Weekly Energy Update (August 24, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices continued to weaken this week, although there are technical signs that prices might be consolidating at these elevated levels.

(Source: Barchart.com)

(Source: Barchart.com)

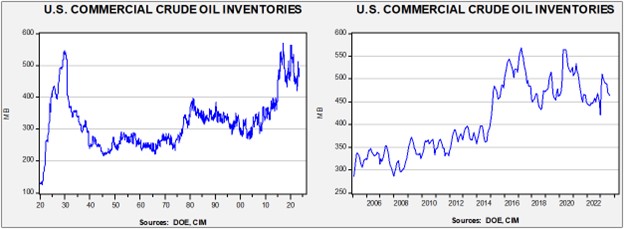

Commercial crude oil inventories fell 6.1 mb, lower than the 2.5 mb draw forecast. The SPR rose 0.6 mb which puts the net build at 5.5 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 12.8 mbpd. The DOE is projecting higher U.S. output on rising well productivity. Exports rose 2.2 mbpd, while imports rose 0.5 mbpd. Refining activity rose 0.9% to 94.7% of capacity, the highest level since early June.

(Sources: DOE, CIM)

(Sources: DOE, CIM)

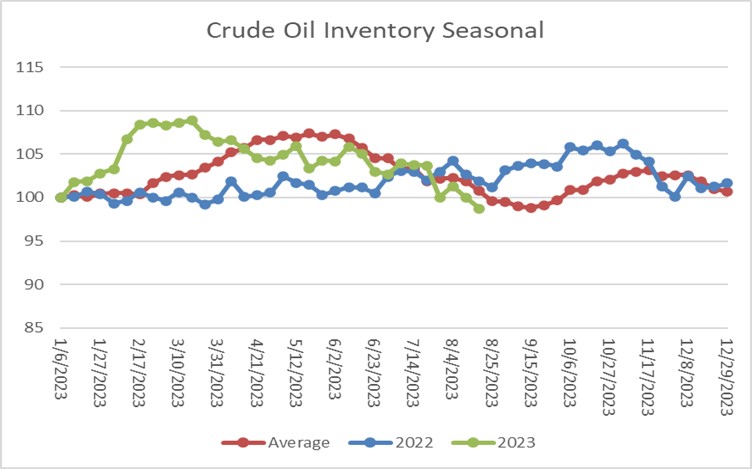

The above chart shows the seasonal pattern for crude oil inventories. Over the past few weeks, the decline in stockpiles is consistent with seasonal patterns. Inventories remain a bit below their seasonal average. Based on the seasonal pattern, inventories should start to rise after mid-September.

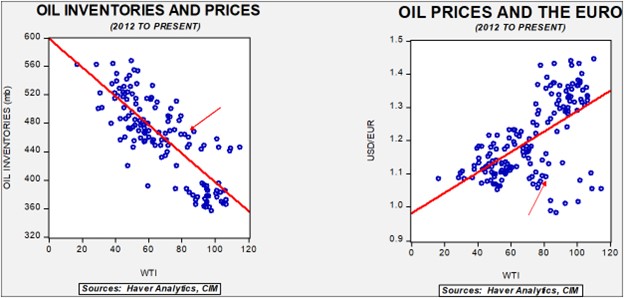

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $68.13. Commercial inventory levels are a bearish factor for oil prices, but with the unprecedented withdrawal of SPR oil, we think that the total-stocks number is more relevant.

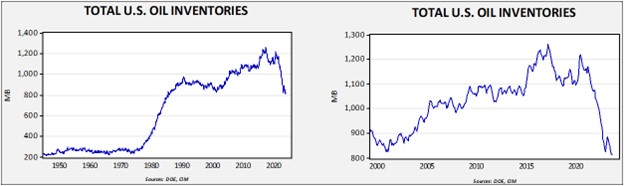

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in late 1985. Using total stocks since 2015, fair value is $94.46.

Market News:

- The European natural gas market is behaving in a peculiar fashion. European natural gas storage is nearly full, which should be depressing prices. After all, if a consumer lacks storage, there is no place to put the product in the immediate term. Last week, prices rose on fears of a strike in Australia’s LNG facilities. It should be noted that European storage only represents about a third of winter consumption. Barring another mild winter, Europe will need LNG in the coming months. We are starting to see the futures curve for natural gas price in a premium for winter gas; we are also seeing rising charter rates for LNG tankers. Essentially, it appears that the EU is using tankers as a form of floating storage.

- China is expanding its LNG trading desks to facilitate imports.

- The Kingdom of Saudi Arabia’s (KSA) decision to cut production has led to lower exports to China.

- The Midwest (including St. Louis) has withered under a heat dome this week. Temperatures have triggered strong electricity demand. August temperatures are running above recent norms.

- BASF (BASF, $12.32) has signed a long-term LNG deal with Cheniere (LNG, $164.39) to secure natural gas supplies. Traditionally, LNG deals tended to be based on term contracts. Since building LNG infrastructure is expensive, the firms typically wanted to see reliable demand before making the investment, but in recent years, more LNG has been traded on the spot market. Thus, this deal harkens back to an earlier era. More importantly, it suggests BASF doesn’t expect a return of Russian natural gas.

- U.S. oil firms’ payouts to investors topped exploration spending for the first time on record, according to auditors. The energy transition has changed the behavior of oil companies. They are clearly more focused on returns to shareholders, fearing falling demand in the future.

Geopolitical News:

- The KSA, Russia, and Iran are in a competition to supply oil to China. Last month, Iran’s oil exports to China reached a 10-year high.

- Iran’s foreign minister has travelled to Riyadh, marking the first visit since the two countries restored relations.

- Relations between the U.S. and the KSA have been deteriorating for some time. Although the Saudis made a concerted effort to woo President Trump, they were disappointed when their key oil facility was attacked in 2019 by Iranian-backed Houthis and the U.S. didn’t respond by attacking Iran or the Houthis. When candidate Biden was running for president, he vowed to isolate Crown Prince Salman, hoping to turn the Saudi leader into an international pariah. As oil markets tightened and prices rose, the Saudis, understandably, were not all that keen on lifting production to ease prices. The U.S. is currently wooing Riyadh for the goal of normalizing relations between Israel and the KSA. There are reports President Biden may meet with the crown prince in this effort. However, despite recent optimism, normalization is probably not imminent.

- In a dispute dating back to the 1960s, Iran, Kuwait, and the KSA have been at odds over the Durra, or, from Iran’s perspective, the Arash natural gas field in the Persian Gulf. The dispute lies over the maritime boundaries between the nations. Development of this field has stalled due to the uncertainty surrounding the claims. As we have reported recently, relations between the Gulf States and Iran have improved this year, and this disputed region will be a good test to see just how much relations have improved.

- In March, Chinese diplomats made news by brokering a thaw in relations between the KSA and Iran. However, in the months following the announcement, and despite meetings between the two nations, there has been precious little progress. Saudi Arabia continues to uphold U.S. sanctions on Iran, which is limiting trade. Iranian diplomats traveled to Riyadh last week, raising hopes of an improvement in relations, although our take is that it looks like Crown Prince Salman is “slow walking” relations.

- As we noted last week, the U.S. and Iran have been working on a prisoner swap and a release of a portion of Iran’s frozen reserves. While this attempt at improving relations continues, maritime tensions in the Persian Gulf are escalating. The U.S. is offloading the oil it seized from an Iranian tanker, and Iran is threatening to attack U.S. Navy vessels operating in the Persian Gulf.

- Iran has unveiled a copycat version of the U.S. MQ-9 “Reaper” drone. The U.S. version is capable of staying aloft for 24 hours; Iran is claiming similar capabilities. Iran also claims that the drone is capable of reaching Israel.

- One of the perks of living in Iran is that the government subsidizes gasoline. Fuel prices can be as low as 11 cents per gallon. Such low prices encourage smuggling, meaning that Tehran is providing cheap gasoline to its neighbors. The smuggling, as expected, has increased demand, straining the domestic refining industry and prompting Iran to import Attempts by the government to curtail the subsidies have led to protests in the past. For now, the subsidies will likely remain in place, meaning the stress on Iran’s fiscal budget will continue.

- As oil prices have increased, India’s discounts on Russian oil are evaporating. Indian imports from Russia appear to be declining as a result.

- Russia continues to build out alternative routes for oil exports. Sanctions have created a “ghost fleet” of aging tankers and new entrants into oil shipping.

- Russia continues to evade sanctions due to several factors, including opaque prices, which allow Western firms to traffic in Russian oil.

- U.K. officials have accused Nigeria’s former oil minister of bribery. We note that Nigeria’s oil production has been declining; poor security and the lack of investment have plagued the oil sector. Bribery is probably part of the problem.

Alternative Energy/Policy News:

- There is a school of thought within the environmental movement that is Malthusian; simply put, they hold reservations that technology can resolve environmental problems and instead press for less economic growth. The rising opposition to carbon capture reflects this thinking, as does the continued rejection of potential mining sites due to environmental concerns. Although we agree the concerns are real, the energy transition rests on expanding the availability of key metals, such as copper, lithium, nickel, etc.

- As these rejections continue, the attractiveness of metals recycling

- The Inflation Reduction Act is a year old. The act’s main goal is to speed up the U.S.’s energy transition. At the same time, it is also trying to boost U.S. jobs and secure mineral supply chains. There is great resistance to performing the mining necessary in the U.S. to replace fossil fuels, which means the Biden administration is left with cultivating supply sources in Africa.

- Research from Bloomberg projects that EVs will reduce gasoline demand dramatically by 2040.

- It looks increasingly likely that the UAW will strike. One of the key issues is that the union fears less complex EVs will lead to a notable decline in the workers required to build vehicles. The UAW is considering a strike to protect future jobs as EVs expand over time.

- Although Brazil’s President Lula has openly supported alternative energy projects, he is also supporting new oil exploration. The support for fossil fuel exploration has divided his political coalition.

- One of the more difficult parts of the energy transition involves industrial processes, especially tied to metal refining. There is work being done in the area of “thermal batteries,” which essentially heats bricks to high temperatures and then uses the heat from said bricks to engage in metals processing. If renewable sources of electricity are used, thermal batteries would be mostly clean, and since the bricks can hold heat for a long period of time, this means the intermittency from wind or solar might be workable.

- Shipping companies are starting to test the use of sails for ocean-going vessels as a way to reduce fuel consumption.

- Chile, which has the world’s largest lithium reserves (and is the second largest producer), has revamped its investment procedures. This change has led to an influx of firms bidding for access to the country’s lithium deposits.

- U.S. uranium production rose modestly in 2022 but production levels remain very low. However, the U.S. and EU are taking steps to find new sources of uranium for power production.

- Although China continues to dominate rare earths mining and processing, consumers of these metals are making efforts to diversify. Investment in processing is occurring in Vietnam.