Weekly Energy Update (February 11, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Here is an updated crude oil price chart. Prices continue to rise.

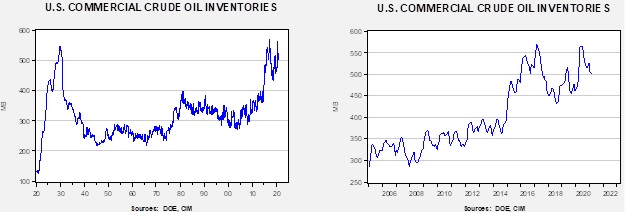

Crude oil inventories fell 6.6 mb when a draw of 0.8 mb was forecast. The SPR fell 0.2 mb, meaning the draw in commercial inventories was 6.8 mb.

In the details, U.S. crude oil production rose 0.1 mb to 11.0 mbpd. Exports fell 0.9 mbpd, while imports declined 0.7 mbpd. Refining activity rose 0.7%.

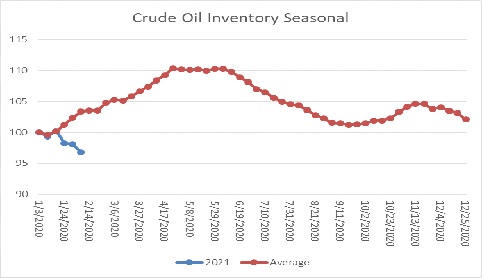

The above chart shows the annual seasonal pattern for crude oil inventories. This week’s decline is contraseasonal. The usual seasonal pattern occurs due to refinery maintenance; in the past, the U.S. oil industry had limited ability to export, which contributed to the seasonal pattern. With the potential for higher exports, the expected seasonal build may not occur, which would be bullish for prices. If we were following the normal seasonal pattern, oil inventories would be 27.1 mb higher.

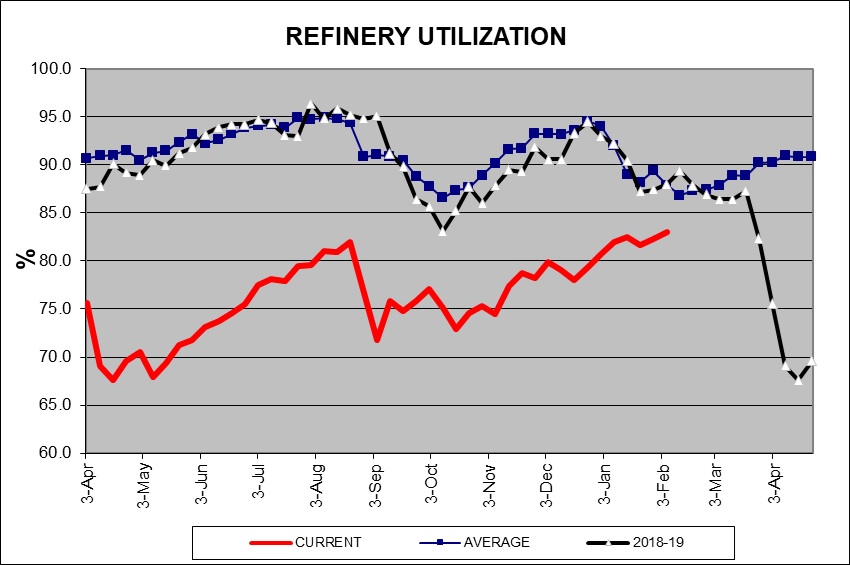

A key factor in this unusual pattern is that refinery operations are not showing signs of maintenance.

Refinery utilization usually falls into the new year and is troughing now. Instead, we are seeing continued strength as the industry is preparing for stronger demand later this year.

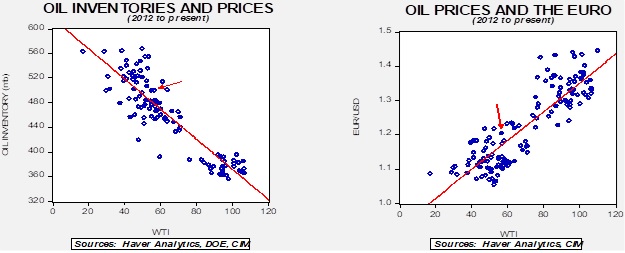

Based on our oil inventory/price model, fair value is $50.63; using the euro/price model, fair value is $68.06. The combined model, a broader analysis of the oil price, generates a fair value of $58.20. The wide divergence continues between the EUR and oil inventory models.

Geopolitical news:

- China has suffered severe environmental degradation caused by its rapid industrialization. General Secretary Xi has made environmental improvement a priority. We note that he has brought Xie Zhenhua back into government as a special envoy for climate issues, a move designed to send signals to Washington that the country is willing to cooperate on this shared concern.

- The Biden administration has removed the Houthis, the key rebel group in Yemen, from the U.S. terrorism list. However, that doesn’t mean the Houthis are now in the clear. The State Department indicates that the group will continue to be under scrutiny.

Alternative energy/policy news:

- If there is one factor to watch in terms of environmental regulation, carbon pricing is probably the key. Until, as a society, we price carbon, the ability to manage climate policy is hamstrung. Why? Because putting a price on carbon will unleash the power of markets on this problem. As David Hume realized, there is only one force in the universe that can control self-interest, and that is self-interest. In other words, what makes markets so powerful is that it forces interests to align and compete, leading to efficient outcomes. This is the basis of capitalism. Once a price for carbon emissions is established, markets will rapidly adjust. However, this efficiency isn’t without consequences. There will be great pain inflicted on some industries (fossil fuels, in particular) and excellent opportunities in others. The price we are watching for is $100 per ton by the end of the decade.

- Europe is leading the charge on climate policy, trying to establish itself as the standard. This plan is a way to increase its influence.

- Part of carbon pricing will lead to the push for low carbon emission energy (which is why we keep reporting on nuclear). Another element of this process is what we like to refer to as the swap of drilling for mining; in other words, to reduce fossil fuel consumption we will need to use more metals and less oil and gas. That means mining companies, which use lots of energy, will need to source cleaner fuels.

- With the potential for change, there is a corresponding push to mitigate or transfer the costs of adjustment. Especially driven by ESG concerns, companies are trying to advertise that they are taking climate change seriously. At the same time, they are also trying to avoid or affect government regulation that would actually require significant changes.

- The Fed has indicated that climate change will be an element to bank oversight.

- Rapid increases in battery storage are allowing for wind and solar energy to become increasingly viable replacements for coal and natural gas for electricity production. For automobiles, the “holy grail” of batteries is solid state lithium, which would allow for greater capacity and faster charging.

- We are also continuing to watch what may be the most significant competitor to EVs, hydrogen/fuel cell vehicles. It appears the most likely use of these vehicles will be in large semi-trucks.