Daily Comment (September 4, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT]

Yesterday was busy; the ISM manufacturing data disappointed and there was lots of Brexit news. Here are the details and other items we are watching:

Boris’s terrible, horrible, no-good, very bad day: PM Johnson had a rough day yesterday. First, his government fell into minority status as MP Phillip Lee left the Tory Party to join the Liberal-Democrats. Second, despite threats of ouster, 21 MPs of his own party broke ranks and voted to pass a bill that would delay a no-deal Brexit. The last time a PM lost his first vote in the House of Commons was William Pitt the Younger in 1793. So now, Johnson is in power but has lost control of Parliament. His party is deeply and perhaps permanently divided. His predecessor, Theresa May, studiously avoided the path Johnson has taken on fears that it would divide the Conservatives. Johnson criticized her management but has revealed why she acted as she did.

Johnson is moving to call snap elections, but it is not obvious that Parliament will support the motion. According to the Fixed Term Parliaments Act, Johnson needs a two-thirds majority to trigger an election. MPs fear he will set the date after Halloween, thus bringing a hard Brexit. As a result, it is unlikely that Parliament will approve an election before securing a delay in Brexit. Corbyn has been supporting an early election but is apparently rethinking his position. We would not be surprised to see a new Brexit referendum before new elections. It should be noted that Labour may be as divided as the Conservatives are with regard to Brexit. A referendum would “clear the decks” and allow for elections on issues other than leaving the EU.

So, where are we now? Essentially, PM Johnson is running a minority government that won’t be ousted until some sort of delay on Brexit is established. Johnson gambled that he could hold his party together by threats of expulsion and that ploy failed. Now, he probably can’t even choose when he will face voters. The fact that Brexit will likely be delayed has boosted the GBP overnight. There are still twists and turns to monitor but, overall, it is less likely that the U.K. will leave on Halloween. At the same time, Brexit has upended U.K. politics; even with new elections, it isn’t obvious how the vote will turn out. This is because the two main parties are divided over this issue and the parties that have a clear stance (Lib-Dems to remain; Brexit Party to leave) may not be able to pull together a government to run the country.

Lam retreats: Carrie Lam, Hong Kong’s chief executive, has formally withdrawn the extradition bill. Hong Kong equities rallied on the report, but the move has been seen as “too little, too late.” Lam is also setting up an investigation to examine the fundamental causes of the unrest, but is stopping short of a commission of inquiry, a demand of the protestors. Although there is speculation that this modest retreat is being orchestrated by Beijing to ease trade tensions, we doubt this is the case. Our take is that Lam wants to divide the protestors, isolating the most hard-core members who want full democracy from those who were just upset by the extradition bill. Although this might have worked a few weeks ago, it may simply be too late to effectively divide the group.

Iran: A series of cross-currents are emerging on Iran. First, France is offering Iran a $15 bn bailout contingent upon Iran dialing back its nuclear activities. The money, in the form of a letter of credit, would allow Iran to import goods and use the LOC to acquire hard currency for the transaction. The U.S. isn’t likely to go along with this effort, but so far the Trump administration hasn’t pushed back aggressively. Second, Iran is preventing U.N. inspectors from investigating nuclear facilities, increasing tensions about the nuclear deal that is still in place between Iran and the other signatories to the agreement.[1] Third, there are fears that Iran will aggressively increase uranium enrichment, perhaps as high as 20%, if it doesn’t get relief. Such a move would be very provocative and raise fears that Iran is “making a dash to a bomb.” Fourth, Iran claims the U.S. is showing “some flexibility” with regard to oil sales. Although details are lacking, the comment suggests the U.S. is allowing some sales to go forward. There are two possibilities, the first is that the U.S. is easing up on Iran to encourage talks. The second possibility is that the administration wants lower oil prices and cutting Iran some slack might be helpful in bringing down energy prices. Fifth, the U.S. is implementing its patrols for the Persian Gulf, which does increase the odds of an incident. And sixth, President Rouhani has indicated he will not meet with President Trump unless sanctions are lifted.

All this turmoil should help support oil prices but, at least for now, worries about global growth are overwhelming the impact of geopolitics. Iran is clearly pressing the EU to break with the U.S. over Iran’s oil sales, but we doubt that Europe will take that step. If it doesn’t, Iran will probably continue to escalate its uranium enrichment, which will give the hawks within the Trump administration a reason to press for a military solution. However, unless it attacks the U.S. military directly, we doubt President Trump will support military action against Iran.

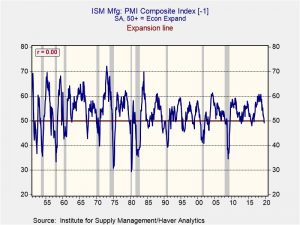

ISM manufacturing: We will have more to say on this item in the near future but the ISM manufacturing index dipping below 50 has raised some alarm bells.

Although we are seeing a lot of recession talk on this dip, we would caution that you really need a reading under 45 before a clear signal of recession is indicated.

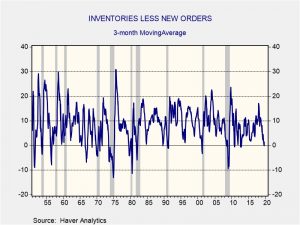

Perhaps the more worrisome development was that the reading on inventories exceeded new orders.

We smooth the difference with a three-month moving average. A reading in this measure of more than minus two points is usually consistent with recession. We are barely negative now but building inventories with falling new orders is not a good sign. This news put pressure on the equity markets yesterday.

Fed news: On Tuesday, St. Louis Fed President James Bullard and Boston Fed President Eric Rosengren gave opposing speeches as to whether the Fed should cut rates in its next meeting. Rising trade tensions and a decline in manufacturing have led many to speculate that the Fed will look to cut rates at the next meeting, even though strong employment still suggests that the economy doesn’t need additional stimulus. Currently, Bullard seems to be in favor of the former, and Rosengren the latter. The opposing viewpoints suggest there is a growing likelihood of another dissent in the next agreement. Earlier this year, Bullard dissented from the Fed’s decision to maintain interest rates as opposed to cutting, while Rosengren is expected to dissent if rates are lowered. Although dissents are not highly unusual, frequent and contrasting dissents suggests the Fed is deeply divided. One of Fed Chairman Jerome Powell’s biggest weaknesses is that he is not a trained economist and, as a result, he lacks a strong ideological base to fall back on. If dissents become more common, it would undermine Powell’s authority. At the same time, it is important to note that governor dissents tend to carry more weight than those from regional presidents, who are not permanent voters.

Italy has a government: The Five Star Movement ratified the new coalition, allowing a new government to take power.

USMCA: The trade agreement with North America is still facing a vote. Some Democrats are pressing for a deal to be approved. These supporters mostly come from conservative-leaning districts and the idea is that passing USMCA would be popular in these areas. However, labor doesn’t appear to be on board, which would lead the populist wing of the Democratic Party to oppose the measure.

[1] The U.S. formally exited the agreement in May 2018.