Weekly Energy Update (June 17, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices are moving steadily higher in an orderly fashion.

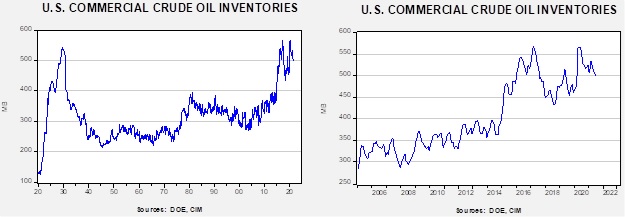

Crude oil inventories fell 7.4 mb compared to the 2.0 mb draw expected. The SPR fell 0.9 mb, meaning without the addition from the reserve, commercial inventories would have declined 8.2 mb. We note the SPR is at its lowest level since October 2003.

In the details, U.S. crude oil production rose 0.2 mbpd to 11.2 mbpd. Exports rose 1.0 mbpd, while imports rose 0.1 mb. Refining activity continued to rise, increasing 1.3%, exceeding expectations by 0.9%. The rise in product inventories was due to an increase in refining.

(Sources: DOE, CIM)

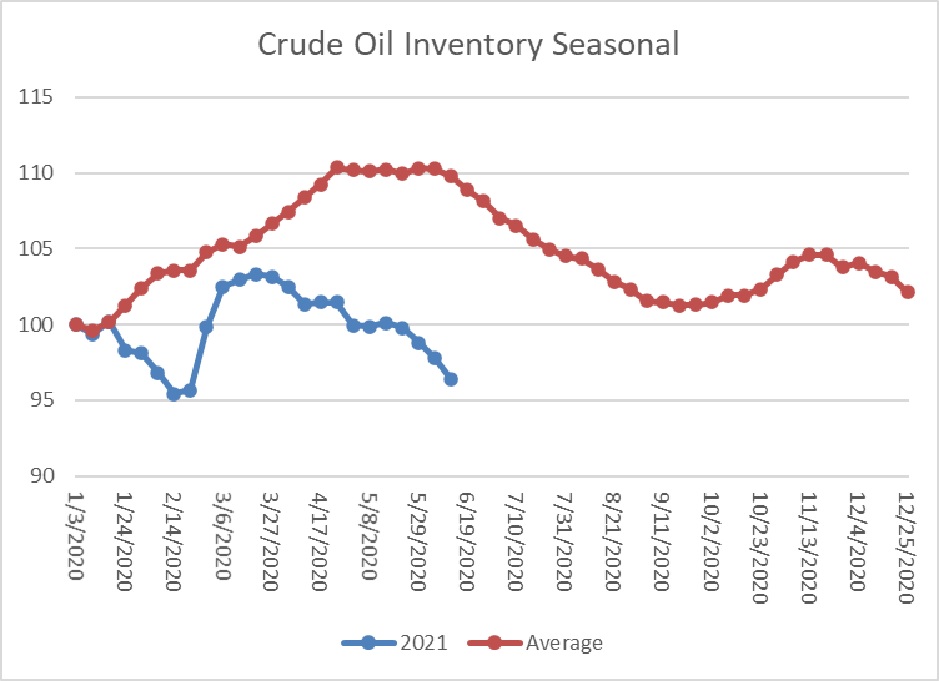

This chart shows the seasonal pattern for crude oil inventories. We are beginning the summer withdrawal season. Note that stocks are already below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 465 mb. Our seasonal deficit is 69.3 mb.

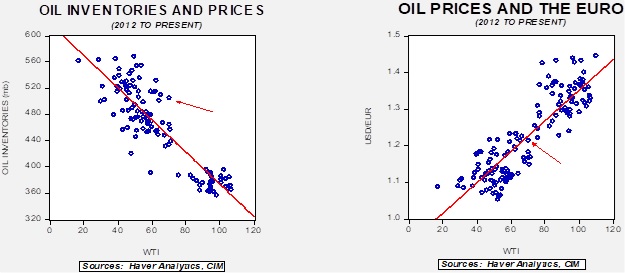

Based on our oil inventory/price model, fair value is $52.64; using the euro/price model, fair value is $70.16. The combined model, a broader analysis of the oil price, generates a fair value of $61.12. Oil prices are still “rich” relative to inventory levels but are in line with the dollar’s level.

Market news:

- A development we have been closely watching has been the financial industry’s reaction to climate change. The ESG movement is a key element of this trend. The Biden administration has issued an executive order mandating increased disclosures of climate risks for firms. The SEC has recently issued comments on this issue and will force firms to hold shareholder votes on the topic. Increasingly, the oil and gas industry is finding it difficult to acquire funding for projects. As this situation continues, oil supplies will likely decline, which is supporting higher oil prices.

- The SEC’s action has led to a pushback from the industry.

- And, the firms themselves, in a bid to improve shareholder value, have become less focused on production at all costs.

- Some of the majors are considering the sale of shale assets in light of these changes.

- It’s summer, and temperatures are rising. The West is dealing with excessive, record-breaking heat and drought conditions, which are pressuring the electric grids in both California and Texas.

- California is expanding its use of commercial-scale batteries to deal with the fluctuations caused by alternative energy.

- We have noted for some time that environmentalists are targeting pipelines to reduce oil and gas flows. The Keystone XL pipeline is now officially canceled. As this tactic expands, it is lifting the value of existing pipelines.

Geopolitical news:

- In recent weeks, about the only bearish news for oil has been the lifting of sanctions on Iran. News that some sanctions were lifted pushed prices temporarily lower last week. We do expect that a modicum of return to the 2015 nuclear deal with Iran is possible. We think that issue is mostly discounted, and Iran will remain a problem for policymakers, even if a deal is reached.

- Iran has sent two warships to Venezuela, which may be part of a weapons deal.

- Venezuela quietly supported FARC rebels who operated in Colombia for years. Recently, some of the fringe post-FARC groups have become a problem for Caracas.

- Saudi Aramco (2222, SAR, 35.30) has issued bonds so it can maintain its dividend. The desire to keep the company an income stock may mean the KSA will keep production restrained.

- The Saudi embassy in the U.S. is accused of helping its citizens facing criminal charges in the U.S. to flee prosecution.

- Europe is continuing to move forward with a carbon adjustment tax on imports. This tax would not allow firms to import products from nations with less strict environmental rules. However, the tariffs also act as a trade barrier. Meanwhile, the G-7 leaders did not commit to a deadline for ending coal consumption.

- PM Trudeau’s environmental policies are creating conflicts for the Canadian oil and gas industry.

- China may have had a leak at one of its nuclear reactors.

Alternative energy/policy news:

- We are seeing a rising drumbeat of interest in hydrogen as an alternative to hydrocarbons. Although electric vehicles continue to dominate the headlines, it is too soon to count out fuel cells and hydrogen as our future fuel. We note the administration has launched a hydrogen initiative designed to generate hydrogen from “green” sources at a much lower cost. Currently, the ordinary way to create hydrogen is to separate it from natural gas. But, as any high school chemistry student has learned, you can also produce hydrogen by separating it from oxygen in water. Using green electricity in the process offers promise. Japan has been supporting hydrogen development. China is also getting into the mix.

- China has come to dominate the solar panel industry by using aggressive subsidies. The support has undercut the price of panels, increasing the adoption but decimating the industry outside of China. Apparently, Beijing has decided to back away from this support. This is now helping to boost the industry outside of China. Meanwhile, solar panel installations in the U.S. have risen sharply over the past year. On a less optimistic note, recent studies suggest solar panels are degrading faster than expected, meaning they may need to be replaced sooner than anticipated.

- One surprise over the past 15 years has been the rise of the fracking industry, which changed the geopolitics of oil. The U.S. became much less dependent on foreign sources of oil; this changed American foreign policy. As the U.S. moves away from fossil fuels, it is beginning to look like foreign dependence on rare earth metals may be developing. Rising demand has lifted the prices of these metals recently, and China dominates their processing.

- The expectation of rising uranium demand is starting to attract interest from hedge funds.

- Climate mitigation plans all generally call for atmospheric carbon removal. So far, there are no commercially feasible plans for that, but a group of scientists is looking to harness the ocean’s ability to absorb carbon from the air. Their research seeks to pull carbon from the oceans, thus allowing the oceans to absorb additional carbon from the atmosphere. The concept is to use calcium and magnesium to capture the carbon in rocks (specifically calcite or magnesite, the stuff of seashells). The researchers are catalyzing the process with electricity. Interestingly enough, the process creates hydrogen as a byproduct.

- The Biden administration paused oil and gas leases on federal land when it took office. A judge this week put an injunction on the order, which would allow leasing to resume. But the issue is only temporarily resolved.

- Voters tend to support environmental restrictions as long as the costs are low. Swiss voters last week narrowly rejected a plan to reduce CO2 emissions.

- China’s Belt and Road project has come under fire for funding coal-fired electric projects. However, a number of the projects have been scuttled due to rising costs.