Daily Comment (September 30, 2019)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] Happy Monday! It’s the last day of the quarter and there is a lot going on. Let’s dig in. Here is what we are watching this morning:

Happy Anniversary! The Communist Party of China (CPC) will hold major celebrations this week for the 70th anniversary of the CPC’s takeover of the mainland. Tomorrow, a large parade will be held. Meanwhile, it was another weekend of protests in Hong Kong. Chairman Xi has been trying to bring Hong Kong under Beijing’s control since coming to office. Xi’s policy has been to homogenize China culturally; he has cracked down on Islam and Christianity, and clearly does not want any other social narrative but that of the CPC. The actions in Hong Kong are affecting Taiwan’s view of the mainland and may make the island even more determined to remain separate from Beijing. In other China news, PMIs came in better than forecast.

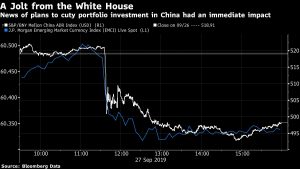

Capital issues: Equity markets took a tumble on Friday on reports that the U.S. is considering delisting Chinese equities from U.S. financial markets. The administration has denied the reports, but we note these ideas have been floating around Congress for some time. As our recent WGRs[1] note, attacking the trade deficit from the current account doesn’t really work in a floating exchange rate environment. But, attacking it from the capital account can be very effective. Similar to the Baldwin/Hawley bill, which would force the Fed to ease policy to achieve a weaker dollar and allow the Fed to levy taxes on foreign Treasury buyers, delisting measures would affect China through the capital account. China has a serious debt overhang and is likely considering something akin to debt/equity swaps to eventually resolve the problem. Getting foreigners to “participate” would be a reasonable desire. Delisting would dramatically reduce China’s ability to tap global financial markets and thus force the debt adjustment onto China.

Financial markets were affected by the reports.

It makes sense that the administration would downplay the delisting news in front of this week’s anniversary (see below) and trade talks in mid-October. However, we doubt this will be the last word on the issue. As the aforementioned WGRs noted, the capital account would be an effective avenue to address deglobalization. Restricting foreign access to U.S. financial markets is part of that process. On a related note, China has been reducing its foreign direct investment, in part, due to worries over the trade deal and also due to some rather questionable investments.

European Union: The European Parliament will hold confirmation hearings this week for incoming European Commission President von der Leyen’s slate of commissioners. Several of her nominees are already in trouble because of financial conflicts of interest, and observers worry political bickering will push the process well beyond November 1.

Trouble for Johnson: PM Johnson isn’t just struggling to deal with a difficult Parliament. His wayward past is also bubbling up to hurt his ability to lead. And, the DUP is cooling to the possibility of a trade deal that keeps Northern Ireland in the EU trading zone.

Repos continue: The Fed carried out repos again this morning among increasing fears that the Federal Reserve may have given the NY FRB presidency to the wrong guy. John Williams was appointed to the position in April 2018. Williams had an illustrious turn as president of the San Francisco FRB and is a well-respected monetary and financial market economist. His work on “R*” has shaped monetary policy for the past decade. However, he is not a “market guy.” Historically, the president of the NY FRB has had experience in the “plumbing” of the financial system. Ed Corrigan and Bill McDonough had long experience on “the desk.” Tim Geithner had broad international experience. However, there was some departure from the streetwise presidents with Bill Dudley, and Williams had little financial market experience. Complicating matters, last May, Williams fired two long-term veterans, Simon Potter, who had been at the NY FRB since 1998 and ran the markets desk since 2012, and Richard Dzina, who had been with the bank since 1991. Reports suggest that Williams wanted to change the management structure of the markets desk and apparently decided these leaders were not helping that effort. It is also important to note that the Fed hasn’t really had to conduct repo operations since 2009 when QE flooded the banking system with reserves. There may be a lack of experience on the trading desk in the execution of these actions. Although Williams’s academic work shows clear expertise in theoretical monetary policy, he may have a gap in understanding the actual operations of the financial system. We suspect Williams will acquire this knowledge in due time, but the actions of the NY FRB have done little to inspire confidence.

Austria elections: Sebastian Kurz’s party had a strong showing in this weekend’s elections, with the center-left and the populist-right losing support. The Greens showed a dramatic improvement. Kurz now has his pick of coalition partners. He could return to the chastened populist-right to form a government, or break tradition and bring the Greens into government. We will be watching to see how Kurz chooses because it could indicate how the political situations of other European nations may evolve.

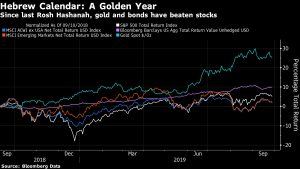

Happy New Year! Rosh Hashanah began yesterday evening and will end tomorrow evening. We usually mark market performance on the Gregorian calendar, but here is a chart showing how we have done over the past year using the Hebrew calendar.

It’s been a good year for gold and bonds, but rather “meh” for stocks.

Saudi Arabia: Fitch’s Ratings cut Saudi Arabia’s long-term, foreign-currency debt rating to A from A+, citing the increased geopolitical and military risks that became evident in the recent attacks on the country’s oil infrastructure. Importantly, the agency said it saw a risk of further attacks that could hurt the country’s economy.

Odds and ends: Protests continue in Moscow. The Houthis are claiming a major victory against Saudi forces in Yemen. Crown Prince Salman warns of “skyrocketing” oil prices if the world does not bring Iran to heel. As one would expect given the turmoil, voter turnout in Afghanistan was light.

[1] See WGRS, Weaponizing the Dollar: The Nuclear Option, Part I (9/16/19) and Part II (9/23/19).