Weekly Energy Update (February 19, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

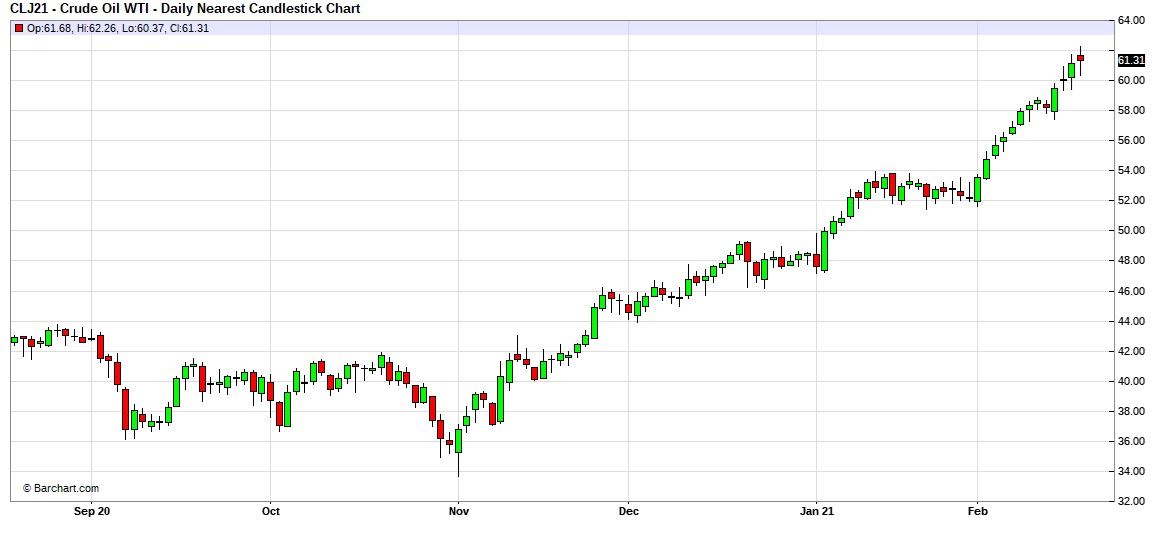

This week’s report is being published on Friday as the DOE data was delayed due to the Presidents’ Day holiday. Here is an updated crude oil price chart. Prices continue to rise.

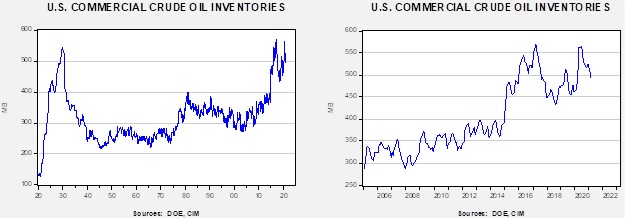

Crude oil inventories fell 7.4 mb when a draw of 2.0 mb was forecast. The SPR fell 0.1 mb, meaning the draw in commercial inventories was 7.3 mb.

In the details, U.S. crude oil production fell 0.2 mb to 10.8 mbpd. Exports rose 1.2 mbpd, while imports were unchanged. Refining activity rose 0.1%. Next week, we expect a significant drop in both production and refinery operations due to the cold snap. The impact on crude oil inventories will likely be negative.

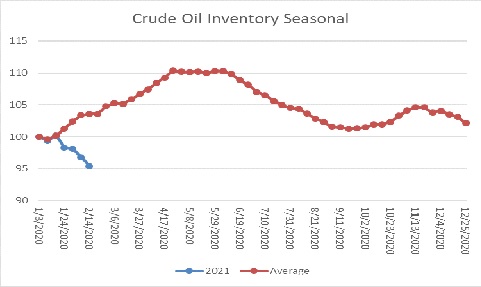

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline is contraseasonal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 28.3 mb higher.

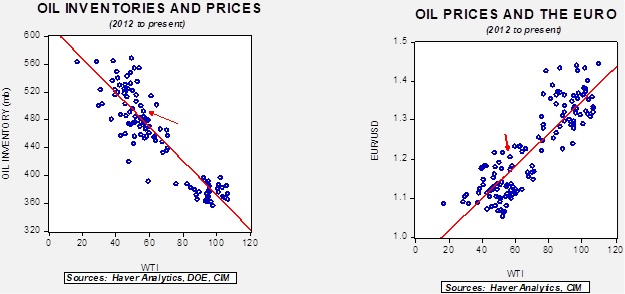

Based on our oil inventory/price model, fair value is $53.02; using the euro/price model, fair value is $68.34. The combined model, a broader analysis of the oil price, generates a fair value of $59.70. The divergence continues between the EUR and oil inventory models, although it is narrowing.

Market news: This week was driven by unusually cold weather that spread well into the South. Texas, a major oil and gas producing state, was hit hard by the drop in temperatures, which brought havoc on energy production. Oil output fell about 30% to 40% this week (which will be reflected in next week’s storage data). At the same time, refinery operations were also affected, so the decline in stockpiles next week will be partially offset by that situation. Fortunately, we are late in the heating season, and forecasts indicate rising temperatures in the coming days.

- In response to higher oil prices and the supply problems in the U.S., the KSA announced it will increase oil production to stabilize the market.

- An issue that pops up every so often is that there is a discrepancy between global oil supply and demand. Currently, nearly 70% of some 1.4 billion barrels of oil is unaccounted for. We suspect that some of it is being held in China, which isn’t part of the OECD and thus doesn’t always report its storage. Another possibility is that it’s due to simple miscounting―either the oil was never there, or we are looking at a significant storage overhead somewhere in the world; if so, this would be a bearish factor. On the other hand, if most of it is in China, the country would be inclined to hold it, making the storage market-neutral.

- Royal Dutch Shell (RDS.A, USD, 40.56) has indicated its production has peaked. This dovetails into our position that supplies will fall in the future, which should support oil prices. Meanwhile, there are estimates that China’s demand may peak in 2025.

- One of the risks from a rapid shift away from fossil fuels is that the incidence of the policy could fall disproportionately on the less affluent. A political reaction will be difficult to avoid.

Geopolitical news:

- The Biden administration is giving Middle East leaders the silent treatment, delaying calls and making it clear the region isn’t a high priority. Although we expect contacts to eventually occur, Biden’s behavior does indicate a shift in policy direction. Israel is also adapting to the new environment.

- Meanwhile, tensions continue. Islamic State is showing signs of returning. Iran has indicated it is considering reducing access to IAEA inspectors unless sanctions are lifted. Kurdish rebels killed 13 Turkish captives, triggering a raid by Turkish soldiers.

- As the world backs away from fossil fuels, oil-producing countries are facing a severe decline in revenue and economic growth. Middle East oil producers are starting to consider hydrogen production as an alternative. We note that the KSA is forcing foreign firms to build or expand operations in the kingdom or lose access.

Alternative energy/policy news:

- We are seeing a rapid increase in battery research investment by auto companies.

- Wind turbine companies are building giant turbines for offshore facilities in a bid to drive down costs.

- Geothermal energy is starting to attract attention.

- The agricultural lobby is starting to push for giving farmers revenue for carbon reduction.

- How investors are using their power to sway companies on their power production and consumption is becoming a major issue; the ESG movement is part of this. Blackrock (BLK, USD, 721.39) has issued a paper on the topic. Given that firm’s massive ownership of stocks, if it enforces these rules, the impact could be significant.