Weekly Energy Update (June 30, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

(N.B.=> due to Independence Day, the next report will be issued on July 14.)

The DOE has resolved its systems issues and released weekly data for 6/17/22 and 6/24/22. We update the data below.

After a sharp correction on recession worries, crude oil prices are recovering.

(Source: Barchart.com)

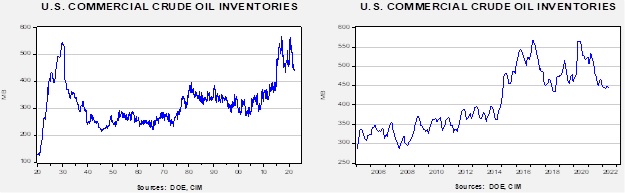

Crude oil inventories fell 2.8 mb compared to a 1.0 mb draw forecast. The SPR declined 7.0 mb, meaning the net draw was 9.8 mb.

In the details, U.S. crude oil production rose from 0.1 mbpd to 12.1 mbpd. Exports and imports both fell 0.2 mbpd. Refining activity rose 1.0% to 95.0% of capacity.

(Sources: DOE, CIM)

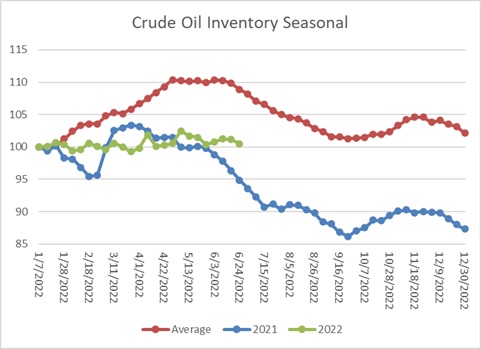

The above chart shows the seasonal pattern for crude oil inventories. This week’s report hints we are starting the usual seasonal decline in inventory that should last into early September. We are not seeing declines similar to last year but something more like the average path.

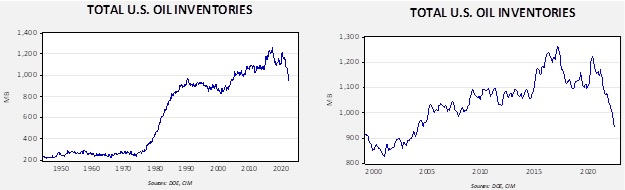

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in 2004. Using total stocks since 2015, fair value is $100.86.

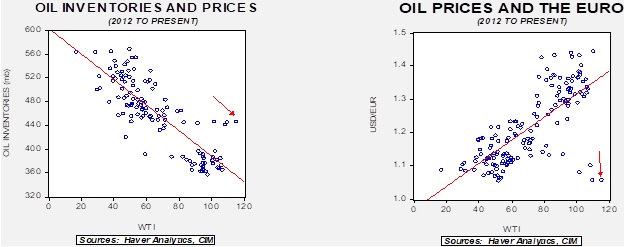

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $65 per barrel, so we are seeing about $50 of risk premium in the market.

Market news:

- Last week, Energy Secretary Granholm met with energy executives. Although the runup to the meeting suggested a “woodshed” moment, in reality, the government really can’t do much to get more product supply to market. Refineries are running around 95% of capacity, and short of nationalizing the industry and running at a loss, there isn’t much that can be done to ease prices. It seems the meeting was cordial. Perhaps the administration realizes (finally!) that lambasting the industry isn’t conducive to cooperation.

- In a sense, the administration wants the oil and gas industry to expand furiously in the short run, only to strand the assets in the long run. That isn’t likely to work.

- The White House has proposed a gas tax holiday for the summer. Not surprisingly, Congress seems unlikely to act. Cutting the tax only to reinstate it in September, about nine weeks before the midterms, won’t be attractive to any incumbent facing election.

- It’s not just high crude oil prices that have boosted gasoline prices; high corn prices have also boosted ethanol costs..

- When an oil well is drilled, it is unusual to completely drain all the available hydrocarbons. Most of the oil is tapped through natural pressure. As pressures fall, oil companies have various techniques to further pull oil out of the ground. Water and carbon dioxide injections are commonly used to “enhance” production. Even shale oil is, in a sense, derived from a technique to further wring oil out of existing fields. Now, oil companies are “re-fracking” existing frack wells to pull out more oil. This process has lower costs, in part, because all the well infrastructure is in place.

- The Dallas FRB has released its Q2 survey of oil and gas firms in its district. The key takeaway—94% of firms report they are suffering from supply chain issues, and nearly 70% don’t see them getting resolved in less than a year. The biggest shortages are in equipment and personnel.

- Despite these hurdles, there is no doubt that Europe can no longer trust Russia for its energy supplies. That means the U.S. could see demand for its energy rise and foster expansion of the American energy sector.

- The DOE estimates the global excess capacity for crude oil is below four mbpd. French President Macron says that the leaders of the UAE and KSA have told him their ability to expand production is severely limited. Javier Blas of Bloomberg examines the notion that Saudi Aramco (2222, SAR, 39.20) can actually sustain production at 12.0 mbpd. The level hasn’t been tested in a while, and, quietly, some officials suggest this number may represent a temporary peak, but it’s not a sustainable level.

- The European Parliament is considering a plan that would obligate EU nations to fill their natural gas storage to a level of 80% by winter. As supply turmoil continues, various EU nations are calling on European consumers to reduce consumption now to allow for a supply replenishment.

- The European chemicals industry is seeing its business model upended. The model was based on cheap, plentiful Russian natural gas. As that supply curtails, the chemical industry in Europe is scrambling for natural gas, which is a key feedstock.

- Russia cut flows on Nord Stream 1 to 40% capacity for “pipeline repairs.” There is a growing fear these flows will be permanently curtailed, perhaps to thwart efforts to build storage.

- Gas supply issues may lead to the reopening of the Groningen gas field, which had been closed because it was thought the depletion was causing earth tremors.

- The U.K. is considering blocking natural gas interconnecting pipelines to the continent in the case of high demand. The EU is warning that cutting off these connectors could result in the U.K. being isolated from the European natural gas pipeline system.

- Germany is warning of financial contagion, a kind of “Lehman event” due to Russian gas supply cuts.

- We are reaching a point where an “all of the above” energy policy is the more likely outcome over a bias toward renewables. The reason? A nation relying on renewables may find itself forced to deindustrialize.

- Although the public usually believes “oil is oil,” in reality, there are differences. In general, oil is either heavy or light, sour or sweet. The first group refers to viscosity; some oil flows easily (shale oil, for example) while others are thick (Canadian tar sands, Venezuelan Orinoco). The second group refers to sulfur contents. Refineries tend to specialize in these differences. A refinery constructed to refine sweet/light won’t easily be able to process sour/heavy. Over the past 20 years, U.S. refineries increasingly invested in the ability to process heavy/sour crude oil on the idea that as production dwindled, the most plentiful oil would be of that grade. Shale oil upended that forecast, which is why the U.S. mainly exports shale oil and imports heavy/sour crude. The SPR has both types, but in the most recent release, the government has primarily been selling the heavier/sour grades, which U.S. refineries can process most efficiently. It is estimated that at the end of October, when this phase of the SPR release ends, the U.S. will only have 179 mb of the heavier/sour crude oil. This will make the SPR a much less effective price buffer going forward.

Geopolitical news:

- The G-7 is meeting this week to discuss the Ukraine situation and the energy crisis. As we note below, the climate change agenda has clearly taken a back seat to trying to avoid an energy crisis. The G-7 has made this switch abundantly clear. The group admits fostering new investment in oil, gas, and coal may be necessary.

- The group has unveiled new sanctions on Russia. One item being considered is a price cap on Russian oil. In other words, the group plus others could decide they would buy Russian oil, but only at a price of $60 per barrel. This action would limit the revenue to Russia and ease the supply crunch. Such schemes are ripe for manipulation. Marc Rich ended up afoul of U.S. law attempting something like this in the 1970s, leading him into exile to Switzerland.

- Despite G-7 efforts to reduce Russian oil sales and revenues, simply put, the sanctions are really leading to a massive restructuring of oil flows. India is a primary beneficiary. Interestingly enough, these sales have not led to a rise in the price of Urals crude oil, suggesting that the sanctions have not been fully offset.

- Not surprisingly, India and China seem to be warming to the idea of a price cap on Russian oil. It shows, to some extent, the limits of China’s support for an ally.

- The S. continues to offer support to ease the EU’s energy situation, but American supply constraints undermine that effort.

- The energy crisis in Europe could lead to the fragmentation of the EU.

- Although the EU continues to try to revive the Iran nuclear deal, we still contend the odds of success are nil. Still, our take isn’t curbing the desire of the EU to make a deal. To some extent, the Biden administration seemed to want this, too, although we have doubted the president really wants to use political capital for this mission. We note Special Envoy Robert Malley is traveling to Qatar to engage in backchannel discussions with Tehran. The main sticking points remain. Iran wants guarantees that a future administration will not renege on this arrangement (which is not possible as an administration cannot easily bind a future one), and Iran wants the Islamic Revolutionary Guard Corps removed from the U.S. designation as a Foreign Terrorist organization (which would be politically costly for the Biden administration).

- Iran has applied[1] to join the BRICS bloc.

- France is pushing to ease pressures on pariah petrostates such as Iran and Venezuela.

- Meanwhile, there are increasing worries that Israel, backed by its new partners in the Abraham Accords, may attack Iran’s nuclear facilities. Israel successfully destroyed nuclear facilities in Iraq and Syria, but the hardened facilities in Iran were thought to be strong enough to prevent Israel from successfully doing the same. However, that was before Israel was allied with the Persian Gulf states. Earlier assessments assumed Israeli warplanes would fly from Israel across semi-hostile territory to strike Iran. The length of the trip would limit the number of sorties and reduce the chances of success, but if Israel’s warplanes could use bases in the Persian Gulf states, it is likely there would be multiple days, if not weeks, of air operations. Of course, if the Persian Gulf states cooperated with Israel, it would open them up to Iranian retaliation. So far, energy markets are mostly ignoring this risk. Given the political risks that President Biden is taking by traveling to the region, we suspect that the war situation may be the reason for the visit.

- South America is facing turmoil caused by the energy situation:

- In Ecuador, the government is being forced to retreat from increasing gasoline prices due to protests.

- In Peru, farmers and truckers are scheduled to go on strike in protests against higher diesel and fertilizer prices.

Alternative energy/policy news:

- It’s summer in the northern hemisphere, which means rising temperatures and increasing air conditioning demand. We are seeing unusually high temperatures in the Far East, including China, Japan, and Russia, especially Siberia. Norilsk, Russia, about 180 miles from the Arctic Circle, recorded temperatures in excess of 89o, a new record. Japan has issued warnings of potential blackouts from the heat. China is not only facing high temperatures but flooding as well. China’s temperatures have sent power consumption to new records.

- Attributing all unusual weather events to climate change is fraught with risk, but Climate Central claims it has developed ways to determine what is caused by higher CO2 concentrations and what is mere seasonal variation.

- When the Ukraine war broke out, some in the analyst community thought this event would speed up the energy transition. Instead, it appears to be leading to a return to fossil fuels. It is becoming clear that Europe won’t tolerate deindustrialization in the face of dwindling Russian oil and gas supplies and instead is not only scrambling for oil and natural gas from other sources but is returning to coal.

- Coal is having a renaissance of sorts in the U.S. as well, as natural gas prices rise.

- To get an idea of just how strong the demand for coal is, Australia reports that thermal coal (the type used to make electricity) is now trading at a premium to coking coal (used in steel production). Given the higher value added from steel, such a premium is highly unusual.

- Although Tesla (TSLA, USD, 745.46) continues to dominate the EV space in the U.S., it faces increasing competition from the traditional automakers.

- In the early days of the auto industry, vertical integration was common as the companies wanted secure supply lines. We notice similar behavior with EVs.

- As discussed above, climate change concerns tend to take a “back seat” when conventional energy costs rise. Sadly, addressing high costs by burning coal and oil doesn’t address the problems of rising CO2 levels. Even without the events of the past few months, it was doubtful that goals would be met by clean energy production. Direct removal of carbon from the atmosphere remains necessary if temperature containment is to occur. Fortunately, removal efforts are showing signs of ramping up. Big tech is a major funder of these efforts.

- Another emerging technology is to expand efforts to tap geothermal energy in the earth’s core. The key to this technology is a Soviet-era technique that employs gyrotrons.

[1] Strictly speaking, the BIRC isn’t a formal organization, so it isn’t obvious how one “applies.”