Weekly Energy Update (August 26, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

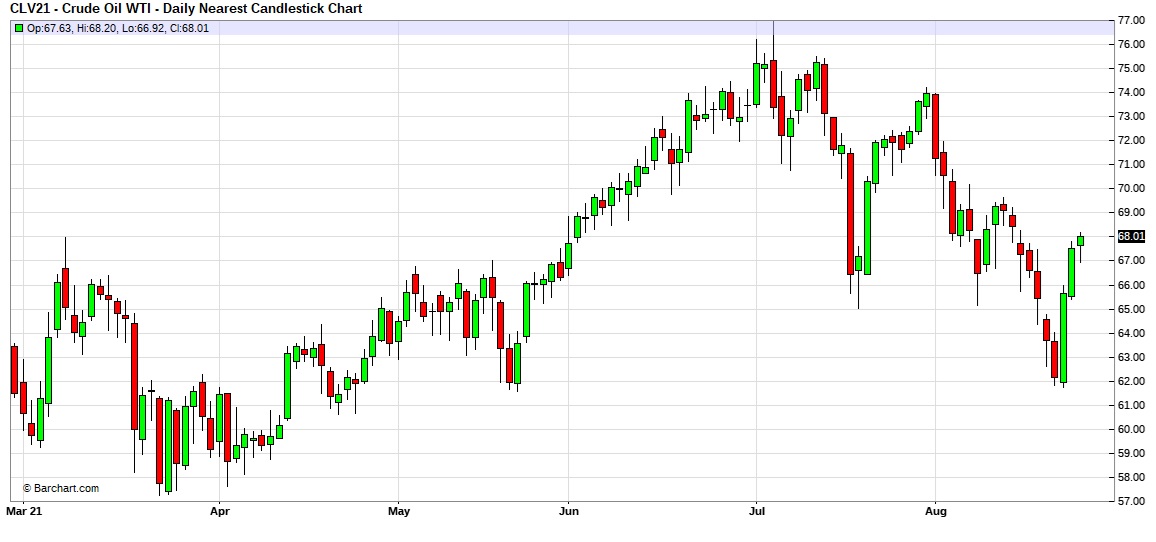

After reaching $62 per barrel support, prices have snapped back.

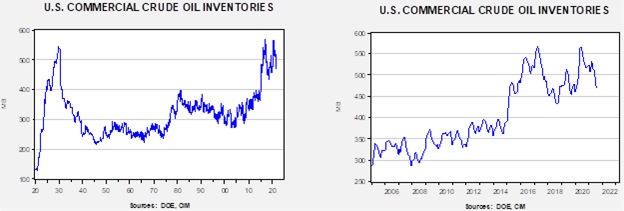

Crude oil inventories fell 3.0 mb compared to the 2.0 mb draw forecast. The SPR was unchanged this week.

In the details, U.S. crude oil production was steady at 11.4 mbpd. Exports fell 0.6 mbpd, while imports declined 0.2 mbpd. Refining activity rose 0.2%.

(Sources: DOE, CIM)

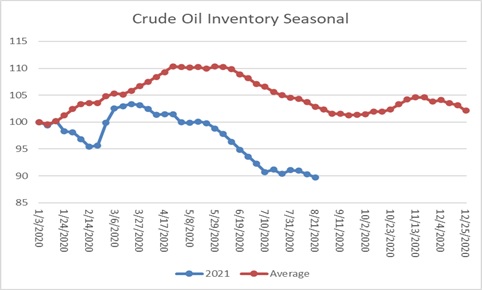

This chart shows the seasonal pattern for crude oil inventories. We are well into the summer withdrawal season. Note that stocks are significantly below the usual seasonal trough seen in early September. A normal seasonal decline would result in inventories around 550 mb. Our seasonal deficit is 67.7 mb. Since early July, inventory levels have stabilized. As the chart indicates, seasonal inventory stabilization usually occurs in September, and with stabilization, the seasonal deficit has narrowed compared to earlier in the summer.

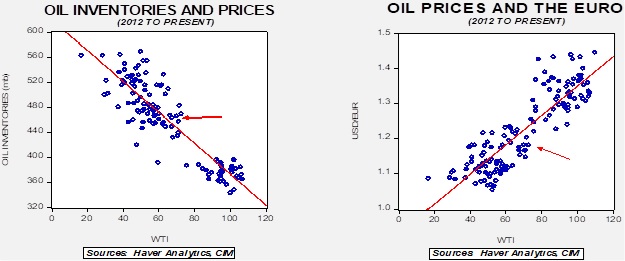

Based on our oil inventory/price model, fair value is $63.65; using the euro/price model, fair value is $61.75. The combined model, a broader analysis of the oil price, generates a fair value of $62.43. Continued dollar strength is weighing on oil prices.

Market news:

- As large oil companies and developers face pressure to divest oil and gas assets, they often sell them to smaller firms. Environmental activists are increasingly opposing such sales. Environmentalists really want to see the projects shut down, but as long as the projects have value, sales are more likely to occur and pass to firms with fewer resources to make the projects less damaging.

- Although the Biden administration is considered hostile to the oil and gas industry, the DOE has signaled it would support LNG exports.

- A federal judge has blocked Alaska oil permits on the North Slope, arguing that environmental impact studies were inadequate.

- The lack of pipeline capacity may eventually crimp natural gas production in Appalachia.

- There is a constant tension between farmers and refiners concerning biofuel blending. The EPA has recently sided with refiners on blending mandates.

- A major fire on a PEMEX offshore oil platform led to five fatalities and has cut production by 420 kbpd. It is not clear when production will resume.

Geopolitical news:

- The world’s attention has been focused on the crisis in Afghanistan, but the U.S. is also planning to withdraw combat forces from Iraq. The Kurds could be at risk, as both Iran and Turkey want to prevent moves toward a Kurdish state. Turkey has been taking aggressive actions against Kurdish groups they deem as terrorist organizations.

- As the Taliban gains control of Afghanistan, Iran is facing a series of potential problems. The Taliban is a Sunni group, and Shiites in Afghanistan may be at risk; if they are, the logical place to flee would be Iran. Iran has established refugee camps along its border with Afghanistan. As the West freezes accounts and denies the Taliban government aid, it is likely the new government in Kabul will turn to opium, which raises the risk of trafficking and addiction in Iran.

- EU carbon taxes may be worse for Russia than sanctions, according to Igor Sechin, the head of Rosneft (OJSCY, USD, 6.23).

Alternative energy/policy news:

- As we approach the end of fossil fuels, research is being conducted on all sorts of alternative energies. Perhaps the “holy grail” of electricity production would be fusion reactors. These reactors would not create the byproducts associated with nuclear fission or the runaway reactions. It is still a challenging technology. However, if the issues are resolved, it might resolve much of the climate problem.

- Although wind turbines are cropping up across the country, the firms involved continue to struggle to achieve consistent profits.

- A common criticism of solar power is that it needs subsidies to work. However, Georgia (the state, not the country) is seeing a flourishing expansion of solar power without subsidies.

- The U.S. Treasury has issued new guidelines to multilateral development banks on fossil fuel projects. The bottom line is that all coal projects and most oil projects won’t get funding.

- One factor that could push more aggressive development of clean energy is a growing realization that climate change isn’t just increasing global temperatures; it appears to be leading to a wider variety of weather events. Recent temperature peaks in various parts of the world have increased awareness.

- The EU is considering investing in rare earth magnet production.