Weekly Energy Update (February 25, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices briefly moved above $100 per barrel on news of the Russian invasion of Ukraine.

(Source: Barchart.com)

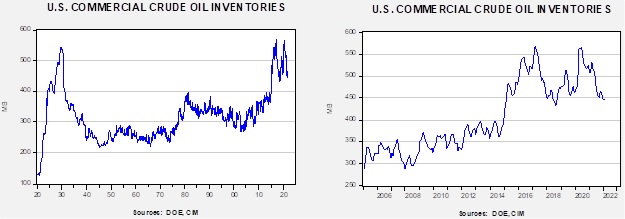

Crude oil inventories unexpectedly rose 4.5 mb compared to a 1.0 mb draw forecast. The SPR declined 2.4 mb, meaning the net build was 2.1 mb.

In the details, U.S. crude oil production was unchanged at 11.6 mbpd. Exports rose 0.4 mbpd while imports increased 1.0 mbpd. Refining activity rose 2.1%, recovering from the previous week’s decline tied to the cold snap that adversely affected refining in Texas and Louisiana.

(Sources: DOE, CIM)

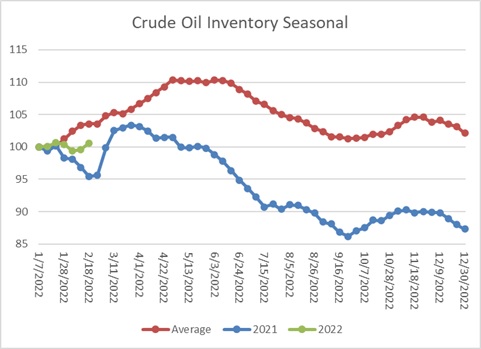

This chart shows the seasonal pattern for crude oil inventories. This week’s report shows we are “splitting the difference” between last year’s plunge and the usual rise seen in the 5-year average. Under normal circumstances, we would anticipate a steady rise in stockpiles, but under current conditions, normal patterns may not develop this year.

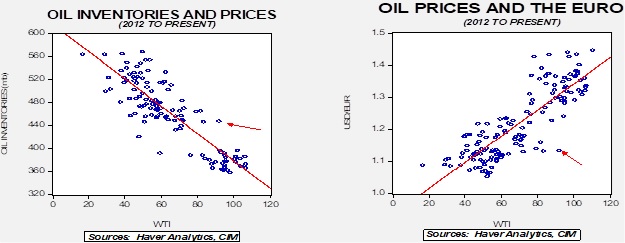

Based on our oil inventory/price model, fair value is $69.56; using the euro/price model, fair value is $54.54. The combined model, a broader analysis of the oil price, generates a fair value of $62.62. Current prices are being driven by ESG and geopolitics, so the usual impact of inventory and the dollar has been overwhelmed. However, the analysis shows that any sort of normalization will likely lead to lower oil prices.

Market news:

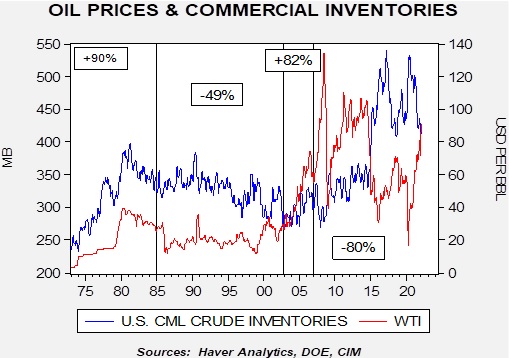

- Clearly the crisis in Ukraine is bullish for oil and natural gas prices. For now, conditions are fluid, but we expect rising concerns about the security of supply. One key relationship to watch is the correlation between oil prices and commercial crude oil inventories.

The normal relationship between inventory and price is inverse. In general, rising inventories suggest excess supply, so rising stockpiles are usually bearish. However, as the above chart shows, there are periods where the two series are positively correlated. During the geopolitical turbulence of the 1970s into the early 1980s, U.S. commercial crude stocks and prices were positively correlated. Another word for this condition is “hoarding.” In other words, rising inventories indicate increasing demand. Since 2007, inventories and prices have been inversely correlated; we will be watching closely to see if this correlation “flips.” If it does, it would be considered very bullish for crude oil prices.

- Although geopolitics always plays a role in the oil markets, the current effect is higher than we have seen since the advent of shale oil.

- The Biden administration has been promoting policies designed to reduce the production of fossil fuels. However, the jump in prices is leading the White House to reverse course, encouraging OPEC and oil firms to rebuild supplies.

- On the energy company front, coal companies, mostly left for dead, are showing remarkably strong earnings. Oil companies are using their earnings to buy back stock.

- The industry is beginning to prepare for massive investment in electricity distribution.

- Methane leaks are leading to a review of America’s natural gas pipeline system. Environmentalists have been targeting pipeline projects to reduce fuel availability.

Geopolitical news:

- As Russia faces sanctions from the West for its actions in Ukraine, one uncertainty is how well Moscow will cope. It should be noted that Russia has increased its reserves and has engaged in fiscal austerity, which should give it some ability to press back against sanctions.

- Germany has, at least temporarily, halted the Nord Stream 2.

- One way the Biden administration is addressing high oil prices is to restore the nuclear deal with Iran. We estimate the removal of sanctions on Iran would likely add about 1.0 mbpd to the market. Iran has been breaking sanctions in recent years, so the increase in supply will probably be modest. In addition, due to distrust on both sides, the deal will probably be implemented in stages, meaning oil flows will not be immediate if a deal is struck. One major worry is that Iran is so close to a “bomb” that the new deal will freeze it at the threshold level, meaning if the deal ever fails, Iran could rapidly become a nuclear power.

- A sign of progress is that the U.S. and Iran are negotiating a prisoner swap, something the U.S. demanded as part of a deal. Another sign is that the Ayatollah Khamenei is supporting a deal.

- Iranian MPs put forth their demands for a new agreement; if followed, a major sticking point is that the Iranian parliament wants the West to remove sanctions before performing their end of the bargain.

- Iranian president Raisi has visited Qatar in a bid to encourage regional powers to support a return to the nuclear deal.

- Israel, which opposes any thaw with Iran, is increasing its security cooperation with Bahrain. The threat from Iran is leading the Gulf States to normalize relations with Israel. Even Turkey, which had been at odds with the Gulf States over the former’s support of the Muslim Brotherhood, is moving to improve relations.

- Next week’s BWGR discusses the situation in Turkey. The country has been hit with rapid inflation caused in part by heterodox monetary policy. Recent reports indicate that electric utility prices are soaring, adding to the woes of Turks.

- Ethiopia has started generating electricity from the largest dam on the Blue Nile, raising fears that flows north will be cut.

Alternative energy/policy news:

- As EVs grow in popularity, the need for battery disposal or recycling is emerging. New firms are springing up to meet the challenge.

- A recent report from the Institute for Energy Economics and Financial Analysis (IEEFA) says that small modular nuclear reactors won’t be an answer for climate change.

- One issue that could constrain the growth of green energy is the lack of trained labor to build out the green infrastructure.

- The administration is attempting to speed up the build out of EV charging stations.