Weekly Energy Update (July 29, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

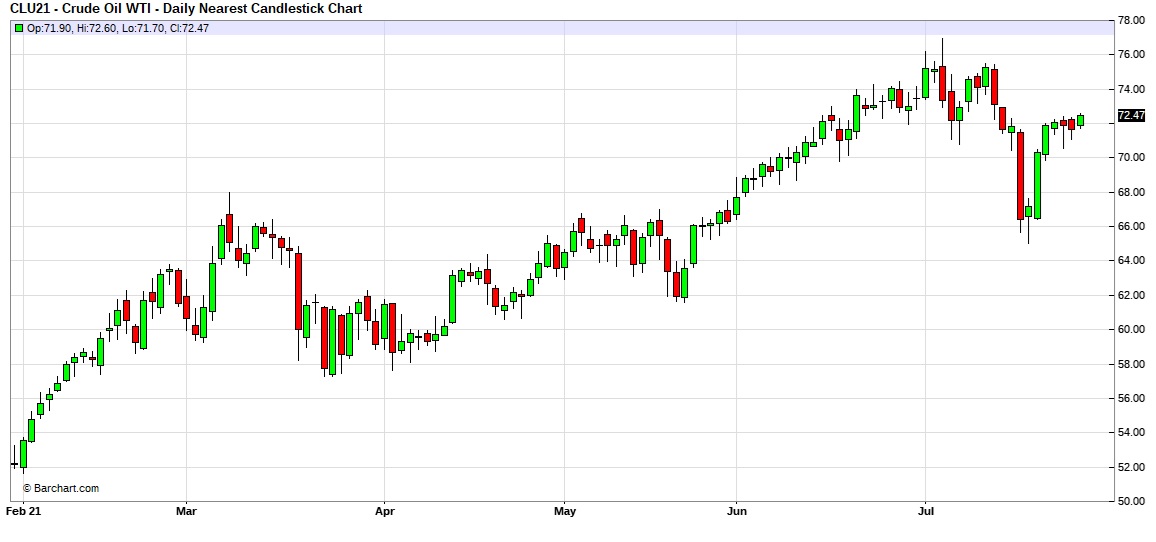

After last week’s selling, prices have recovered back above $70 per barrel.

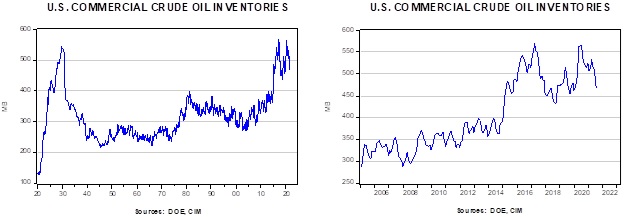

Crude oil inventories fell 4.1 mb compared to the 2.1 mb draw forecast. The SPR was unchanged this week.

In the details, U.S. crude oil production fell 0.2 mbpd at 11.2 mbpd. Exports were unchanged while imports fell 0.6 mb. Refining activity fell 0.3%.

(Sources: DOE, CIM)

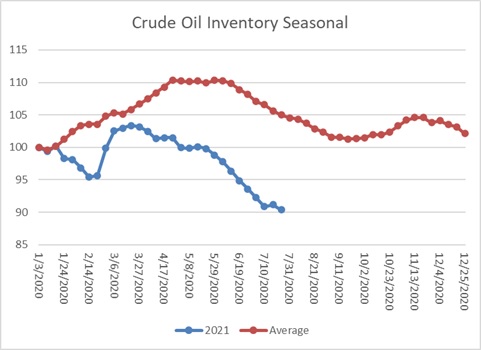

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are well below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 79.0 mb. At present, inventories have started to stabilize after falling quickly since March.

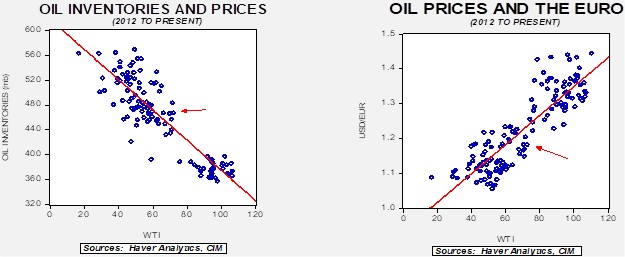

Based on our oil inventory/price model, fair value is $62.91; using the euro/price model, fair value is $72.29. The combined model, a broader analysis of the oil price, generates a fair value of $62.51. Oil prices are now in line with oil inventories but undervalued compared to the dollar.

Market news:

- As electricity demand rises along with natural gas prices, coal demand and prices have risen as well. Although coal has been under pressure for some time, the economic recovery is lifting electricity production, and high natural gas prices make coal an attractive alternative.

- China uses import quotas for crude oil, but these are often manipulated to permit firms to import more than their quotas allow. Beijing is cracking down on the practice, which may lead to a drop in imports.

- As U.S. production improves, oil service companies are seeing better performance. Meanwhile, shale drillers are merging, leading to industry consolidation.

Geopolitical news:

- On August 5, Ebrahim Raisi will take over the Iranian presidency. Although the U.S. is continuing to press for a return to the 2015 nuclear agreement, the odds of that occurring may be less under the new president. Raisi will also inherit continued unrest in Khuzestan province. Given Raisi’s history, we would expect a harsh crackdown on the protests.

- There is some evidence to suggest that the KSA had a role in the purported coup attempt in Jordan. The idea is that Riyadh wanted Jordan to approve the Trump-era Israeli/Palestinian peace plan, and King Abdullah opposed it. In the wake of the tensions, both sides appear to be reestablishing relations.

- Hackers demand $50 million from Saudi Aramco (2222, SAR, 34.90) over data it took from the company.

- The U.S. will end combat missions in Iraq; a small contingent of troops will remain for training purposes.

Alternative energy/policy news:

- Electrification has created a pressing need for improved battery technology. Lithium-ion batteries are commonly used because they hold a high level of energy relative to their weight. The lead-acid batteries used in cars that have internal combustion engines, for example, are too heavy for standalone auto use. However, for some uses, such as backup power for electric utilities, lithium-ion batteries are too expensive to be an economic alternative. A number of firms are unveiling new battery technology that uses iron and air to hold power. Iron is significantly cheaper than the metals used in lithium-ion batteries; although the weight precludes their use in transportation, for stationary backup power, iron is perfectly suitable. If this technology lowers costs, it will make the combination of wind/solar and batteries a viable alternative to coal and natural gas-fired turbines.

- Another emerging battery technology uses molten salt, although it is probably not evolving as quickly as the aforementioned iron-air batteries.

- China is working on a commercially viable thorium nuclear reactor. Such a reactor would not generate the nuclear waste that current reactors produce.

- As the world warms, the need for air conditioning will rise. The concern is that air conditioning requires electricity, and if the “juice” comes from fossil fuels, using air conditioning will compound the problem caused by greenhouse gases. However, even if that hurdle is overcome by using renewables or nuclear, air conditioning refrigerants can also be potent greenhouse gases. A new process would not only eliminate the current refrigerants but also be more efficient.