Weekly Energy Update (January 28, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices are consolidating between $54 to $52 dollars per barrel after a strong rally from early November into late January.

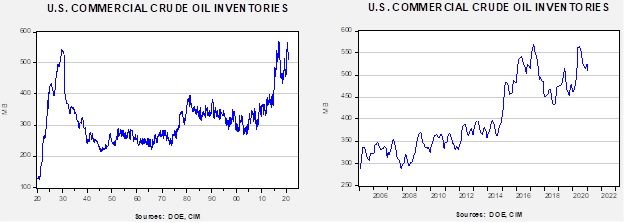

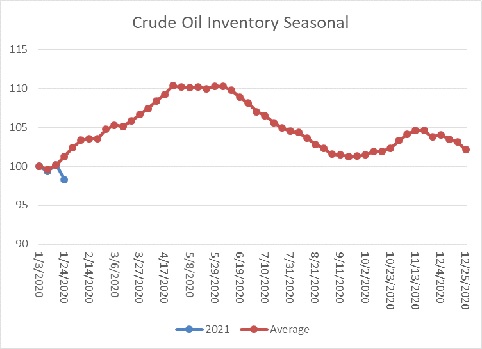

Commercial crude oil inventories unexpectedly fell 9.9 mb when a build of 1.5 mb was forecast.

In the details, U.S. crude oil production declined 0.1 mbpd to 10.9 mbpd. Exports rose 1.1 mbpd, while imports declined 1.0 mbpd. Refining activity fell 0.8%.

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline is abnormal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. Of course, one week doesn’t constitute a trend, but the decline was notable.

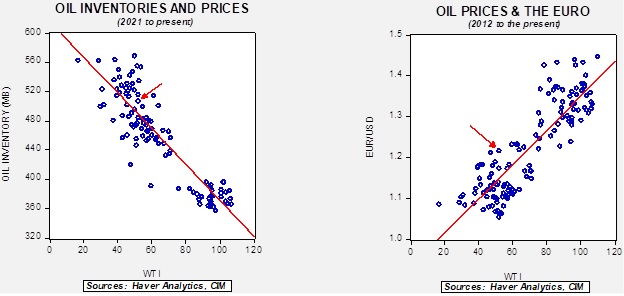

Based on our oil inventory/price model, fair value is $48.05; using the euro/price model, fair value is $70.80. The combined model, a broader analysis of the oil price, generates a fair value of $58.18. The wide divergence continues between the EUR and oil inventory models.

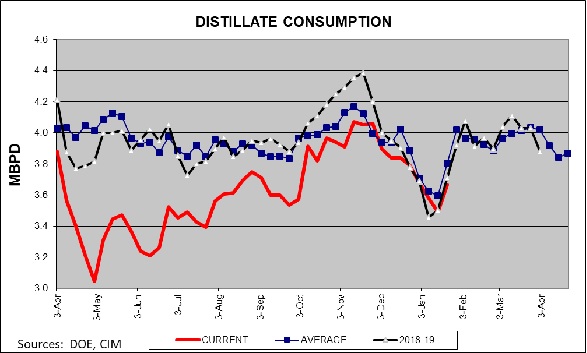

Distillate consumption has returned to normal and should continue to rise on a seasonal basis.

We continue to see evidence of market and policy measures causing a divergence between oil and gas prices compared to related equities.

- The steady supply of oil relies, in part, on continued exploration and field development. Last year, there was a notable decline in acreage acquisition by the largest oil companies in part due to low oil prices. Because virgin oil fields require investment well before they begin producing, there is a risk that future declining demand will strand the investment. We are already seeing declines in exploration budgets.

- We expect that pipeline growth will be further restricted. This is bullish for oil and gas prices, and bullish for existing pipelines, but determining the impact on individual companies is hard to generalize.

- As expected, the Biden administration is restricting drilling on federal lands. The oil industry will likely engage the courts to overturn this ruling, but, for now, it looks like this area won’t be available for production. It represents about 9% of onshore production.

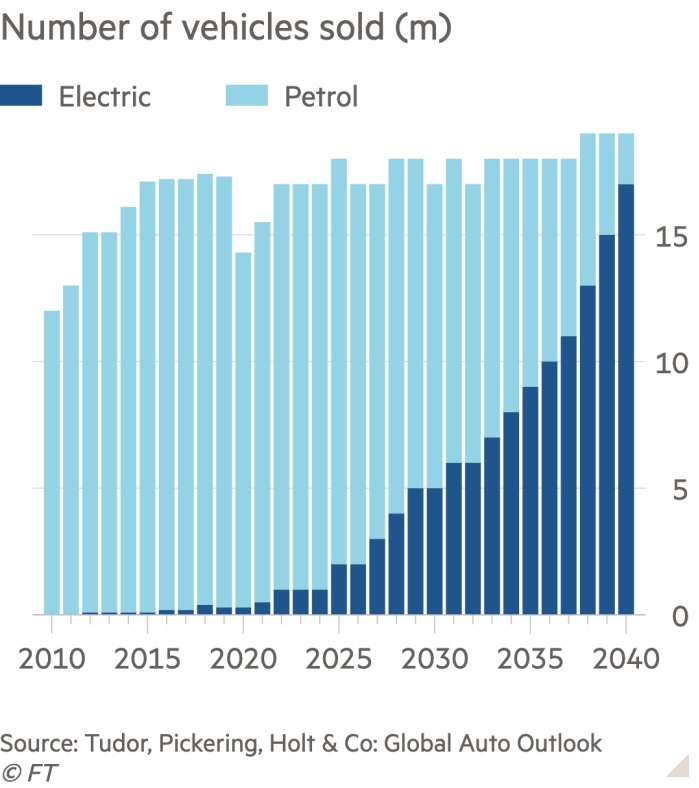

- By early in the next decade, it is estimated that 50% of new car sales will be EVs.

Here is the geopolitical news:

- In a bid to diversify its economy, the Kingdom of Saudi Arabia (KSA) is using its sovereign wealth fund to encourage health and tech companies to set up operations in the country.

- Also in the KSA, the U.S. is engaging in a quiet buildup of forces to counteract Iranian actions.

- As the Biden administration takes power, Israel is starting to saber-rattle, warning it may attack Iran. Such comments dwindled under the last administration but were common during the Obama government. Our take is that Israel probably won’t take unilateral action, but there is a chance that a coordinated action may be more likely as relations improve with the Arab Gulf states.

- Indonesia has detained Chinese and Iranian oil tanker crews who were engaged in illegal oil transfers in Indonesian waters. We suspect this was done to evade sanctions.

- China is expanding its investment in green projects as part of the “belt and road” program.

On the alternative energy front, here is what we saw this week:

- Lenders are offering lower interest rates to commodity firms and traders who lower their carbon output. This allows the banks to package these as “green” loans to investors to meet ESG goals.

- Blackrock (BLK, USD, 709.76) CEO Larry Fink warned companies that if they lag in achieving the goal of net zero emissions by 2050, the asset manager may exclude them from active portfolios. Blackrock is using its power as a large owner of company equities to press for climate change action.

- Exxon (XOM, USD, 46.38) has partially succumbed to activist pressure, announcing it will make changes to its board and take measures to reduce its carbon output.

- Large battery arrays are becoming more common as utilities use them to smooth out the variable flows from wind and solar power.

- We are seeing a buildup of U.S. battery production.

- Recent studies suggest the costs of solar power will continue to decline and replace conventional energy.