Weekly Energy Update (August 31, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices were mostly rangebound this week, holding near recent highs. We are watching Hurricane Idalia as it travels through the Gulf of Mexico. Its current track suggests it will miss the most sensitive areas of oil and gas production, but it could disrupt oil and gas shipping for a few days.

(Source: Barchart.com)

(Source: Barchart.com)

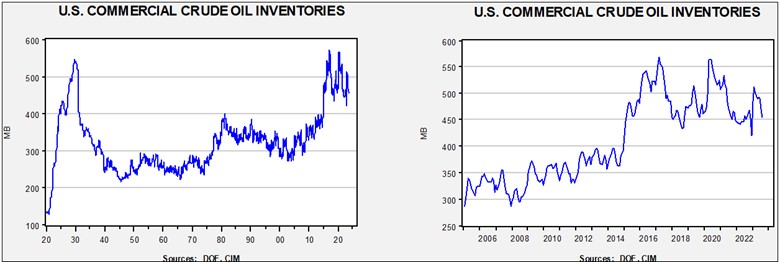

Commercial crude oil inventories fell 10.6 mb, much lower than the 2.2 mb draw forecast. The SPR rose 0.6 mb which puts the net draw at 10.0 mb.

In the details, U.S. crude oil production was steady at 12.8 mbpd. Exports rose 2.2 mbpd, while imports rose 0.5 mbpd. Refining activity fell 1.2% to 93.3% of capacity.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

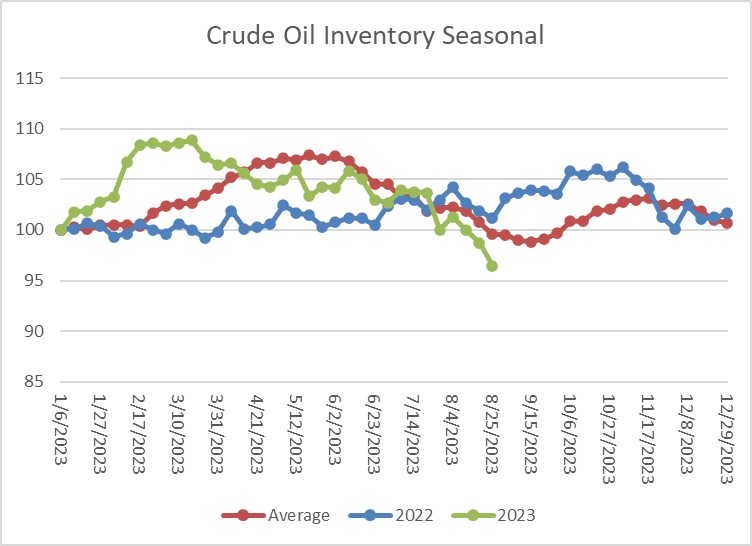

The above chart shows the seasonal pattern for crude oil inventories. Last week, the sharp drop in inventories put stocks well below seasonal norms. We would expect inventories to continue to decline into mid-September and then start their seasonal rise into November.

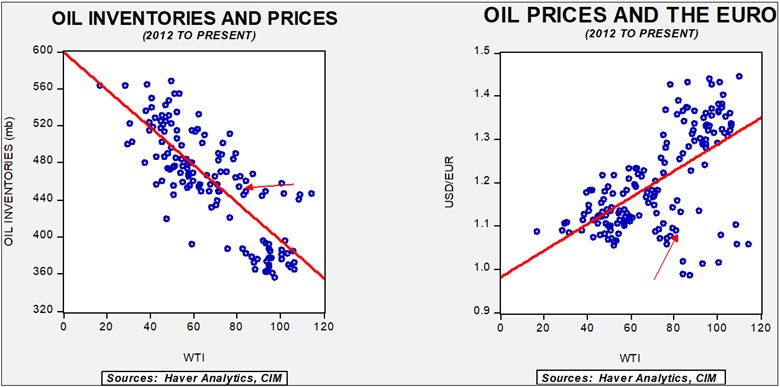

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $71.86. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

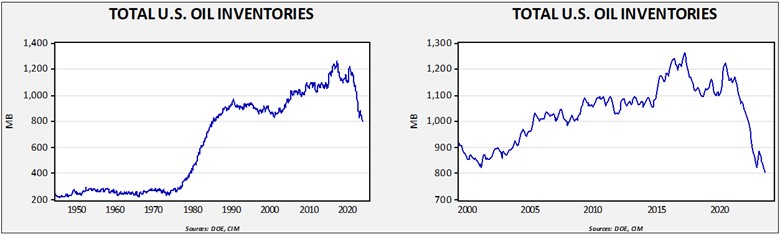

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1985. Using total stocks since 2015, fair value is $95.49.

Market News:

- Although it is commonly held that oil demand will peak sometime over the next 20 years, there are skeptics who argue that this is unlikely. One reason is that developing economies will likely see more intensive energy consumption which will keep oil demand growing. The problem with the more commonly held view is that it affects investment. As we noted last week, for the first time ever, U.S. oil firms returned more cash to shareholders than they spent on exploration. This sort of activity makes sense if the future of oil and natural gas is bleak; however, if that is not the case, we could be dangerously underproducing oil which would lead to higher prices.

- Low water levels in the Panama Canal are forcing delays and light loadings of vessels. The problem could constrain LNG shipping to Europe.

- The Kingdom of Saudi Arabia (KSA) is expected to roll over its current cuts into October.

- During the pandemic, oil prices briefly “went negative.” Essentially, there was a lack of storage space for crude oil and those trying to sell it were forced to pay traders to take it. One of the contributing factors to the situation was selling from the oil ETFs. As investors moved to sell the ETFs, the managers of the funds, which held nearby oil futures contracts, were also forced to “dump” contracts. The forced selling created the downdraft in prices, leading to the unprecedented negative oil price. In response, the largest ETF from the United States Oil Fund (USO, $72.78) changed its investing pattern. Instead of holding the nearby futures, it spread its holdings among numerous contract months. Although this action dampened the impact on the front month, it also made the ETF less sensitive to nearby prices. Thus, investors wanting exposure to nearby oil prices found the product less attractive. We note that the fund manager has decided to return to holding the nearby futures again. Although this decision will make the product more attractive, it also will recreate the problem that led to the May 2020 price collapse.

- Although it is rarely discussed in polite company, there is an undercurrent of assigning costs of regulation. This is the reason lobbying exists. It is well known that the global shipping industry is “dirty,” as it has historically used bunker fuel, the dirtiest but cheapest cut of the crude oil barrel, but because of its international situation, it tends to be hard to regulate. As new global regulations are put into place, there is a battle on how (or better yet, to whom) the costs of regulation will be allocated.

- We have noted recently that U.S. oil production is rising. Interestingly enough, so is Canada’s.

- Although U.S. oil production is rising, drilling activity in the Permian Basin is declining rapidly. However, we may see this trend reverse in the coming months.

- The U.S.’s third largest oil refinery has been shut down due to a storage tank fire. The news lifted diesel fuel prices.

- Another area seeing expanding oil production is in Suriname.

Geopolitical News:

- We have not commented in detail on the Robert Malley situation. To recap, Malley was a special envoy to Iran who was recently relieved of his security clearance (and put on unpaid leave). Officially, the concern is his handling of sensitive documents, but the real issue is that he may have been an Iranian mole in the State Department. Although the mainstream U.S. media has mostly ignored the issue, it has been examined in great detail by John Schindler on Substack. Interestingly enough, the Iranian media is reporting on the topic and has disclosed internal State Department documents. It is unlikely that this situation will directly affect the oil and gas markets; however, it may disrupt administration negotiations with Iran and thus could lead to a drop in Iranian oil supplies.

- There was an apparent coup in Gabon, which is a member of OPEC+. President Bongo had just won a third term, but apparently elements of the military opposed his continued rule. Gabon is a relatively small producer (0.2 mbpd), so we don’t expect this event to have much impact on oil prices.

- Turkey and Iraq are in a dispute over who will pay the $1.5 billion fine incurred by the Kurdish Regional Government. Until the fine is paid, Turkey is blocking Iraqi oil exports from Northern Iraq.

- Iran has lived under some element of U.S. sanctions since 1979. The goal of sanctions is to change the sanctioned nation’s behavior. With Iran, for the most part, it seems this really hasn’t worked. It is clear sanctions have hurt Iran’s economy and its people, but Iran continues to act contrary to U.S. goals and persists despite the sanctions. A new paper suggests that a major reason for this is that Iranian elites actually benefit from sanctions. Essentially, Iranian elites shift the burden of sanctions onto ordinary Iranians and thus are willing to accept the sanctions regime.

- As the U.S. increases pressure on Russia, Washington is easing sanctions on Venezuela. The Biden administration doesn’t want high oil prices; it just wants to undermine Moscow.

- Although Iraq has ample natural gas reserves, it lacks processing capacity. Raw natural gas often contains liquids (which are quite valuable) and impurities that need to be refined for use in power plants, chemical processes, etc. Because Iraq lacks processing capacity, it has been forced to import “dry” natural gas from abroad. Turkmenistan and Iraq have announced a new trade deal for natural gas to feed Iraq’s electricity production.

- The KSA wants to build nuclear power stations. By doing so, it can free up more oil and natural gas for export. The U.S. and China are competing to provide the reactors, but Washington faces an impediment. The U.S. wants to build reactors that won’t create materials that could be used in nuclear weapons, while Beijing does not have similar requirements. Thus, the U.S. could find itself in a situation where it either doesn’t enforce its non-proliferation standards to get the business (which would probably be done by South Korea) or hold to the standards and see China build the reactors. In either case, the program could give Saudi Arabia the materials needed to build a nuclear weapon. We also note that Riyadh is using the nuclear issue as part of the U.S. goal of normalizing relations between Israel and the KSA.

- Saudi foreign reserves fell last month despite high oil prices. This drop reflects production cuts. Generally speaking, higher oil prices have tended to lift reserves, so the cuts are having an impact.

Alternative Energy/Policy News:

- Fossil fuels receive subsidies. It is common in emerging market economies for governments to subsidize fuels to households, for example. The IMF calculates these subsidies exceeded $7.0 trillion last year.

- As we have been noting on a regular basis, China is dominating the EV battery market. Not only is China becoming the low-cost producer, but it is also developing new battery technologies that could extend range and use cheaper, more abundant materials. For the West, the continued dilemma is whether to simply accept Chinese dominance to accelerate the energy transition or exclude China and pay higher costs.

- There is growing concern that China may be creating a glut of batteries, which will make excluding them even more difficult.

- There are increasing experiments using dense materials, such as sand, to hold heat which could then be used as batteries. Although not necessarily efficient, the material is cheap enough that, for some applications, it works quite well.

- In electrolysis, which splits hydrogen from oxygen in water and frees up the former for energy use, the process typically uses platinum as a catalyst. New studies suggest that gold and nickel might be more effective as a catalyst.

- One factor that is often overlooked in the energy transition is the role of efficiency. By using less fuel in transportation, HVAC, etc., less carbon will be emitted. Promoting efficiency through regulation tends to be less effective than through price, which is why economists always press for carbon taxes as the fastest way to promote the energy transition.

- As Europe warms, nations are finding that their housing stock is ill-equipped for higher temperatures.

- Australian researchers report progress on an air/zinc battery.

- For the first time, the U.S. auctioned wind energy leases in the Gulf of Mexico. The bidding was rather tepid.

- Germany is promoting geothermal energy to replace fossil fuels.