Weekly Energy Update (January 21, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Since troughing in early December, oil prices have been steadily rising due to tightening supplies. We are approaching the highs set in November.

(Source: Barchart.com)

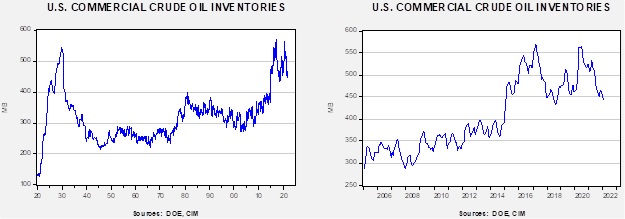

Crude oil inventories unexpectedly rose 0.5 mb compared to a 2.0 mb draw forecast. The SPR declined 1.3 mb, meaning the net draw was 0.7 mb.

In the details, U.S. crude oil production was unchanged at 11.7 mbpd. Exports and imports both rose 0.7 mbpd. Refining activity fell 0.3%.

(Sources: DOE, CIM)

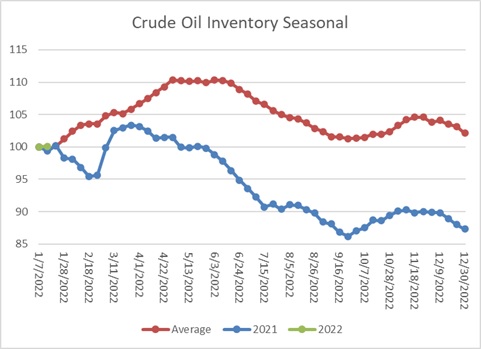

This chart shows the seasonal pattern for crude oil inventories. This week’s report shows a pattern consistent with average and last year.

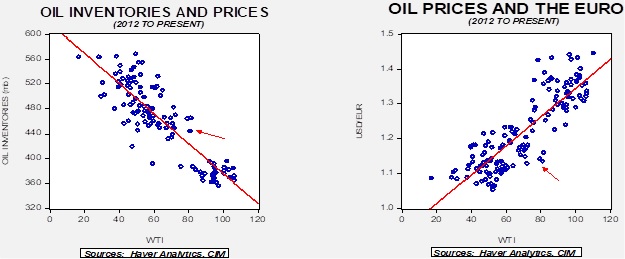

Based on our oil inventory/price model, fair value is $70.04; using the euro/price model, fair value is $54.12. The combined model, a broader analysis of the oil price, generates a fair value of $62.32. Current prices exceed our model projections, but price momentum is likely to push prices higher.

Market news:

- Oil prices have surged recently. The combination of tight supplies, rising demand, and geopolitical tensions are all conspiring to move prices higher. So far, the supply response has been modest, which means that price volatility remains elevated. However, we are starting to see some rumblings of supply from the U.S. shale sector. Other production areas remain stagnant, likely worried about stranded investment.

- Disinvestment has weighed on the energy sector, but recent comments from some major financial firms suggest the trend isn’t universal. One issue that has been raised is that divestment could simply shift production from publicly held to privately held firms that may have lower environmental standards. Essentially, the idea of reducing fossil fuel use by supply restrictions may not solve the problem and may cause higher prices and little environmental improvement.

- The recovery in energy demand in 2021 has led to higher emissions.

Geopolitical news:

- The Houthis, one of the principal actors in the civil war in Yemen, launched a drone attack on the UAE, killing three. The target was the Abu Dhabi International Airport, nearly 800 miles from Yemen. Although attacks on the KSA by the Houthis occur often, the last time the UAE was attacked was in 2018. It seems the decision by the UAE to reduce its military support for groups aligned against the Houthis led to an unofficial ceasefire. However, recently, UAE and the groups it supports have resumed attacks on the Houthis, apparently prompting the Houthis response. The Houthis have been allied with Iran, but so far, the attacks by this group on the UAE have not affected attempts by Abu Dhabi and Tehran to normalize relations.

- Although we harbor strong doubts that the U.S. and Iran will be able to return to the 2015 nuclear deal, talks continue. One major sticking point is that Iran wants guarantees the U.S. won’t withdraw from a new agreement. This isn’t possible; there is little chance that the Senate would approve a treaty with Iran, which is the closest the U.S. can come to a guarantee. Although we remain skeptical, there is some evidence within Iran that the hardliners are open to a deal. The conservatives do not trust Washington, but lifting sanctions would boost the economy, which has been in the doldrums since the U.S. withdrew from the accord.

- Meanwhile, Iran is building stronger relations with China and Russia. Iranian President Raisi recently visited Moscow to highlight growing ties. It should be noted that Iran and Russia are not long-time allies. Despite these moves to improve relations, Iran knows Russia is on friendly terms with Israel, Tehran’s sworn enemy, and the U.S.S.R. was a supporter of Saddam Hussein. Iran fought a bloody eight-year war with Iraq when the latter was governed by Hussein. Thus, Tehran understands that Iran’s foreign policy goals have not always coincided with Russia’s actions in the region. However, Iran and Russia share an animosity toward the U.S., which gives them an interest in improving relations. The two countries announced progress on a 20-year cooperation agreement. Meanwhile, Beijing and Tehran have begun implementing a 25-year strategic partnership forged in March of last year.

- China hosted meetings of the GCC nations this week; as the U.S. attempts to reduce its activities in the region, China is signaling an increased interest.

- The KSA is considering the development of its indigenous uranium supplies. Although such mining may be used for civilian purposes, it could also support nuclear weapons development.

Alternative energy/policy news:

- The key to expanding the EV market is batteries. Not only do supplies need to increase, but the technology will likely need to improve. Solid-state batteries hold the promise of quicker charging and a farther range. QuantumScape (QS, USD, 18.48) announced a plan to build batteries for stationary applications, e.g., storage for wind and solar.

- Transportation is not the only area where reducing carbon emissions is important. Cement and steel are also large emitters. There has been some recent progress in producing “green steel.”

- Although there is some debate on the issue of climate change and the best way to address it, one area we watch closely is the behavior of insurers. If insurance providers require various steps to be taken before providing coverage, or simply decide not to provide coverage at all, changes in economic activity will result. It is possible the decisions made by insurance companies may lead to changes to address climate change. Along with banks, decisions from the finance industry could have a bigger impact than regulation.