Weekly Energy Update (April 21, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices did break out of a descending triangle, which is bullish, but for the most part, we look for prices to be rangebound for the next six months during the SPR withdrawal.

(Source: Barchart.com)

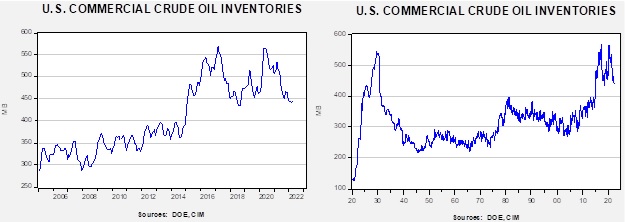

Crude oil inventories unexpectedly fell 8.0 mb compared to a 3.0 mb forecast. The SPR declined 4.7 mb, meaning the net draw was 12.7 mb.

In the details, U.S. crude oil production rose 0.1 mbpd to 11.9 mbpd. Exports rose 2.1 mbpd, while imports declined 0.2 mbpd. Refining activity increased 1.0% and is now 91.0% of capacity. This week’s large and unexpected draw was mostly due to rising exports, although the increase in refinery operations contributed to the draw.

(Sources: DOE, CIM)

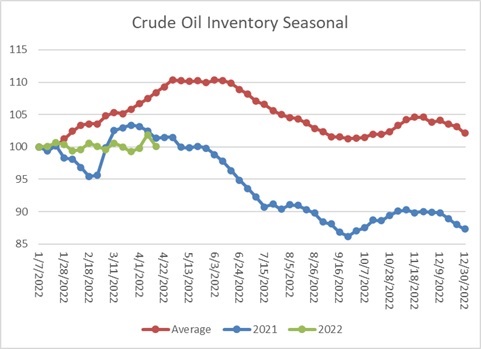

This chart shows the seasonal pattern for crude oil inventories. This week’s large draw is reflected in the chart. If we follow last year’s pattern, we will see a rather rapid decline in commercial stocks in the coming weeks.

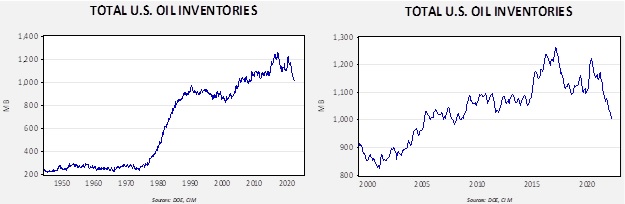

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in late 2008. Using total stocks since 2015, fair value is $85.06.

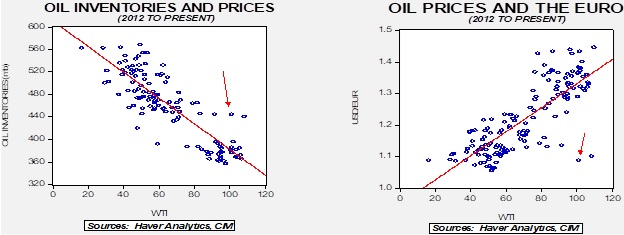

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

Natural Gas Update:

Natural gas prices have been strong.

(Source: Barchart)

Robust demand from U.S. LNG is pushing prices higher.

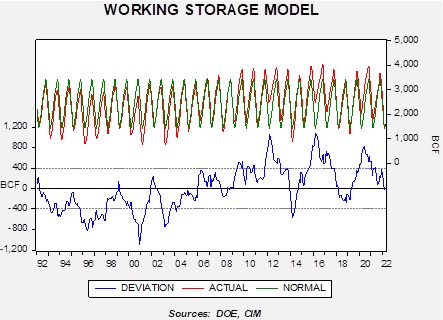

Current stockpiles, on a seasonally adjusted basis, are normal. This model seasonally adjusts inventory back to 1992. Note, however, that there is an upward shift in the deviation after 2008, when shale gas production began to expand.

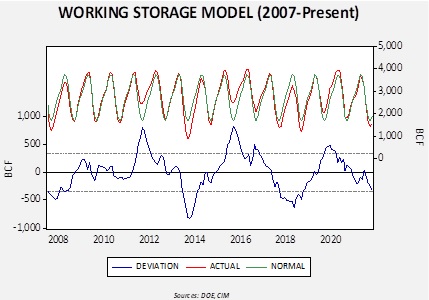

If we shorten the model to account for the advent of shale, we are currently a bit short at the end of this heating season.

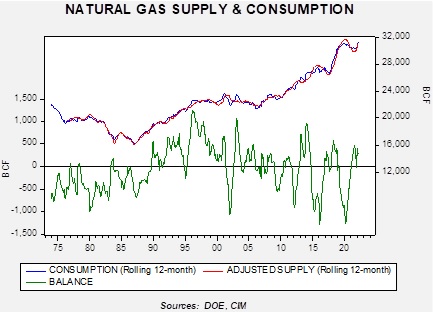

As consumption has increased, so has production.

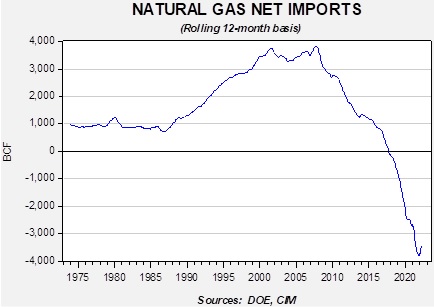

But, with the U.S. now a net exporter, the domestic market will likely remain tight, which will support prices over the summer.

Market news:

- Markets and policymakers are all wrestling with high energy prices. Under normal circumstances, high prices usually create conditions to address that problem. In other words, high prices tend to stimulate supply and constrain demand, eventually bringing prices lower. However, we haven’t really seen that occur this time around in oil and gas. There are myriads of reasons. After years of “burning” investor capital, investors are forcing production discipline on oil producers, which has reduced drilling. ESG has discouraged oil firms from large projects with long development times; the fear is that this investment will be stranded. The problem, of course, is that in the here and now, high energy prices are taking a toll on the economy, lifting inflation and depressing consumer sentiment.

- We are seeing some signs of improvement. Drilling permits in the Permian Basin have ticked higher. The Biden administration, which initially froze new oil and gas leases on federal property, has resumed leasing but with less acreage and higher royalties. This move has led to grumbling from both the environmental community, which wants continued constraints, and the energy industry, which wants support.

- Meanwhile, the state of the Russian oil industry remains uncertain. There is a rising likelihood that Russia is running out of storage space. If Russia is forced to shut in production due to the lack of demand for their oil, restarting this production may be close to impossible. Complicating matters is that major Western oil servicing companies have mostly abandoned the country. The longer the war goes on, the greater the likelihood that production will be permanently lost.

- The U.S. is investing to expand its LNG production. Natural gas liquefaction plants are usually large facilities that take years to complete. However, often overlooked are smaller-scale LNG plants for both liquefaction and gasification, which add to capacity.

Geopolitical news:

- The Ukraine War continues to be the most significant geopolitical event in the energy markets. So far, Russian oil continues to flow, but as we detail in our upcoming Bi-Weekly Geopolitical Report, the payments part of the supply chain is mostly ruptured, which may lead to an effective embargo on Russian oil and gas.

- Another element of this separation is that units of Russian oil companies in Europe are slowly being seized by EU governments.

- Further evidence of a dividing world comes from China; state Chinese oil firms are preparing to exit the West to protect against future sanctions.

- As oil prices rose, the White House has asked OPEC to increase production. That call has mostly been rebuffed due to deteriorating relations between the Biden administration and Crown Prince Salman. House Democrats are pushing for information about that relationship. Our position is that the U.S. is reducing its influence in the Middle East and, thus, America’s ability to influence OPEC behavior is declining.

- Despite German reluctance, the EU is moving to embargo Russian oil.

- Mexican President Andrés Manuel López Obrador supported a change to the constitution, which would have reserved 54% of Mexico’s electricity market for the state company. The legislature rejected this measure.

- Despite nuclear talks with the West, Iran vows to avenge the assassination of Qasem Soleimani. This stance could undermine U.S. support for the deal.

- After a seven-month hiatus, talks between Iran and the KSA are scheduled to resume. On the one hand, we don’t expect much progress. On the other, the fact the talks are happening at all reflects expectations the U.S. will be less involved in the region, forcing the parties to adjust.

- Elements within Iran are calling for a closure of the Straits of Hormuz to South Korea shipping. Seoul has frozen Iranian assets, and Iran wants to punish it. As part of this effort, Tehran wants to ban U.S. shipping in the area as well.

Alternative energy/policy news:

- South Korea has reversed its phaseout of nuclear power in the face of rising oil prices and energy insecurity. The U.S. is also creating support for extending the life of current nuclear power facilities.

- A major part of the energy transition away from fossil fuels is effectively a swap toward metals and away from hydrocarbons. Unfortunately, the Ukraine War is reducing supplies of key metals required for the transition.

- Although we doubt E-15 (a 15% ethanol blend) will have much impact on gasoline prices, this report offers more detail on the fuel. Bottom line: it’s a bit cheaper but less energy efficient.