Weekly Energy Update (February 3, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

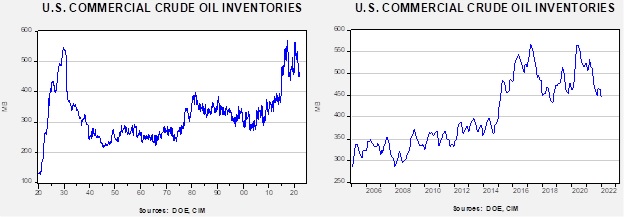

Since troughing in early December, oil prices have been steadily rising due to tightening supplies. We are approaching the highs set in November.

Crude oil inventories unexpectedly fell 1.0 mb compared to a 1.8 mb build forecast. The SPR declined 1.9 mb, meaning the net draw was 2.9 mb.

In the details, U.S. crude oil production fell 0.1 mbpd to 11.5 mbpd. Exports fell 0.4 mbpd while imports rose 0.8 mbpd. Refining activity fell 1.0%.

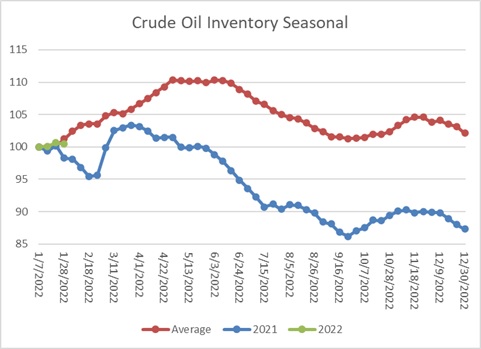

This chart shows the seasonal pattern for crude oil inventories. This week’s report shows a pattern more consistent with average and less with last year. Last year, we had a sharp drop in stockpiles in a period where inventories usually accumulate. So far, it looks like we will see inventories rise rather than decline.

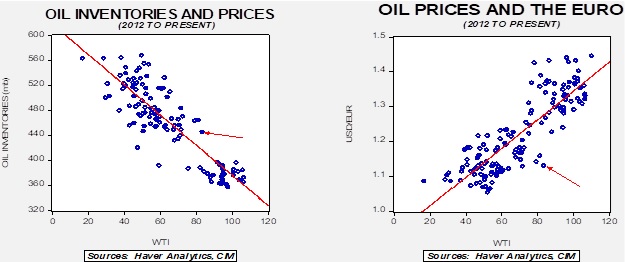

Based on our oil inventory/price model, fair value is $69.62; using the euro/price model, fair value is $53.34. The combined model, a broader analysis of the oil price, generates a fair value of $61.72. Current prices exceed our model projections, but price momentum is likely to push prices higher.

Market news:

- OPEC+ announced it would lift its production quotas by 0.4 mbpd. Although this news is bearish, there are strong doubts the cartel can meet this goal. Several of the group’s producers are effectively at full capacity, and thus, it is unlikely that there will be a significant rise in OPEC+ production.

- One concern of oil producers is that the shift away from fossil fuels will create “stranded assets,” which is oil and gas investments that become lost due to falling demand. A recent study warns that if the industry attempts to boost production through investment in reaction to current high prices, it risks stranding $500 billion in wasted investment.

- Los Angeles has banned new oil and gas wells in its city proper and will phase out current wells over the next five years.

- The DOE announced it would sell 13.4 mb of crude oil from the SPR this year.

- Investors are trying to map out how energy equities will fare in the coming years in the face of falling demand. Increasingly, they are using the tobacco industry as a model.

- Initially, the Biden administration wanted to ban new oil and gas leases on federal land and offshore. That ruling was reversed, but a recent court order is banning offshore leases. However, even with this ruling and the initial goals of the administration, in reality, the current administration is approving drilling permits faster than the Trump administration did.

Geopolitical news:

- It is no secret that the U.S. is trying to reduce its involvement in both Europe and the Middle East. As the U.S. steadily lowers its involvement with the region, China is attempting to extend its influence.

- The U.S. claims that it has crafted a deal with Iran, which now is dependent on the Raisi government to decide if it wants to resurrect the 2015 pact. We doubt a deal will be made.

- Europe has been facing a natural gas crisis which has partly been affected by the tensions between Russia and Ukraine. Before the crisis, the U.S. tried to boost natural gas sales to Europe but was mostly rebuffed. Now, as the EU scrambles to find sources of natural gas from venues other than Russia, Qatar has emerged as a potential source, but it appears unlikely it will be able to offset the loss of Russian supplies.

- Tensions with Ukraine are also lifting coal prices.

- Russia has put an LNG tanker in place to supply natural gas to its enclave in Kaliningrad in case war disrupts supplies.

Alternative energy/policy news:

- General Motors (GM, USD, 52.79) is planning to accelerate its EV production and potentially sacrifice earnings.

- Range anxiety is one factor that slows the adoption of EVs. The gasoline/diesel infrastructure is widespread, and there is less concern about “running out of gas” compared to “running out of juice.” One way to address this problem would be to build electrified roads that could charge the battery while the vehicle is in motion. Testing programs are being developed to see if this solution would be possible.

- EV could prove very popular with construction workers. An EV could provide electricity to power tools, turning a pickup truck into a power hub. If this trend develops, it could accelerate the move toward EVs.

- Although creating alternative energy supplies is still the focus of the industry, energy conservation remains a key element in reducing fossil fuel consumption.

- Solar power continues to lag in the U.S. A key reason is the decentralized nature of the U.S. political system. Without a national standard for distributed power, adoption will remain spotty.

- The NY Senate is considering a 3-year moratorium on bitcoin mining. Energy consumption is the primary concern.

- We continue to monitor development in geoengineering, which is the deliberate use of aerosols and other measures to reflect energy back into space and lower temperatures.

- ESG investment remains a popular topic; however, defining what it means is far from consistent. It turns out the arbiters of what constitutes ESG are conflicted.

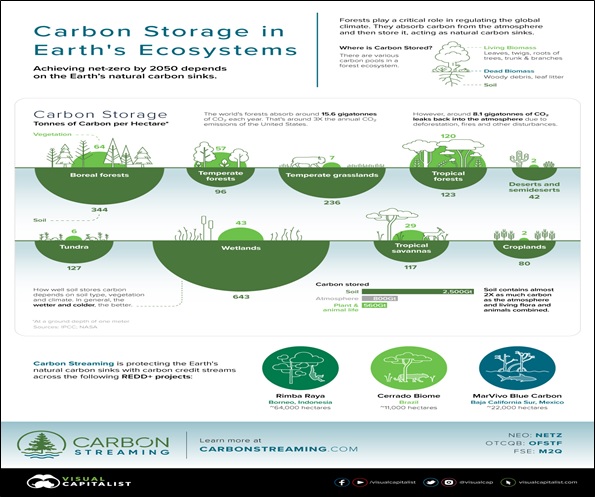

- Nature is a carbon sink. This graphic shows how well various environments absorb carbon.