Weekly Energy Update (March 17, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

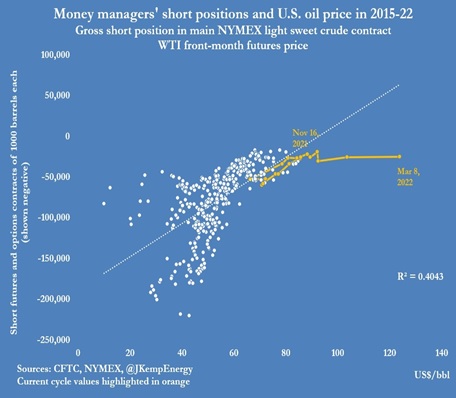

Oil prices have fallen to near pre-invasion levels. The initial rally was driven by short covering, and price volatility has reduced market participation.

(Source: Barchart.com)

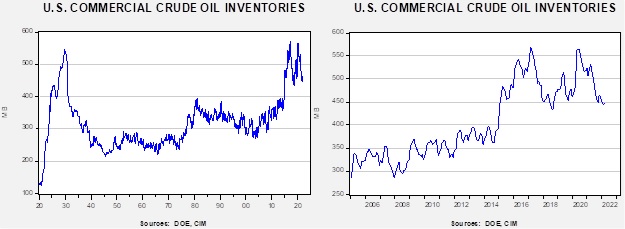

Crude oil inventories unexpectedly rose 4.3 mb compared to a 1.6 mb draw forecast. The SPR declined 2.0 mb, meaning the net build was 2.4 mb.

In the details, U.S. crude oil production was unchanged at 11.6 mbpd. Exports rose 0.5 mbpd, while imports fell 0.4 mb. Refining activity rose 1.1% and is now 90.4% of capacity.

(Sources: DOE, CIM)

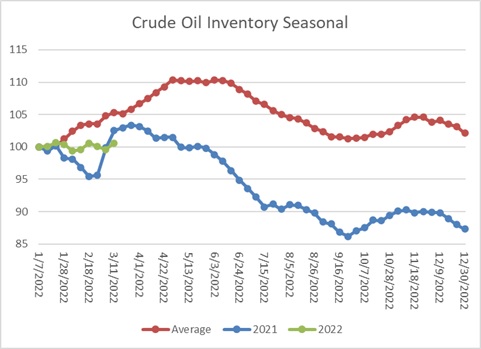

This chart shows the seasonal pattern for crude oil inventories. Even though inventories rose this week, they remain below last year and well below the seasonal average.

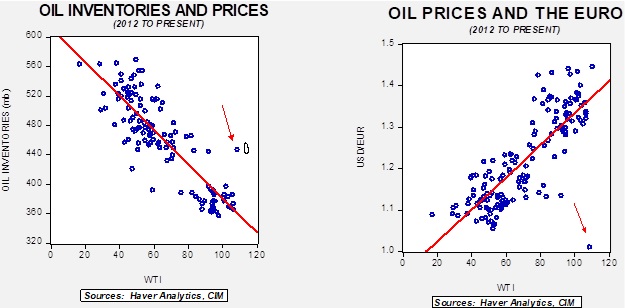

These charts make evident that the normal relationships between the dollar, inventory, and oil prices are currently broken. However, the chart on the left indicates the degree of overvaluation has narrowed. Last week is represented by the circle; we have seen prices move in (the average daily price during the month of March is used for this dot). Overall, the market is consolidating after the major war spike. We look for continued consolidation, although we note that the situation with Ukraine remains fluid, and prices could move strongly in either direction on war news.

Market news:

- The oil market has been rocked by massive price volatility. As the above chart shows, we are seeing giant swings in the market. The spike we have seen recently appears to be a product of short covering.

As the chart above shows, we have seen a bout of short covering. Producing hedgers often use short positions in the futures markets or in over-the-counter instruments. When prices spike higher, a hedged producer will see the value of the short hedges fall rapidly. Eventually, of course, the producer will sell higher-priced crude into the cash market, but until the sale is made, the hedger will face margin calls to maintain the short hedges. Essentially, a hedger trades price risk for liquidity risk. The current extreme situation is creating conditions of liquidity risk for the oil industry (metals too, as seen by the LME closing the nickel trading pit) and creating calls for central bank support.

- The recent rise in oil prices has prompted calls for increased oil production, but the response by industry has been cautious. OPEC appears unwilling to accelerate production. It is worried about the lingering impact of the pandemic and policy tightening across the world. S. producers face funding constraints from Wall Street, which wants producers to ensure that any additional production is profitable.

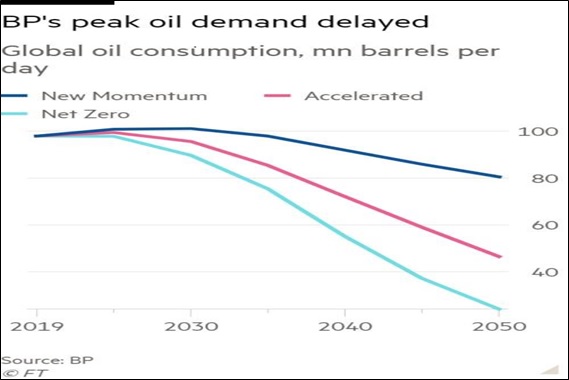

- Complicating matters is that in its annual demand forecast, BP (BP, USD, 28.52) is projecting peak demand, in the most optimistic case, by 2030 and, under alternative scenarios, sooner.

It is hard to justify increased investment into declining demand; the odds of creating stranded assets are elevated.

- Another area of concern is pipelines. Environmental groups have been focusing on pipelines to reduce oil and natural gas flows in a bid to cut consumption. Standing in the middle of industry and environmentalists is the Federal Energy Regulatory Commission (FERC), which approves pipeline projects. The FERC recently issued guidelines that hopefully will make the process less uncertain.

Geopolitical news:

- The biggest geopolitical news continues to be the Ukraine War, but it isn’t the only event that matters. The Iran nuclear deal remains a significant issue. The Biden administration has pushed to return to the 2015 deal. A return has looked imminent for weeks, yet the talks remain stalled. The most recent snag is that Russia wants guarantees it could continue to invest in Iran and avoid sanctions. It appears that hurdle has been overcome; the agreement narrows the sanctions relief only to areas affected by the JCPOA. Now the U.S. will need to approve this arrangement. It remains unclear whether the Biden administration will accept this loophole, but Moscow claims it has “written” relief.

- With the loss of Russian oil, the U.S. has moved to improve relations with Venezuela. So far, despite last week’s release of prisoners by Caracas, the U.S. hasn’t moved to ease sanctions. Nevertheless, we might see the U.S. ease up on Venezuela in an attempt to pull Caracas out of Russia’s orbit.

- While there are reports that Ukraine and Russia are formulating a ceasefire arrangement, the removal of sanctions remains uncertain. And, the disinvestment that has occurred will not likely be reversed anytime soon.

- As we have noted, the U.S. has been trying to “pivot to Asia” since the Obama administration. The JCPOA was an attempt to reduce America’s commitment to the Middle East. This signal of withdrawal has raised tensions between nations in the region and Washington. The KSA has invited General Secretary Xi to visit Riyadh and is in talks to price oil in CNY, a significant departure from pricing oil in dollars. Pricing oil in dollars was part of the agreement between the U.S. and the KSA after the Arab Oil Embargo. Although this agreement may be limited (holding CNY in reserve when China has a restricted capital account seems less than optimal), it indicates Saudi displeasure with the path of relations.

Alternative energy/policy news:

- The Ukraine War and the disruption of Russian energy supplies have raised fears among environmentalists that progress toward carbon reduction will stall. In general, environmental progress is something of a luxury good, one that people will pay for until acquiring energy becomes overly expensive. One potential way to reduce the carbon emissions from coal is to combine it with ammonia. Japan is testing out a coal and ammonia-fired power plant to see if it reduces carbon emissions. If it works, it could provide a stable form of energy (coal) with less emission.

- Producing and piping hydrogen created by solar energy is on the drawing boards in Northern Africa.

- Russia is a key supplier of several metals used in battery technology. The disruptions caused by the Ukraine War have sent prices soaring, raising fears that the war will slow the progress being made on reducing fossil fuels.

- Optimizing cropland by concentrating production in the most productive areas could increase agricultural output and reduce carbon emissions.

- Geothermal energy holds great promise for creating carbon-free power. Privately held Quaise Energy, an MIT spinoff, is raising funds for a project to dig a hole 20 kilometers (12.4 miles) into the earth’s mantle. This would be the deepest hole ever drilled into areas of the earth, with temperatures at 500o

- The Biden administration is proposing to power the government 24/7 on zero-carbon power.