Weekly Energy Update (April 20, 2023)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

After gapping last week, prices are consolidating.

(Source: Barchart.com)

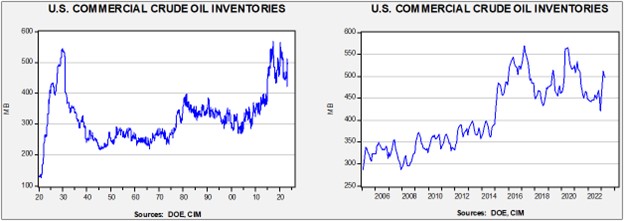

Commercial crude oil inventories fell 4.6 mb compared to the forecast draw of 0.9 mb. The SPR fell 1.6 mb, putting the total draw at 6.2 mb.

In the details, U.S. crude oil production was unchanged at 12.3 mbpd. Exports rose 1.8 mbpd, while imports rose 0.1 mbpd. Refining activity rose 1.7% to 91.0% of capacity.

(Sources: DOE, CIM)

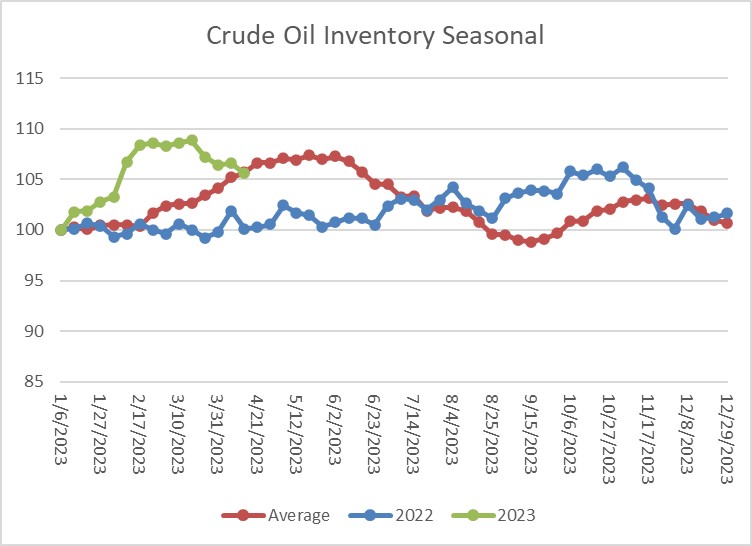

The above chart shows the seasonal pattern for crude oil inventories. After accumulating oil inventory at a rapid pace into mid-February, injections first slowed and have since declined, putting storage levels in line with seasonal norms.

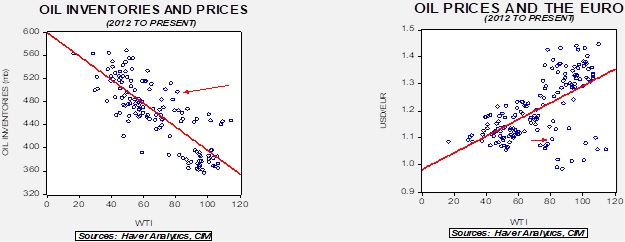

Fair value, using commercial inventories and the EUR for independent variables, yields a price of $56.81. The recent actions of OPEC+ are clearly designed to prevent this sort of price from emerging.

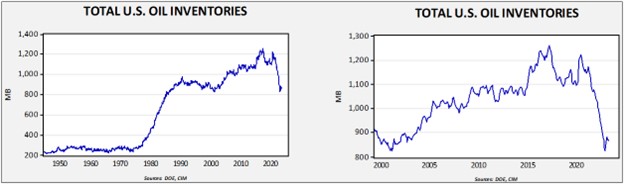

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories. With another round of SPR sales set to happen, the combined storage data will again be important.

Total stockpiles peaked in 2017 and are now at levels last seen in 2001. Using total stocks since 2015, fair value is $94.11.

Market News:

- Climate activists are bewailing the continued investments from financial firms into the fossil fuel industry. Canadian banks were highlighted for their continued support of the oil and gas industry. These reports suggest activists will continue to pressure the financial services industry in a bid to reduce lending and investment into fossil fuels.

- The bearish case for oil rests on demand concerns. There is evidence that global diesel demand is declining, adding to signs of a global recession, which is bearish for oil demand and prices. However, we note that China’s refiners processed nearly 15.0 mbpd of crude oil in March, a new record.

- At the same time, the Biden administration’s recent moves to expand oil and gas production isn’t garnering much support from industry executives.

- The administration has approved natural gas exports from Alaska. Although environmentalists are upset, the increased supplies will likely go to Asia and reduce Russia’s gas sales.

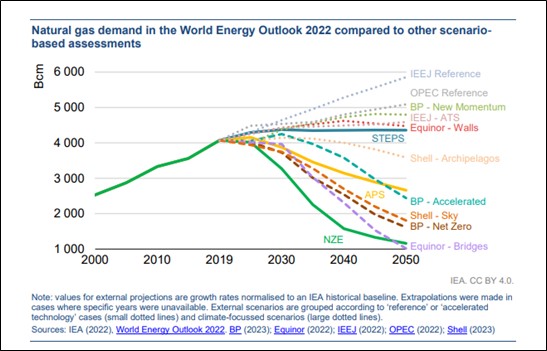

- The G-7 finance minister’s meeting highlights the ambivalence of the group toward natural gas. Over the long term, the goal is to shift away from fossil fuels; however, it is unclear just how long that “long term” will take. To ensure ample supplies in the here and now, investment will be necessary. For investors, though, the fear of stranded assets is a strong consideration, which means that longer-term projects probably don’t get funded. This situation suggests higher prices are likely. The IEA’s recount of the range of potential outcomes shows the dilemma for investors.

- The state of California cannot ban natural gas hookups in new buildings.

- We continue to monitor the supply chain shifts caused by the war in Ukraine as well as the consequent sanctions. We note that Russia is redirecting oil and product supplies away from Europe to other parts of the world. The disruption has boosted U.S. exports of oil, natural gas, and associated products.

- DOE Secretary Granholm reiterated that the administration was prepared to rebuild the SPR if “it is advantageous to taxpayers.” Which means, most likely, that the injections are not expected.

- China is aggressively expanding its coal supplies.

- After the world dealt with an unusually long La Niña cycle, there is increasing evidence that we are rapidly shifting to a El Niño cycle. The latter increases the chances of Midwest drought (which would lift crop prices, including ethanol), reduces hurricane numbers (bearish for natural gas) and often leads to wet conditions across the South.

- Although unrelated, Asia is dealing with an early season heat wave. India is experiencing temperatures in excess of 104°F. Thailand recorded highs of 113.7°F with multiple locations within the country setting new highs.

- Although the investment took over two decades to bring to market, Guyana is poised to rapidly add to global oil supplies.

- Turkey has started natural gas deliveries from its offshore drilling in the Black Sea.

- Due to a strike in Nigeria, Exxon (XOM, $115.02) has declared force majeure on some of its oil contracts.

Geopolitical News:

- Saudi Crown Prince Salman announced that 4% of Saudi Aramco (2222, SAR, 34.65), worth about $80 billion, will be moved to the nation’s sovereign wealth fund. The reason is to support the Kingdom of Saudi Arabia’s economic diversification. Although the amount doesn’t necessarily suggest a rapid move away from fossil fuels, the “direction of travel” suggests less investment in oil and gas, and more in other parts of the economy.

- The IEA admits that the price cap on Russian oil has been violated. Russian oil exports are now exceeding prewar levels with nearly all of the oil flows going to China and India. Russia is also apparently selling oil in the Far East that is being exported by tanker, but this voyage is short enough to avoid insurance, which means that buyers can violate the price cap. The U.S. is warning that it will begin cracking down on this practice.

- Russia has surprisingly little domestic oil storage. Because of this lack of storage capacity, it must sell most of what it produces. The country has announced that it will build new storage facilities which will give it more flexibility for timing sales.

- China is proposing new natural gas pipelines from Kazakhstan to diversify its sources of the product.

- Given China’s dominance in renewable energy and EV components, Chinese companies are often participants in foreign investment projects. However, due to deteriorating relations between China and the West, political resistance to these projects is growing.

Alternative Energy/Policy News:

- Planting trees is often touted as a solution to elevated carbon dioxide levels. As it turns out, it’s much more complicated than just increasing the number of trees.

- Ember, a firm that tracks energy data, indicates that renewables are growing rapidly and now account for 40% of the world’s electricity supply. However, we doubt the data takes into account the reserve power required to ensure stable baseload when the climate or the clock fail to cooperate (when the wind doesn’t blow and/or the sun doesn’t shine).

- Last week, we discussed the Biden administration’s proposed emissions rules that would strongly tilt the market toward EVs. As one would expect, the auto industry is not wild about the recommended regulations.

- The government released its list of EVs and plug-in hybrids that qualify for a tax credit. The new list excludes most foreign models. Here is a link to the website to see what does qualify. Look for European auto makers to begin considering a shift in the production of EVs to the U.S.

- Volkswagen (VWAPY, $13.98) announced a joint venture to make EV batteries in Indonesia.

- Panasonic (PCRFY, $9.28) announced it is considering a plan to build an EV battery factory in Oklahoma.

- Germany has closed its last nuclear power facilities. The shutdown, originally scheduled for December, was delayed due to the war in Ukraine. The decision to decommission the facilities means that Germany is even more vulnerable to supply disruptions.

- A developing economy alliance on geoengineering has been formed.

- China is building a hydrogen pipeline from Inner Mongolia to its eastern cities.