Weekly Energy Update (June 24, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices continue to rise in an orderly fashion.

(Source: Barchart.com)

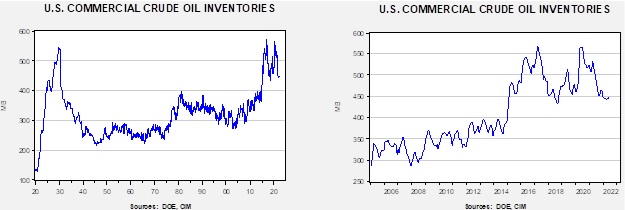

Crude oil inventories rose 2.0 mb compared to a 2.0 mb draw forecast. The SPR declined 7.7 mb, meaning the net draw was 5.8 mb.

In the details, U.S. crude oil production rose from 0.1 mbpd to 12.0 mbpd. Exports rose 1.5 mbpd, while imports rose 0.8 mbpd. Refining activity fell 0.5% to 93.7% of capacity.

(Sources: DOE, CIM)

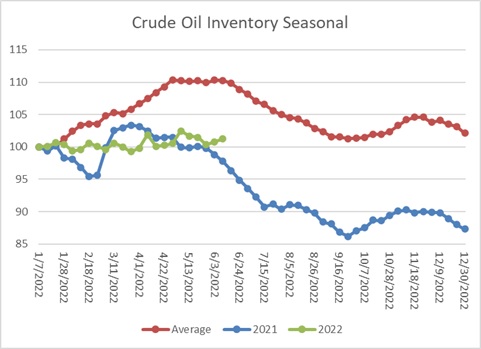

The above chart shows the seasonal pattern for crude oil inventories. This week’s report is consistent with the average pattern. Note the average pattern shows declines into September.

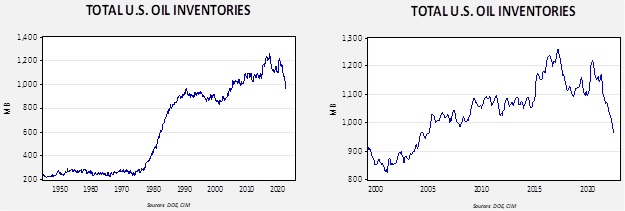

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in 2005. Using total stocks since 2015, fair value is $97.79.

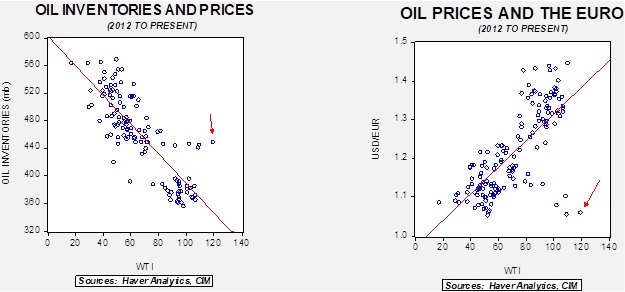

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $65 per barrel, so we are seeing about $50 of risk premium in the market.

Market news:

- Want a well-crafted primer on why the oil industry is struggling to lift production in the face of high prices? Check out this Odd Lots Podcast, as Joe Weisenthal and Tracy Alloway interview Peter Tertzakian about the hurdles in place that are preventing a greater expansion of output. The interview makes it perfectly clear that supply problems will be with us for a long time.

- Last week, the IEA warned that global supplies for oil will likely be tight through 2023. Perhaps the biggest issue facing oil markets is that OPEC+ may be close to producing at capacity. Capacity numbers in OPEC+ are a mixed bag. Throughout history they have usually been inflated because the cartel used capacity data to allocate production quotas. The higher a nation’s capacity, the more they were allowed to produce. OPEC+ is expected to allow producers to expand output to pre-pandemic levels in August, but capacity has fallen since then. By August, it appears only the KSA and UAE will have available capacity, perhaps about 1.6 mbpd. However, these producers may decide it is unwise to lift output further. For most of the oil market’s history, there has been a cartel body limiting production. This situation has led to prices higher than would have existed in a fully free market but with less volatility due to the supply buffer. If OPEC+ uses up all its capacity, the only buffers will be strategic reserves, which are already being used.

- A couple of weeks ago, a fire at a U.S. LNG facility cut U.S. exports by up to 20%. Although initial reports suggested there would be a three-week outage, it now looks like full throughput won’t return until at least September. Shortly after this news, Russia announced that gas flows to the EU would be curtailed due to the lack of repair parts, allegedly caused by sanctions. Several European sources confirm that supplies have been reduced. In addition, rising temperatures are boosting natural gas demand, making it difficult to build storage.

- In response, Germany has instructed consumers to conserve energy so inventories can be rebuilt. The government has declared the first “alarm stage” of its gas emergency plan. The plan has three stages, but essentially, if supplies are inadequate, industrial and commercial users face rationing, and prices will be free to rise. If so, this action could reduce industrial output this winter.

- Despite the environmental concerns, EU nations are returning to coal to ensure energy supplies. Germany, The Netherlands, and Austria are reopening some coal generation. It is becoming clear that environmental goals will be missed to ensure adequate energy supplies. The EU continues to pay lip service toward environmental goals. In reality, faced with either an economic crisis or curtailing greenhouse gasses, the latter loses out. In addition, as coal is being rediscovered, mining firms, like oil companies, have become cautious about expanding production.

- Even though China has boosted its coal consumption, there are still worries that electricity production could be crimped later this summer due to tight fuel worries.

- The EU announced a natural gas deal with Israel and Egypt. The U.S. is also making long-term supply commitments to Europe.

- The IEA is warning the EU that Russia could cut off all natural gas supplies, and they should take steps to address that risk.

- The EU has increased sanctions on ensuring Russian oil and gas shipments. The U.S. is becoming increasingly concerned that this measure may be too effective, reducing supplies further. Insurance companies may not have the capital to bear the risk of sanctions, meaning shipments may simply not occur. The Treasury is trying to “thread the needle” of ensuring adequate oil supplies while preventing Russia from benefiting. That outcome may not be possible.

- As high energy prices weigh on the political fortunes of the party in power, the administration is scrambling to determine ways to reduce energy costs. The Secretary of Energy met yesterday with energy executives. A gasoline tax holiday has been proposed. Also under consideration are fuel export limits, although such measures would be a foreign policy disaster as they would force the EU and other global consumers to bear higher costs.

- Relations between the administration and the energy sector are at a low state. The petroleum industry wants regulatory relief. Environmentalists have been quite successful in blocking pipeline projects, in particular. The industry wants the processes for building pipelines changed to reduce the ability of the courts to prevent expanding pipelines and other facilities. Unfortunately, for the president, the environmental wing of the party understands that, due to the marginal cost structure of such facilities, once built, they will be used for decades.[1] So far, the White House is trying to reduce gasoline prices by badgering the industry, most likely because it has concluded that blaming the industry is better politically than disappointing the environmental wing.

- One oddity of the current oil market is that while U.S. refining capacity is running above 90%, China is sitting on lots of unused capacity. China manages its refineries primarily for domestic supply. With the Chinese economy sluggish, product demand has been soft. So far, China hasn’t shown much interest in lifting product exports.

- U.S. gasoline prices have eased modestly, just before the July 4 weekend.

Geopolitical news:

- Colombia has a new president who ran on curtailing Colombia’s oil and gas industry. Although important, oil and gas production has been falling in recent years.

- The Biden administration isn’t alone in trying to push back against high energy prices. Brazil’s president has created a revolving door for the CEOs of Petrobras (PBR, USD, 11.05) over the past year. The company announced another fuel price hike, which wasn’t popular with the political class. However, the company is considering a temporary price freeze, perhaps to quell the unrest.

- Venezuela’s oil exports to Europe are resuming as the U.S. eases restrictions on Caracas.

- For the past year, we have cast doubt on the nuclear talks with Iran. As the odds of success decline, the potential for a “hot war” between Iran and regional powers is increasing.

- Iran is apparently fortifying and expanding its nuclear facilities with a new tunnel network.

- There are reports the U.S. has prescreened Israel’s attack plans to ensure American operations in the region would not be affected.

- For the past couple of years, Israel has been using assassinations and other covert attacks to undermine Iran’s nuclear program. There are reports these operations are expanding.

- This week, Iranian small vessels, manned by the Islamic Revolutionary Guard Corps, made a run at two U.S. Navy vessels.

- The anti-Iran coalition appears to be expanding. We note that Turkey and the KSA appear to be mending relations, which frayed after Saudi operatives murdered Jamal Khashoggi on Turkish soil. Turkey needs economic support from the KSA, and the latter needs Turkish military support against Iran.

- This report is a good backgrounder on the extent of Russia’s involvement with the EU energy supply. The EU believed that by becoming a large consumer of Russian energy exports, Moscow would avoid actions to jeopardize those sales. Clearly, that was a mistake. However, the Ukraine war isn’t just hurting Russia; it is also upsetting Europe’s politics. We note that recent comments from Jens Plötner, a foreign policy advisor to German Chancellor Scholz, support relations with Russia. For Germany, breaking the Russian energy habit will be hard. Chancellor Scholz disavowed the comments from his aforementioned advisor.

- History shows that sanctions regimes are hard to maintain. Sanctions distort markets, often causing divergences between the prices of similar goods that market participants naturally want to arbitrage. Although there has been a remarkably strong response to sanctions on Russia, we expect that over time, market participants will try to take advantage of the lower-priced sanctioned goods. Thus, to monitor the degree of sanctions-busting, the Brent/Urals spread should provide some insight into how well sanctions are holding up.

(Source: Bloomberg)

This chart shows the nearest contract for the Brent/Urals spread. Before the war, Brent enjoyed roughly a $2 premium on Urals. It is now around $35 per barrel and, so far, has shown little evidence of narrowing. In general, if more buyers are able to purchase the cheaper Urals product, one would expect the price to rise, narrowing the spread. Although we know India and China have been buyers of Russian oil, there still isn’t much evidence to suggest other buyers are participating. In other words, we know sanctions are being violated, but for now, the degree of violation hasn’t been enough to bring lower oil prices.

Alternative energy/policy news:

- The FAA has announced new emission rules on commercial aircraft.

- The U.S. and several other nations have entered an agreement designed to secure critical minerals for the energy transition.

- If wind and solar power are going to replace fossil fuels, the issue of energy storage is critical. Currently, these renewables require fossil fuel or nuclear backup capacity, requiring redundant investment. It is becoming clear that lithium-ion batteries are probably not the best solution for this need; this report discusses other metals and batteries being tested for this role.

- Environmental groups have used the courts to create environmental standards. That avenue is under threat from a group of state AGs. As the U.S. pulls back from its hegemonic role, Congress may move to gain power over the regulatory apparatus.

- The problem of sourcing key metals for batteries has created a global scramble to find supplies. One answer could be recycling; Toyota (TM, USD, 156.80) announced a partnership designed to recycle batteries from its cars.

- The oil and gas industry is teaming up with the geothermal industry in what could prove to be an important expansion of the latter industry using the technology of the former.

- Although the Texas-Louisiana region is a key oil and gas producing region, it will likely also become an important hub for hydrogen.

[1] The initial costs are high, but the marginal costs are low, meaning that once built, the throughput is cheap.