Weekly Energy Update (February 25, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices continue to rise.

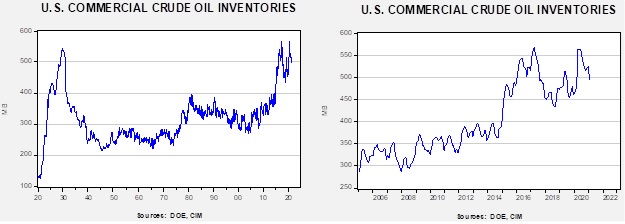

Crude oil inventories rose 1.3 mb when a draw of 6.5 mb was forecast. There was no change in the SPR. Analysts (us included) expected production outages in Texas to lead to a decline in inventories. Although production did decline, refinery operations fell double expectations.

In the details, U.S. crude oil production fell 1.1 mbpd to 9.7 mbpd. Exports fell 1.5 mbpd, while imports declined 1.3 mbpd. Refining activity plunged 14.5%. The collapse in refining activity led to the unanticipated rise in inventories. We also note that consumption eased as cold temperatures forced people to stay home.

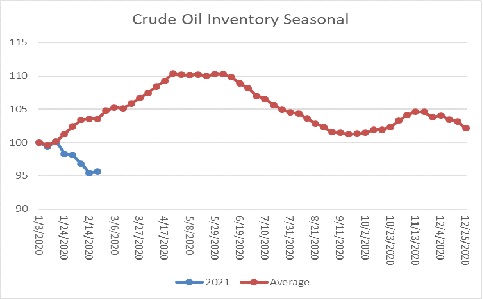

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s rise is seasonally normal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 28.2 mb higher.

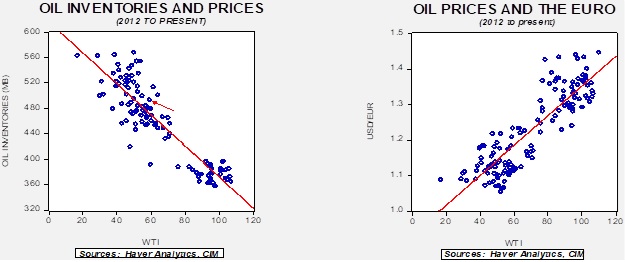

Based on our oil inventory/price model, fair value is $52.62; using the euro/price model, fair value is $68.79. The combined model, a broader analysis of the oil price, generates a fair value of $59.72. The divergence continues between the EUR and oil inventory models, although it is narrowing.

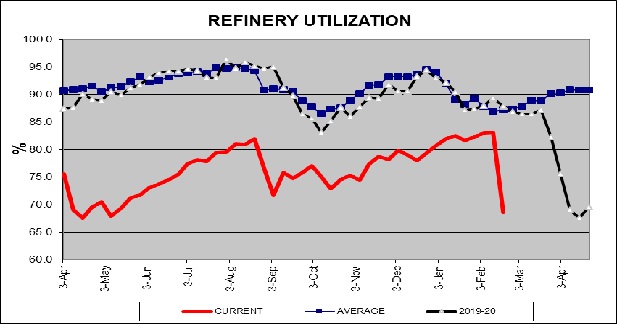

As we noted above, refinery utilization plunged last week. The drop was similar to what we saw in the pandemic.

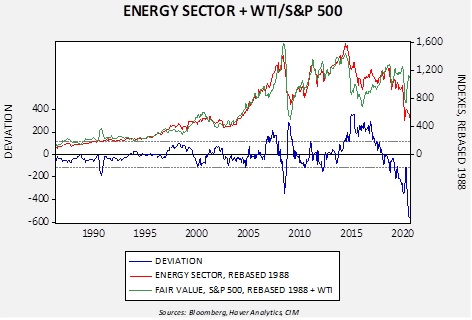

The energy sector has been on a tear after being weak for most of last year. However, when compared to the S&P and oil prices, energy stocks have mostly marked time recently.

The blue deviation line shows the spread between the fair value calculation, based off the S&P and WTI, and the energy sector. Even with the rally in the sector, it is failing to keep up with the independent variables. This suggests that one is better off owning the commodity rather than the equities. Or, put another way, even this rally in the energy sector is less than what we have seen in the past with this combination of equity performance and oil price increases.

Market news: The markets are still dealing with the disruption caused by the recent cold snap which hit Texas hard. This report, on natural gas, gives a detailed look at the cascade of problems caused by the weather. The media tends to try to simplify such situations, looking for clear villains. In reality, outcomes seen in Texas are rarely due to one decision but occur due to a whole series of logical steps that rest on a critical assumption. In this case, the expectation was that natural gas flows would remain stable. Deregulation has generally led to lower prices across many markets. However, sometimes risks are shifted to those with the least ability to manage that risk. That has been seen in Texas.

Geopolitical news:

- Brazil was in the news this week as President Bolsonaro removed the head of Petrobras (PBR, USD, 8.72), the Brazilian state oil company. Bolsonaro fired Castello Branco, who has a post-doc from the University of Chicago, replacing him with Gen. Joaquim Silva e Luna. Like most parts of the world, fuel prices are politically sensitive; in 2018, rising diesel fuel costs triggered a truckers’ strike that reduced support for Michel Temer, Bolsonaro’s predecessor. Shares in Petrobras tumbled on the news; the fear is that Bolsonaro will force the company to keep fuel prices low in the face of rising global crude oil prices, hurting margins.

- Iran continues to send mixed signals to the Biden administration. On the one hand, it is enriching uranium and restricting IAEA investigators. On the other, it says it is open to talks. Our take is that Iran thinks it is dealing with Obama 2.0 and assumes the new U.S. president wants a deal as badly as President Obama did. We doubt this is the case, so this means that there probably won’t be much movement to restart talks.

Alternative energy/policy news:

- Financial firms are starting to balk at “green” lending restrictions.

- This report has been highlighting the growing attractiveness of nuclear power. Here is a long read from the New Yorker on environmentalists who support nuclear power. The current focus is on modular, small reactors.

- Biomass is considered a climate friendly fuel, mostly because wood (the most common) absorbs CO2 as it grows. However, the fuel is getting a reexamination. Generally speaking, the less energy dense a fuel is, the dirtier it is. Wood is not energy dense. It takes lots of it to generate the same heat as coal, oil, or gas.

- NIMBY is alive and well in Sweden, where opposition to onshore wind farms is growing.