Weekly Energy Update (April 14, 2022)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA | PDF

Oil prices appear to be settling into a trading range.

(Source: Barchart.com)

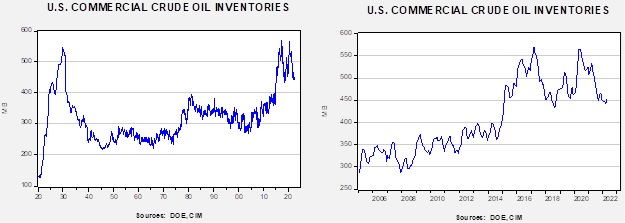

Crude oil inventories rose 9.4 mb compared to an unchanged forecast. The SPR declined 3.9 mb, meaning the net build was 5.5 mb.

In the details, U.S. crude oil production is unchanged at 11.8 mbpd. Exports fell 1.5 mbpd, while imports declined 0.3 mbpd. Refining activity dropped 2.5% and is now 90.0% of capacity. This week’s large and unexpected draw was due to the decline in refinery operations and exports. We don’t expect these factors to continue.

(Sources: DOE, CIM)

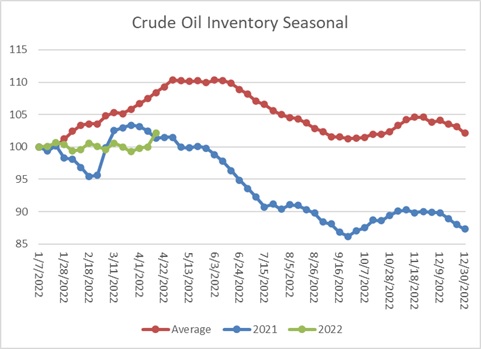

This chart shows the seasonal pattern for crude oil inventories. This week’s large build is reflected in the chart. If this continues, we could reach the normal seasonal high in the coming weeks. However, in this week’s report, we noted a large decline in refinery operations and exports, so we probably won’t see builds at this level in the near future.

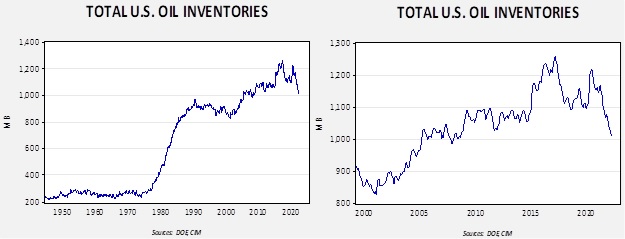

Since the SPR is being used, to some extent, as a buffer stock, we have constructed oil inventory charts incorporating both the SPR and commercial inventories.

Total stockpiles peaked in 2017 and are now at levels seen in late 2008. Using total stocks since 2015, fair value is $82.44.

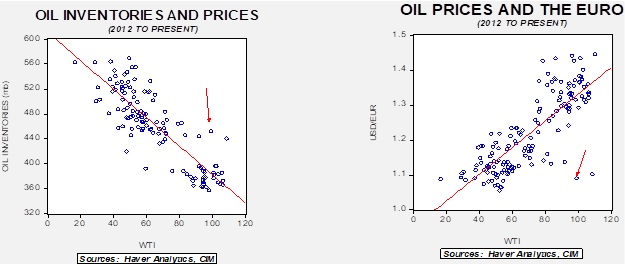

With so many crosscurrents in the oil markets, we see some degree of normalization. The inventory/EUR model suggests oil prices should be around $60 per barrel, so we are seeing about $40 of risk premium in the market.

Market news:

- The oil markets continue to be affected by the Ukraine War and the policy response. Last week, we discussed the SPR release in great detail. We expect that oil to start flowing in the next few weeks. By itself, the release is bearish for energy, but it isn’t by itself; oil producers will react to the decision and will likely slow output.

- Although we still believe the oil being sold from the SPR won’t be replaced, it has been suggested the government could buy long-dated oil futures (the 2029 contracts are trading around $67 per barrel) to lock in the purchase price. That’s because the oil market is in backwardation. Of course, the very act of buying those contracts will almost certainly lift the price, so the idea is less attractive.

- Hedging itself has become a problem. When a commodity is hedged, the hedger trades price risk for liquidity risk. In other words, the hedge will require a margin set by the commodity exchange, mostly based on price volatility. As volatility rises, margin increases, meaning the hedger must commit liquidity now for price protection later. In current circumstances, hedging costs are soaring, leading firms to forgo price hedging. Commodity firms have asked for government aid for hedging. Politically, that might be difficult to do until there is a crisis. It is one area that could trigger problems for the overall financial system.

- Meanwhile, Russian oil is making its way into some markets, but at notable discounts. The U.S. is suggesting to India, for example, that it shouldn’t increase Russian oil imports; so far, the jawboning has had little effect. However, we also warn that India’s support of Russia is not open-ended; we note India has recently rejected a tender for Urals oil.

- Perhaps a bigger issue is the impact of sanctions on Russia’s oil industry. Reports suggest that Russian oil production has declined below 10 mbpd. There are also reports that Russia’s oil storage facilities are filling up rapidly. Although the public perception is that an oil well is like a cistern that can be closed and reopened easily, that is not the case. Once these wells are shut, they will require almost a redrilling to open up again. Some of these wells are in inhospitable areas, and there is no guarantee that Russia has the expertise or the investment capital to restart them. The bottom line is that if Russian output is shut, it may never come back on stream.

- OPEC is forecasting a drop in demand this year. This news is important because it signals the cartel probably will not ramp up production on fears that it will simply lead to lower prices in the future when demand is expected to decline. On a related note, OPEC has stopped using IEA data to monitor the production levels of its members. OPEC apparently fears the U.S. is pressuring the IEA to project tight oil markets in a bid to prompt more oil production and lower prices.

- The U.S. announced it would allow high blending levels of ethanol into gasoline, hoping that the additive might lower the gasoline price. This strategy may not work out as planned. There are concerns that the higher level of ethanol might raise pollution levels in cities, so E-15 gasoline may not be sold nationwide. In addition, the corn crop will likely be restricted this year due to high fertilizer costs. High corn prices could thwart the policy goal by not helping lower gasoline prices. It should also be noted that only 1.5% of U.S. filling stations have the equipment to handle high ethanol content.

- OPEC is warning the EU that it cannot physically replace Russian oil. This warning comes as the EU considers a ban on Russian oil and gas imports. Russia has been selling oil through the good graces of commodity trading firms. Ukraine’s leadership is calling for these companies to stop facilitating oil and gas transactions.

- There are also concerns that the withdrawal of Western oil firms may lead to lower Russian oil and gas production.

- Drought in the western U.S. may reduce hydroelectricity and increase demand for natural gas this summer. Snowpack in the Sierras is well below normal.

Geopolitical news:

- Shell (SHEL, GBP, 2,165.50) announced it will write off its investments in Russia to the tune of $5.0 billion.

- The EU is continuing to debate whether it should ban Russian energy. Germany and Hungary continue to hold out against an outright ban. We expect this to occur eventually, but we also believe that both sides would prefer the other to make the first move so blame could be assigned. It would be easier for the EU if Russia banned sales, and Moscow would likely rather have Brussels halt the sales.

- We noted in a recent BWGR that Turkey is facing a serious economic crisis caused by increasing inflation. As stated in the report, Ankara has been working to improve relationships with the Gulf States to attract economic aid. It recently suspended the trial of those accused of murdering Jamal Khashoggi and allowed the KSA to become the venue for the proceedings. This move will probably mean those accused won’t be convicted. We would expect Turkish/KSA relations to improve in the coming months.

- The KSA has also encouraged Yemen’s exiled President Abdu Rabbu Mansour Hadi to resign and turn power over to a new group in Yemen. The goal is to create conditions to end the conflict.

- Germany is providing €100 billion to energy firms adversely affected by the war.

- Ukraine was a major supplier of biomass. The war has disrupted those supplies as well.

- S. forces in Syria were attacked by what appear to be paramilitary groups operating in the country. Four American servicemen were injured.

- Italy and Algeria have announced a plan for the former to import more energy from the latter. The idea is to reduce Italy’s dependence on Russia.

Alternative energy/policy news:

- The Ukraine War is encouraging the development of alternative energy. Germany announced an expansion of green energy, and the U.K. is looking to increase wind energy fivefold. The U.K. is also planning to build eight new nuclear reactors.

- There is a steady increase in EV sales.

- The IEA has a report on direct carbon capture. Rice University is working on a program that would use plastic waste to capture carbon. Oil majors are also increasing investment in this area.

- China is ramping up its hydrogen development.