea is to mimic volcanic eruptions which spew particulates into the upper atmosphere. After major eruptions, temperatures tend to fall for several months. We note that a startup firm claims it is using weather balloons to disperse particles into the stratosphere in a bid to cool temperatures. The practice is controversial because it is cheap enough for private actors to perform but various tactics could have unanticipated side effects. Scientists have been calling for more research on geoengineering as a way to slow implementation until we can get a better idea of what various practices will actually do.

- Lurking in the background of clean fuels is hydrogen. The gas burns cleanly in a fuel cell with high efficiency. The problem is getting the hydrogen. In general, it comes from two sources: electrolysis and by splitting natural gas. The former breaks down water into oxygen and hydrogen, usually at a great cost, and the latter isn’t much cleaner than just burning natural gas. However, there may be a direct source as there are pockets of hydrogen available in free form. These sources have mostly been ignored by the industry, but there is now growing interest in free hydrogen which may prove to be a cheap, clean, and abundant source of energy.

- Direct carbon capture could conceivably reverse climate change. The problem is that current methods are either too small to matter or consume too much energy. Researchers are working to tap thermal energy to address the problem.

- Japan is starting commercial production of “semi-solid” batteries. Although they have less capacity, they are considered safer and less polluting.

- Japan is also returning to nuclear power, reversing policies enacted after the Fukushima disaster.

- China’s purchases of Russian uranium are raising fears of a new arm’s race. In addition, as nations expand their nuclear weapons capacity, it could drive up the price of uranium used for power production.

- Biochar comes from heating biomass in the absence of oxygen. The resulting charcoal-like lumps can be applied to soil and will absorb carbon.

[1] Heating degree days (HDD) are a measure of how cold the temperature was on a given day or during a period of days compared to 65oF. For example, a day with a mean temperature of 40°F has 25 HDD. Two such cold days in a row have a total of 50 HDD for the two-day period.