Weekly Energy Update (June 10, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices have moved above the $60 to $68 per barrel trading range and are testing $70 per barrel.

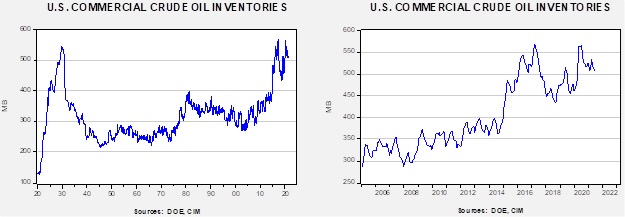

Crude oil inventories fell 5.2 mb compared to the 3.3 mb draw expected. The SPR fell 1.3 mb, meaning without the addition from the reserve, commercial inventories would have declined 6.5 mb.

In the details, U.S. crude oil production rose 0.2 mbpd to 11.0 mbpd. Exports rose 0.4 mbpd while imports rose 1.0 mb. Refining activity jumped 2.6%, which accounts for the rise in product inventories.

(Sources: DOE, CIM)

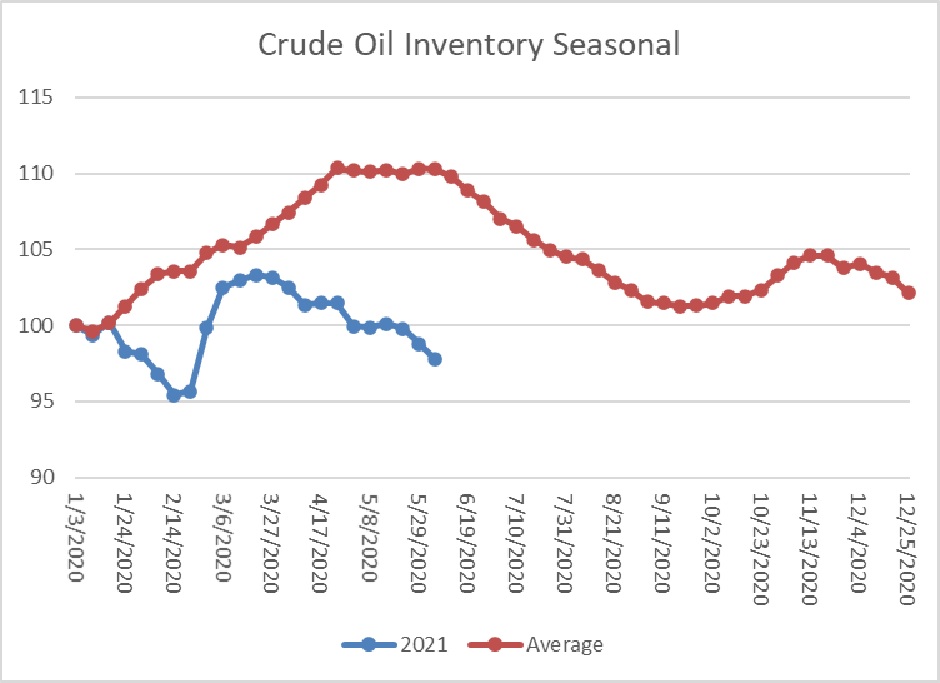

This chart shows the seasonal pattern for crude oil inventories. We are beginning the summer withdrawal season. Note that stocks are already below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 465 mb. Our seasonal deficit is 64.4 mb.

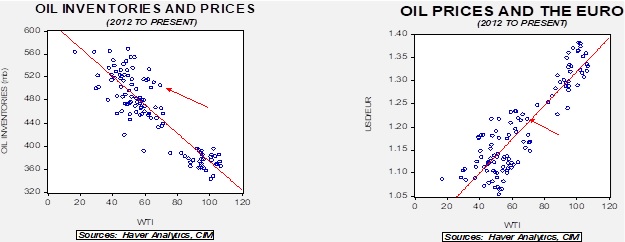

Based on our oil inventory/price model, fair value is $50.31; using the euro/price model, fair value is $69.15. The combined model, a broader analysis of the oil price, generates a fair value of $60.16. Oil prices are outpacing inventory levels but are in line with the dollar’s decline.

Market news:

- Although the Biden administration has numerous “green” policies in the works, the reality is that oil and gas will still be used for the foreseeable future. And, there are political concerns that lawmakers in oil-producing states need to address. We note that the administration confirmed a Trump-era project in Alaska, which favors Sen. Murkowski (R-AK).

- Options market activity suggests traders are projecting an increasing likelihood of $100 per barrel of oil.

- China is taking steps to reduce its oil demand by preventing oil firms from selling import permits to small refineries.

Geopolitical news:

- It is well known that China has a stranglehold on rare earths, but more important is that Beijing has even more market power in rare earths processing. That activity is environmentally “dirty,” and since China was willing to suffer the damage from that industry, the developed world allowed it to dominate. Now, nations realize that to construct key products for the transition away from fossil fuels, they must maintain relations with China.

- Balancing environmental concerns often collides with economic growth issues. China is easing some environmental restrictions due to worries about slowing economic growth.

- Iran is expanding its disinformation campaign in the U.S. to create discord.

Alternative energy/policy news:

- Investors and courts are increasing pressure on oil companies.

- Royal Dutch Shell (RDS.A, USD, 40.10) and Exxon (XOM, USD, 62.89) are being forced to reassess investment models. Recently, a Dutch court ordered Royal Dutch Shell to cut emissions by 45% by the end of the decade. The company is starting to take steps to address the court’s decision.

- Exxon has seen activist groups put three of their members on the company’s board.

- Chevron (CVX, USD, 109.03) is facing investor pressure as well.

- Increasingly, oil companies are finding their political influence is waning with governments. As their impact declines, the regulatory environment will become increasingly hostile.

- We expect these actions to continue, which is bullish for crude oil and natural gas prices.

- The EU has seen its plans for carbon tariffs on industrial products leaked. Called the “Carbon Border Adjustment Mechanism,” the Europeans are considering tariffs based on carbon prices for fertilizer, metals, cement, and power. The countries most at risk of the tariff are Russia, the U.K., and Turkey. We may see a WTO challenge brought to the plan under the idea that the EU is using environmental rules as a form of protectionism.

- Another pattern we have noted is that environmental groups are constraining pipeline development through legal action and protests. If these actions work, it will strand some assets; at the same time, it makes existing pipelines increasingly valuable.

- We hold that nuclear power will become more popular as it creates zero carbon emissions electricity. However, opposition to the industry is formidable, as seen by the problems faced by the only new nuclear project in the U.S.

- The U.S. is considering tariffs on Chinese rare earth magnets. The goal is to build alternative supply sources. The administration is also trying to support American battery manufacturing.

- Alternative energy has its own quirks—like solar eclipses.

- Although reducing carbon emissions is a necessary step in controlling climate change, to really combat the problem, pulling carbon from the atmosphere will probably be necessary. There are many projects underway. Carbon capture projects are also being planned. Current CO2 levels hit a new high in May. Recently, temperatures in the Middle East reached 125.2o Fahrenheit.

- Ford (F, USD, 15.55) announced it will invest $30 billion in electric vehicles (EV’s) by 2025 and expects that 40% of its sales will be EV’s by 2030.

- China’s Sinopec (SNP, USD, 53.30) is investing in plants designed to make 500,000 tonnes of green hydrogen per year; production is scheduled to begin in 2025.