Daily Comment (September 21, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] Equity markets are generally higher following the BOJ release. The BOJ did not do anything too radical—no helicopter money or foreign bond purchases. But, there were some changes. The focus of policy will shift to the yield curve as the 10-year JGB will be pegged at zero; the rate had been negative. This move appears designed to steepen the yield curve. Asset purchases will continue but will depend on rates as opposed to a specific target amount for QE. Thus, in theory, QE could exceed the ¥80 bn per month but could also fall from that level, introducing tapering, depending on the rate path of the long end of the curve. There will probably be no changes in purchases in the short run, but we would look for a modest decline in purchases over time. Finally, there was some degree of forward guidance as the bank promised to exceed its 2% inflation target. This move isn’t really significant as it has been missing its 2% inflation target for over a year.

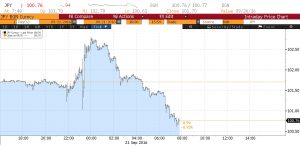

Although global equity markets seem to like the BOJ’s moves, we think a key insight can be derived from the forex market. The JPY initially weakened but has subsequently rallied.

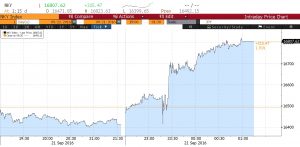

If BOJ policy had been seen as stimulative, the JPY would have continued to weaken. We suspect that, eventually, markets will conclude the BOJ is running out of policy tools and deflation will remain in place indefinitely. It would not be unusual for markets to take 24-48 hours to digest the ramifications of the central bank’s moves. Investors’ attention is now turned to the Fed and market reaction to the BOJ decision could change following the FOMC release. Nevertheless, today’s market reaction to the BOJ was not negative. The chart below shows the overnight move in the Nikkei index, which rose following the BOJ release.

The consensus is that the FOMC will stand pat, with market expectations calling for a 22% likelihood of a rate increase. We recently read a provocative analysis from Ben Hunt, the chief risk officer at Salient Partners. In his report, “Epsilon Theory,” he makes the case that the Fed’s culture is much like a large research university. If this is true, the Fed’s decision making isn’t about keeping the markets calm or supporting the banking system. Instead, it’s all about reputation. A college professor usually isn’t in it for the money (although most are not opposed to getting a bit of cash along the way); the goal is to be perceived as smart. Hunt’s argument is that if a decision is between hurting the market but sustaining the Fed’s reputation or supporting the market but making the Fed look incompetent, then the former will win. Thus, the idea that the Fed follows the market is nothing more than a coincidence, a spurious correlation.

The Fed’s reputation has been taking a beating recently. Negative interest rates are feared by the public and seen as a potential mistake. Low interest rates are quite unpopular with the retiring baby boom generation. What does the Fed need to do, at least according to Hunt? Raise rates and declare victory. Does the economy need a rate hike? Probably not. However, if negative rates are not a possibility, then the Fed has little room to act when the next recession hits. Lifting rates to give itself room to cut doesn’t make a lot of sense—policy should be in response to current circumstances. But, from a reputational perspective, having room to cut will give the illusion that the central bank can act, even if the rate hike itself potentially contributed to the recession.

In addition, if the Fed is really nothing more than a high-powered university economics department, then the goal also seems to be about creating a consensus among the really smart people. There does appear to be a growing consensus about a rate hike. Declaring victory by saying the FOMC has met its institutional goals (full employment and low inflation), raising rates today and signaling that it will be a long time before the next move would likely be a good outcome. Although financial markets would not react well initially, the signal of no more moves this year would be welcomed. Financial markets would likely rebound and the dollar would probably remain mostly steady. By declaring victory, the Fed would then put the onus of the next recession on fiscal policy.

An alternative scenario is no hike today but certain hike in December. In fact, market expectations call for a 60% likelihood of a December increase. No hike in September with a hike in December would tend to damper equities and boost the dollar. A better outcome would probably be “a hike today and go away,” stating the terminal rate is in place for the foreseeable future. Of course, the worst outcome would be a hike today that the market doesn’t expect with no declaration of victory.

The bottom line: although odds still favor a December rate increase, the odds of a move today are probably higher than the market thinks. We will find out at 2:00 pm EDT when the Fed releases its policy decision, economic projections and dots chart, followed by a press conference.