Daily Comment (September 5, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] It’s a risk-off day this morning as worries about global trade and emerging market contagion continue to mount. Here is what we are watching this morning:

BREAKING: There are reports that Germany is willing to make concessions to the U.K. The GBP jumped on the news. However, there are no details at this time.

NAFTA: After taking a five-day break, U.S. and Canadian negotiators are back to the bargaining table today. Here are the five major sticking points.[1] First, dairy. Canada has a milk board that allocates production. This leads to less supply and higher prices in Canada; to prevent the milk board from being overwhelmed by cheaper U.S. dairy, Canada restricts trade in this area. If the U.S. wins on this one, the Canadian dairy industry will be hammered. Protecting agriculture is common in many nations (people have a visceral reaction to food insecurity). On the other hand, Canadian consumers would greatly benefit. Second, the dispute management system is under threat. The current system for resolving disputes is a panel of representatives that determines if anti-dumping or countervailing duties should be implemented. The Trump administration opposes this body because it restricts U.S. sovereignty. Third, another part of the dispute management system allows firms to sue governments. The U.S. opposes this measure as well. Fourth is the steel and aluminum tariff issue. The U.S. implemented tariffs on these items and is threatening to do the same on autos. It’s hard to have a free trade zone when one nation can unilaterally apply tariffs. Lastly, culture protection is in question. The original agreement was made before the digitization of the economy. Patent and copyright protection need to be addressed but Canada has concerns about protecting the cultural integrity of French-speaking Quebec.

So, is a deal possible? Yes, but the Trump administration appears to be offering Canada the agreement already in place with Mexico or nothing. If PM Trudeau takes that deal, which is probably the best decision economically, the political ads for next year’s election almost write themselves. His opponents will run as leaders who will protect Canada. On the other hand, if Canada balks, the disruption to the Canadian economy will be massive. We suspect Canadian negotiators will try to get some modest changes to save face but will accept the bulk of the agreement the U.S. has in place with Mexico.

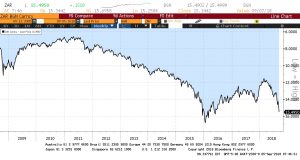

South Africa in the barrel: South Africa is the next EM country to see increasing pressure. Recent economic data indicate the country is in recession.[2] The ZAR continues to slide.

Although there is hope that the new Ramaphosa government will overcome the scandal-ridden Zuma administration, unfortunately the government will be starting under weak economic conditions.

EM thoughts: We are seeing that nations with current account deficits are coming under pressure on fears they won’t be able to fund these shortfalls. Although it does feel a bit like the 1997-98 Asian Economic Crisis, there are some important differences. During that event, most nations were pegging their currencies which led to unsustainable foreign currency debt growth and “hard stops” when the pegs failed. This time around, currencies float, which means they can fall to a sustainable level quickly and signal to domestic borrowers in EM nations to slow or reverse debt growth. That doesn’t mean there won’t be austerity and pain but the path will likely be less jarring. On the other hand, the only way a current account deficit nation can pay back dollar debt is by running trade surpluses with the U.S. If the Trump administration continues to put up trade barriers, the ability of these EM nations to service their debt becomes questionable.

[1] https://www.ft.com/content/2c1cfd8a-b080-11e8-8d14-6f049d06439c?segmentId=a7371401-027d-d8bf-8a7f-2a746e767d56

[2] https://www.ft.com/content/1c538ac6-b036-11e8-8d14-6f049d06439c