Weekly Energy Update (July 14, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Since early June, oil prices have fallen significantly, breaking the psychologically important point of $100 per barrel. Technical support exists at $95 per barrel, so we will be watching to see if it holds.

(Source: Barchart.com)

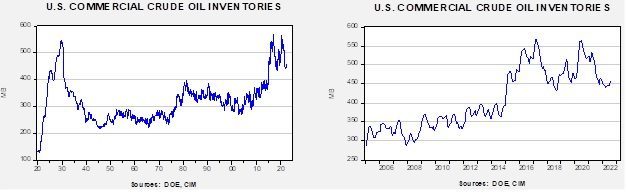

Crude oil inventories rose 3.3 mb compared to a 1.5 mb draw forecast. The SPR declined 6.9 mb, meaning the net draw was 3.6 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 12.0 mbpd. Exports rose 0.4 mb, while imports fell 0.6 mbpd. Refining activity rose 0.4% to 94.9% of capacity.

(Sources: DOE, CIM)

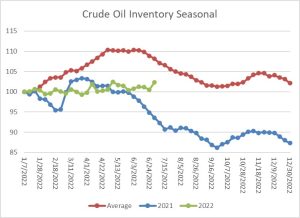

The above chart shows the seasonal pattern for crude oil inventories. It is clear that this year is deviating from the normal path of commercial inventory levels. Although it is rarely mentioned, the fact that we are not seeing the usual seasonal decline is a bearish factor for oil prices.

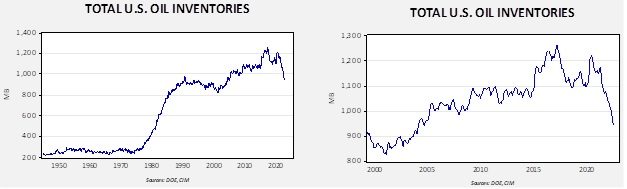

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in 2004. Using total stocks since 2015, fair value is $101.09.

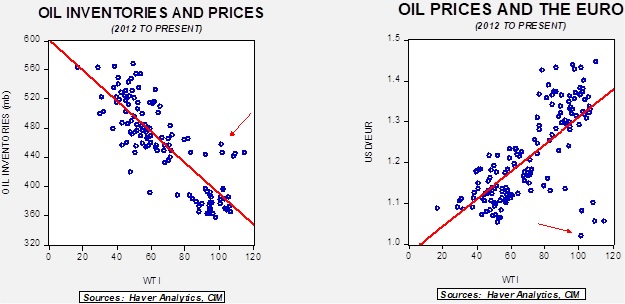

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $65 per barrel, so we are seeing about $35 of risk premium in the market.

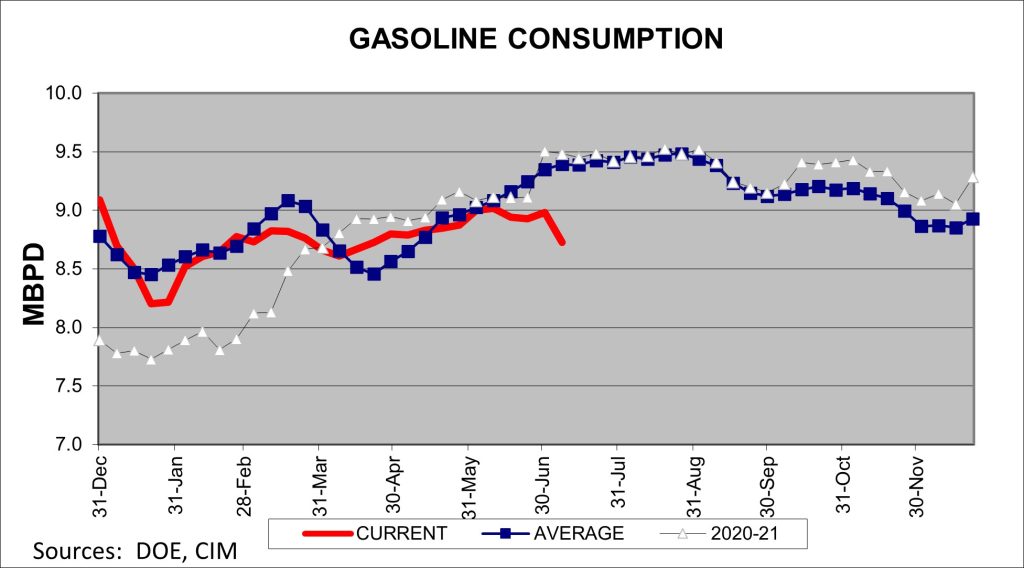

Gasoline demand:

In general, gasoline demand is price inelastic, which is “econ talk” for demand being insensitive to price. Since substitutes for gasoline are mostly non-existent, consumers trying to adapt to higher prices are left with other methods, such as carpooling, combining trips, or using public transportation. Unfortunately, data on public transportation is only available through Q1. However, the data does suggest that ridership is well below pre-pandemic levels. In the long run, demand can fall if car owners shift to more fuel-efficient vehicles; the work-from-home movement may also lead to lower structural demand.

At the same time, gasoline demand is very elastic to economic growth; as growth slows, demand declines. We are seeing clear evidence of weakening demand.

Seasonally, this is where we usually see peak demand. The fact that demand is falling and that it is usually price insensitive likely argues that the economy is weakening.

Market news:

- As the above price chart shows, oil prices have come down hard recently. However, the IEA still says that the energy crisis remains a problem and is likely to get worse before conditions improve.

- In times of supply uncertainty, the hoarding instinct sets in; nations try to ensure they will have adequate supplies even if it means other nations are left short. We note that India has announced export curbs on diesel, an example of such behavior. Meanwhile, Europe is aggressively buying up global LNG, which is denying the product to poorer nations.

- US. refineries continue to run at high levels, which increases the odds of refinery issues.

- Meanwhile, industrial energy users report that operations are being curtailed due to high prices.

- Shippers are reportedly slowing their vessels to meet greenhouse emission regulations.

- Oil and gas workers in Norway went on strike; the government stepped in to end it.

- One of the characteristics of the postwar world in the U.S. has been the expansion of the regulatory state. Congress has tended to delegate the responsibility to agencies by granting them wide latitude. This trend has created a backlash. George Friedman has suggested that we are ending the era of the “rule of experts,” mostly because experts tend to have a narrow focus and, thus, when making recommendations their regulations can often ignore collateral issues that impose unexpected costs. A recent Supreme Court ruling looks to counteract this state of affairs by reducing the ability of the regulatory agencies to impose rules not specifically granted by Congress. This action notably affected the EPA’s ability to regulate greenhouse gasses.

- Although the Biden administration initially wanted to curtail new oil and gas leases, high prices have led the White House to walk back that position. For example, the Willow project in Alaska is still being considered. This stance has not been well received by the environmental wing of the president’s party. Interestingly enough, the new policy shift hasn’t exactly thrilled the oil and gas industry either.

- As oil prices have increased, China has aggressively switched to coal and so has Europe. Russia has been increasing coal exports, which is making a comeback as oil and natural gas prices rise.

- A new surge in COVID cases in Shanghai has raised worries about another lockdown. If Beijing implements such policies, it would be bearish for oil prices.

Geopolitical news:

It’s a big week in geopolitics and energy.

- President Biden is traveling to the Middle East this week. The broader context is stability in the region. Since Obama, the U.S. has been trying to reduce its “footprint” in the Middle East to focus on the Asia-Pacific, the so-called “pivot to Asia” strategy. In order to accomplish that, the U.S. has to create a regional security structure. This area of the world remains important, not just for the oil markets but for the stability of Europe and South Asia. Obama’s model, based on the ideas of Robert Baer, was that Iran was a reliable stabilizer. Assigning Iran that role was what brought about the JCPOA. Obama assumed that the next Democratic administration would finish normalizing relations with Tehran. However, after Trump’s win in 2016, the focus of stabilization shifted to the Arab states and Israel. The Abraham Accords became the model for such an arrangement. It is now being referred to as a potential “Arab NATO.” Although the Biden administration wanted to revive the JCPOA, as we have been documenting for a while now, there appears to be little chance of success. Therefore, Biden seems to be shifting to working with the security arrangement created by the Abraham Accords.

- This is a complicated trip. Biden’s first stop is Israel, which is “between governments” at present. From there, he is off to Riyadh to meet with the crown prince, who the president once labeled a pariah. In general, presidents usually don’t make trips such as this without the agenda resolved. In other words, although there is some concern that Mohammed bin Salman will disappoint the president, it is unlikely that Biden would have gone to the region if he believed he would come away empty handed. However, it is also unlikely that the Kingdom of Saudi Arabia (KSA) will be able to expand production significantly. The kingdom is the key reserve of global excess capacity. If the KSA were to expand output to full capacity, it would mean the world has no production cushion. There have been quiet concerns that the KSA has less capacity than it advertises. It is still possible that MBS will publicly embarrass the president, as he has shown himself to be impetuous. It’s not the most likely outcome, but one that has a higher probability than it would have had with the sons, rather than the grandsons, of King Saud.

- At the same time, it is important not to forget that the U.S. and the KSA are long-term strategic allies. The Saudis operate in a difficult environment and having the U.S. as an ally is important. For example, the U.S. is considering resuming the sale of offensive weapons to the KSA, a significant carrot. Thus, it is quite possible that this visit may reset relations with the KSA, although we harbor serious doubts it will generate much in terms of oil sales.

- It should be noted that OPEC+ continues to be unable to meet production targets.

- One potentially bearish factor for oil is sanctions violations. It is well known that China and India have been active buyers of Russian crude oil at deep discounts. However, Europe continues to buy large quantities of oil and natural gas at high prices, leading to dramatic improvements in Russia’s external accounts. One way the G-7 is thinking about addressing this issue is to create a coalition that agrees to buy Russian oil at around $60 per barrel. It isn’t obvious how this would work; after all, if it’s effective, governments could simply set the price of oil globally. The U.S. is warning that oil prices could rise further without the price cap. Treasury Secretary Yellen is pitching the plan to China. Although China is an ally of Russia, so far, Beijing hasn’t rejected the plan.

- Not only is Russia selling oil, but Iran’s sales have also been rising. The Biden administration hasn’t been actively enforcing Iranian sanctions, and sales, especially to China, have increased. Iran has been using deceptive measures to skirt sanctions enforcement. There are also reports that Russian oil products are finding a home in the Middle East, which can then export their own fuel oil to others. This is part of the adjustment process to sanctions. In fact, the “leaking” of Russian oil to world markets is weakening demand for oil from Venezuela and Iran, both also under some form of international sanctions. That being said, the Brent-Urals crude oil spread remains above $30 per barrel, suggesting that the amount of Russian oil flowing into the system isn’t enough to narrow the spread.

- Russian President Putin is expected to visit Iran next week.

- Iran is hopeful that the global oil crisis will improve its bargaining position to return to the JCPOA.

- The US. is claiming that Iran is planning to deliver armed drones to Russia. Such actions suggest Tehran doesn’t really think the JCPOA will go forward.

- Venezuela, which has been subject to international sanctions, has resumed oil sales to the EU.

- Gazprom (trading suspended) is demanding RUB for LNG.

- Meanwhile, on natural gas, there are growing worries that Russia is curtailing supplies to create a crisis this winter. The IEA is warning that Europe should prepare for a total suspension of Russian gas flows and also estimates such action by Russia would have devastating economic effects. Germany and the Netherlands are already warning users they will need to curtail consumption. Germany is taking steps to nationalize gas importers to prevent their failure. Recently, the Nord Stream 1 pipeline was closed for maintenance, and there is great fear that Russia will not resume supplies. A key part was being repaired in Canada, and the Canadians were reluctant to return it due to sanctions. The EU petitioned Ottawa and the part is being returned. Now we wait to see if gas flows restart.

- Supply concerns have led France to use fuel oil for electricity production instead of natural gas.

- Europe is aggressively buying up global LNG supplies; a large tender by Pakistan failed to find sellers, in part, because the EU outbid them.

- Russia has seized control of the Sakhalin gas project in retaliation for sanctions.

- At the same time, Russian courts have allowed Kazakh oil exports to continue; there was a threat by Russia to halt exports due to concerns over oil spills.

- General secretary of OPEC+, Mohammad Barkindo, passed away last week.

- The civil war in Libya has disrupted oil flows.

- Iran has begun yet another crackdown on dissidents in the midst of a severe inflation shock. We also note that there was a cyberattack on a steel mill that led to physical damage of the facility.

- The new government in Colombia is cooling investors on the energy sector.

Alternative energy/policy news:

- The intelligence apparatus often tries to change policies in target nations. Authoritarian nations, given their control of the media, tend to have a “leg up” in the battle for opinion. A good example of this recently is that China has been using social media to encourage environmental groups to oppose rare earths mining in the U.S. and Canada. Although rare earths mining and processing is often environmentally “dirty,” it is also true that rare earths are critical in alternative energy production. China dominates both mining and processing because it has been willing to absorb the environmental costs.[1] However, as the West has realized its vulnerability in this area, there has been renewed interest in mining and processing rare earths outside of China. Clearly, Beijing is trying to discourage such efforts.

- Although nuclear power remains controversial, there are elements in the environmental community that realize it may be necessary to expand nuclear power to reduce carbon emissions. One especially attractive technology is molten salt reactors. Not only are the facilities smaller, but they should also be safer.

- One of the issues that concerns policymakers is that Russia and China are now at the forefront of nuclear reactor designs. The IEA estimates that nuclear power will need to double by 2050 to have any chance of reaching net zero emissions.

- Thermal technology could also be used to store production from wind and solar power. Currently, utilities must carry traditional redundant capacity to wind and solar capacity due to the natural interruptions of these sources. Having storage would remove that need and improve the economics of renewables. Germany is currently building a similar facility to hold hot water. Finland is experimenting with using geothermal techniques and sand to store power as well.

- Researchers are investigating if old mines could be used for pumped storage to store electricity.

- It is likely that carbon capture from the atmosphere will be required to have any chance of reaching climate goals. An Australian design suggests that solar power could be the key to creating the energy for carbon capture.

- It is also likely that as global temperatures rise, nations and some large firms may try geoengineering to improve conditions. These technologies could have unexpected effects, and so the scientific community has been reluctant to aggressively pursue them. But, as temperatures rise, so will the drive to make such investments. However, given that we will likely see such techniques deployed, the US. government is starting to fund research in a bid to control their implementation.

- In the face of high heat, voluntary cutbacks to demand in Texas have, so far, avoided power disruptions. Bitcoin miners in the state suspended operations.

- Jet fuel made from bacteria may be more energy-dense that that from fossil fuels.

[1] Lacking an effective tort bar is useful for such efforts.