Daily Comment (September 19, 2017)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Markets are very quiet in front of the FOMC meeting, which begins later this morning. President Trump offers formal remarks to the UN this morning, too. Here is what we are watching:

The Fed: As we noted yesterday, we look for the Fed to begin balance sheet reduction after this meeting with no change in the policy rate. In general, there is still a chance the FOMC raises rates in December. We actually doubt that will happen; if the dots chart agrees with our outlook, the dollar could take another leg lower.

Tropical situation: Hurricane Jose will brush Long Island and the northeastern shore but will generally spin out to sea. Hurricane Maria is currently a Category 5 storm; it is expected to weaken modestly to a Category 4 but will slam the U.S. Virgin Islands and Puerto Rico then veer northward. The consensus of computer models have it moving almost due north by the weekend, sparing Florida and probably most of the U.S. mainland. Of course, conditions can change but missing the U.S. Atlantic coast is favorable news. Sadly, the Caribbean islands, many of them still reeling from Hurricane Irma, are set for a second hit that will severely set back recovery efforts.

North Korea: This week’s WGR, published yesterday afternoon, recaps the North Korean situation. SOD Mattis told Reuters today that the U.S. has military options that might spare Seoul from an artillery barrage but gave no details. Although it isn’t obvious to us just what such options might entail, as we noted yesterday, there is no evidence of U.S. mobilization that would be expected to precede military action. Thus, for now, financial markets are mostly ignoring North Korea.

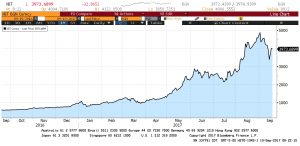

Bitcoin: We continue to monitor the cryptocurrency market. Currently, the behavior seems more akin to gold than a currency. For the most part, a currency fulfills three roles—store of value, a numeraire and a medium of exchange. Gold and cryptocurrencies meet only one of these roles, the store of value. There is limited ability to use either for exchange or pricing things (the numeraire function) because of the volatility. The chart below shows the recent price behavior of bitcoin against the dollar. As a thought experiment, imagine that one borrowed in bitcoin in early January when it was trading around $1k. Your debt service costs have soared ever since. China is moving to quash bitcoin; it has shut down commercial exchanges and is now acting to inhibit peer-to-peer trading. We don’t expect the governments and the central banks to allow cryptocurrencies to undermine national currencies. After all, a currency is a symbol of national sovereignty. Thus, cryptocurrencies will likely be relegated to black market activities, allowing people to avoid capital controls and make cashless anonymous transactions.