Weekly Energy Update (August 18, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Crude oil prices remain under pressure on fears of a deal with Iran and weakening economic growth.

(Source: Barchart.com)

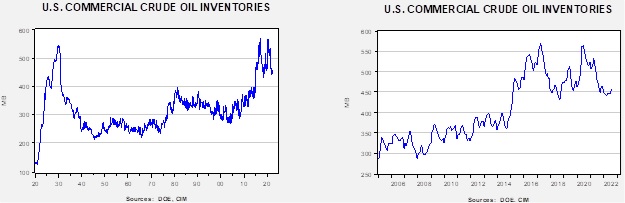

Crude oil inventories fell 7.1 mb compared to a 0.3 mb build forecast. The SPR declined 3.4 mb, meaning the net draw was 10.2 mb.

In the details, U.S. crude oil production was steady at 12.2 mbpd. Exports rose 2.9 mb, while imports were unchanged. Refining activity dipped 0.8% to 93.5% of capacity.

(Sources: DOE, CIM)

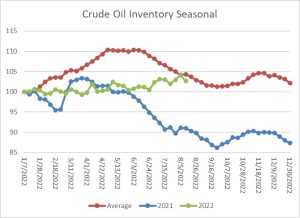

The above chart shows the seasonal pattern for crude oil inventories. Clearly, this year is deviating from the normal path of commercial inventory levels although this week’s outsized decline is consistent with seasonal behavior. We will approach the usual seasonal trough for inventories in mid-September.

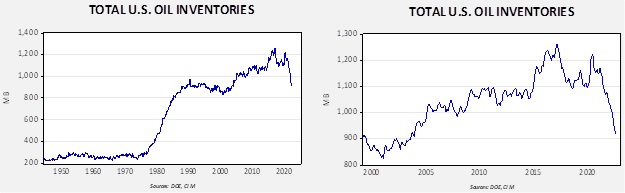

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels last seen in 2004. Using total stocks since 2015, fair value is $104.45.

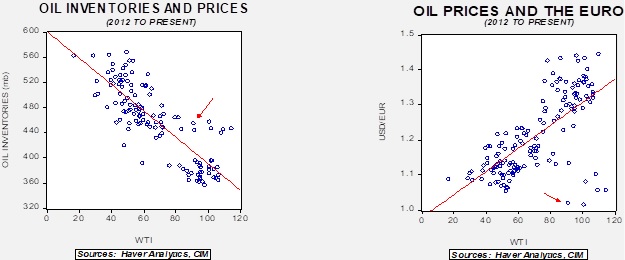

With so many crosscurrents in the oil markets, we are beginning to see some degree of normalization. The inventory/EUR model suggests oil prices should be around $64 per barrel, so we are seeing about $24 of risk premium in the market.

Market news:

- Oil prices have been coming under pressure mostly on fears of slowing demand, and weak economic data from China have been particularly worrisome. Weaker demand has taken US. retail gasoline prices below $4 per gallon. Last month, futures markets were weaker than physical price markers, but even the physical markets are now showing signs of weakness. OPEC+ recent demand forecasts confirm softening consumption, although some of this may be self-serving. If the cartel wanted to justify its modest production increase, citing slowing demand would be a reasonable assertion.

- Meanwhile, we are seeing nations take steps to moderate consumption to reduce prices and ensure adequate supplies. The U.K. is preparing for energy shortages by creating plans to ration energy. The Indian Parliament recently passed conservation measures.

- As we noted last week, German natural gas inventories have risen rapidly. However, even with this inventory accumulation, regulators are still pressing for further cuts in current usage to avoid rationing. Despite this news, natural gas prices are surging in Europe.

- As energy company profitability soars, in the U.K., there is a movement to use these profits for “green” investments. If this becomes a norm, fossil fuel supplies will remain constrained.

- The Ukraine War and subsequent sanctions have disrupted physical supply chains. As the war continues, consumers and producers are working to restructure energy infrastructure. Germany, Portugal, and Spain are considering a plan to build natural gas pipelines through France from the Iberian peninsula to bring LNG to central Europe. Kazakhstan is considering a plan to transmit crude oil through the Azeri pipeline network to avoid Russian pipelines. Also, Azerbaijan itself is likely to become an important supplier of oil and natural gas to the EU. Although these actions will take time, the more that supply chains adjust, the more supply will equalize and bring prices down in currently high priced markets.

- Egypt will ration electricity to reduce domestic natural gas consumption in a bid to increase exports.

- Meanwhile, Hungary is receiving Russian natural gas through the Turkstream pipeline that runs through Serbia. Hungary has generally opposed EU sanctions against Russia.

- Power shortages have led to the closure of a second aluminum smelter in Europe.

- At the same time, resource hoarding is always a temptation. Australia is considering actions to reduce LNG exports to ensure ample domestic supplies.

- Although there has been disruption to crude oil flows due to the war, the IEA suggests that Russian production has fallen only modestly. In contrast to OPEC+, the IEA is projecting higher demand this year due to fuel switching away from natural gas.

- Although new refining projects are considered impossible in the U.S., it hasn’t prevented global refinery building from occurring. However, this new capacity may not relieve product shortages in all markets.

- OPEC’s recent market analysis could lay the groundwork for a production cut. At the same time, Saudi Aramco (2222, SAR, 39.80) claims it can produce 12.0 mbpd.

Geopolitical news:

- We saw conflicting trends on the JCPOA/Iranian situation. The EU has proposed a plan to end the IAEA’s investigation of suspect weapons sites in exchange for Tehran disclosing what it knows. In addition, the EU has also suggested a way to circumvent U.S. sanctions on the Iranian Revolutionary Guard Corp. Reports suggest that the U.S. is considering these changes, and Iran is on board as well. The EU offer was said to be final, but, in dealing with Iran, it is hard to say when negotiations end. Iran did deliver a response, but it was not to accept or reject the deal, but rather to negotiate further. Iran is simultaneously trying to suggest it is “flexible” while suggesting that the U.S. isn’t negotiating in good faith. At press time, the EU was still examining the Iranian response. One element of the response is that Iran wants compensation if the U.S. withdrawals again from the deal. It’s not clear to us if an administration in office could bind a subsequent administration to such an arrangement without legislation or treaty. Thus, this could be a deal killer. We also note Iran wants the U.S. to end the IAEA’s investigation into Iran’s violation of the pact earlier. Again, the IAEA is an independent agency of the UN and the U.S. can’t order them to back away from this investigation (nor should the administration do this, IOHO). Talks appear to have reached the “fish or cut bait” stage, as the U.S. stance is either accept the deal or walk away. We do note that if the administration does allow these changes, the political blowback could be considerable. At the same time, Iran claims it is sitting on 100 mb of crude oil and natural gas condensate that would hit the market immediately. If this is true, it would make a major impact on oil prices, but we have our doubts about this claim. It is clear that the sanctions has been eroding for some time and to the best of our knowledge, these inventory numbers have not been independently verified. Complicating matters further:

- S. intelligence agencies suggest Iran has trained Russian soldiers on the use of drones.

- There are reports that Iran tried to arrange for the assassination of John Bolton, the former National Security Director. To add insult to injury, Tehran only wanted to spend $300k for the effort.

- Although it would likely be difficult to directly tie Iran to the attack on author Salman Rushdie (although the lack of ties didn’t stop SoS Blinken from making the connection), the fatwa issued against him by Iranian clerics was almost certainly a factor. We do note that Iran has officially denied any involvement.

- There are reports that President Xi is planning to visit the Kingdom of Saudi Arabia this week, although these plans have not been confirmed. Closer ties between Beijing and Riyadh will not sit well with the U.S. We also note that there may be something of a market share war developing between Iran, the KSA, and Russia. China has become a favorite market for Russian oil. Xi may be making this trip to maintain relations. We do note that China and the KSA are working on oil and gas investments jointly, and China does appear to be replacing the U.S. as a key market for the Saudis.

- Prince Alwaleed bin Talal made large investments in Russian oil and gas firms just before the attack on Ukraine. Although there is some element of plausible deniability, the optics are unfavorable. Moreover, it suggests closer ties between the KSA and Russia, which could become increasingly problematic for the U.S.

- Intra-Shiite tensions in Iraq have the potential to cause a civil conflict. Essentially, the fight is between al-Sadr and other Shiite groups. The former wants to create a government based on majority rule while the latter wants proportional representation. The inability to come to an agreement may lead the KSA and Iran to become involved.

Alternative energy/policy news:

- With the Inflation Reduction Act now signed into law, a backlash against economists for pushing for a carbon tax is developing. To some extent, this makes sense as using other tools can be more politically popular. However, from an efficiency standpoint, a carbon tax would still be a superior policy, but obviously, if you can’t get it passed, holding on to that policy to the exclusion of all others makes little sense. What the bill is really all about is industrial policy. Government shaping the economy is nothing new but is generally considered legitimate only in cases of clear market failure. Since a carbon tax was never implemented, it really hasn’t been proven that a market failure exists.

- Despite the lack of a carbon tax or a carbon price, market participants are increasingly behaving as if one exists.

- The bill is poised to create an EV production boom in the Midwest.

- There is great excitement in the environmental community over the new measures but one potential concern is the lack of workers to build out the plan.

- Germany is extending the life of its three remaining nuclear power plants.

- Any commodity activity disturbs something. Whether its drilling, ranching, farming, or mining, something or someone gets disturbed. As demand for lithium rises, opposition to mining or brining has emerged. Although such opposition may be overcome, higher costs are likely to result.

- As we noted last week, the price of EVs continues to climb. Ford’s (F, $16.18) announcement of substantial price increases on its F-150 “Lightning” EV pickup is the most recent example of this issue.

- There is growing evidence that the Arctic is warming faster than other parts of the world. The impact is difficult to estimate, but we would expect greater weather variability from this situation.

- Much of the Midwest, parts of the Southwest, Florida, and the Atlantic coast could become subject to extreme heat events in the coming decades. But the real worry is heat in areas unprepared. The linked map shows the areas of installed air conditioning.

- Hot weather just isn’t an inconvenience. The drought and warm weather is affecting industrial activity in Germany. In China, power shortages, caused by hot weather, are causing car and battery plants to suspend operations. Tech firms have also temporarily shut down.

- Delays of utility-scale solar projects are steadily rising. These delays may be tied to trade restrictions which have recently been eased.

- California looks ready to extend the life of the Diablo Canyon nuclear power plant that was scheduled for decommissioning.

- Increasingly, we are seeing an “all of the above” strategy in energy investment. Investing in renewables doesn’t necessarily preclude investing in fossil fuels.

- Although wood burning is not necessarily environmentally friendly, it appears Germans are considering it in the face of rising fossil fuel prices. Wood pellets are also seeing rising demand in Europe and Asia.

- This recent report from the Peterson Institute details China’s dominance in rare earths processing.