Daily Comment (September 17, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity markets are sharply lower this morning; the Fed is being blamed. We begin our comments today with the Fed; the U.S. central bank held its usual meeting. Second, we offer a few thoughts about the historic Abraham Accord. Brexit follows, with China news next. The regular pandemic update is next in line. We follow with some commentary on the EU state of the union address and close with economic news. Being Thursday, a new Weekly Energy Update is available. Here are the details:

Federal Reserve: In some sense, it will be difficult for the Fed to surprise us given all that was done. The statement and the following press conference made it clear that the policy rate will stay on hold, probably through 2023.

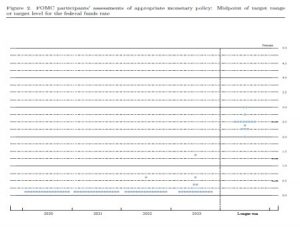

The dots plot above shows no rate changes through 2021 and only one vote (our wager is KC FRB President George) for 2022. We do have four looking at rate hikes in 2023, but it is clear that the preponderance of members is looking at no rate hikes until we reach the mythical “long run.” There were two dissenters. Minneapolis FRB President Kashkari wants a clear rule—no rate hikes until the inflation target is achieved. Dallas FRB President Kaplan’s dissent was a bit difficult to follow—he wants greater policy flexibility in the long run, perhaps to keep the Fed from being tied to keeping rates low indefinitely. The inflation projections don’t even see achieving the target until 2023, so it doesn’t make sense to raise rates in 2022 if preemption is no longer the basis of monetary policy.

The press conference was fairly standard, although Bloomberg’s Mike McKee raised a bit of a concern when he suggested the Fed was out of tools. Powell dissented from that view but the remaining tools, balance sheet expansion and forward guidance, are probably less effective than rate cuts. And there was the matter of the improved economic projections; although the economy isn’t expected to be overly strong, there was a notable uptick in forecasts, which tends to undermine the forward guidance. There was also a comment about the Main Street lending program, which has been modest up to this point. Powell did acknowledge the slow start and did admit the program is dependent on banks doing the lending. He suggested that as banks become more comfortable with the program, its use will likely improve. There were also questions about commercial real estate. In general, the Fed is getting close to specific aid to individual sectors, an area in which the bank does not like to be. But, in the absence of fiscal action, the Fed may have no alternative.

So, in the end, what disappointed financial markets? The reaction of equities and precious metals would suggest this was a hawkish outcome. This is hard to square; if keeping rates steady through 2023 at zero is a hawkish outcome, we are in an odd place. The best explanation of why we are seeing risk off this morning is the realization that the Fed isn’t out of tools to prevent further weakness but is probably powerless to actually stimulate the economy. For that, we would likely need to see either (a) renewed “animal spirits,” i.e., private sector investment and activity, or (b) fiscal stimulus. On that front, the president appeared to triangulate the Senate GOP, suggesting that his party should support a larger economic stimulus package. We are not surprised to see the White House press for such action; after all, this is an election year and American history is full of examples of presidents pushing for “pump priming” the economy to improve re-election chances. And, we are not surprised to the Senate GOP oppose such measures; this wing of the GOP is establishment oriented and prefers slower growth with higher profits. We are surprised at how long it has taken the White House to recognize that fiscal stimulus is in its interest.

The Abraham Accords: Israel, the UAE and Bahrain signed an important peace accord earlier this week, with Arab states giving formal diplomatic recognition. In return, Israel agreed to not annex various parts of the West Bank as allowed by the U.S. peace proposal. We expect other nations to follow at some point; Oman, Qatar and Sudan are likely candidates to join the accord. The KSA won’t as long as King Salman is in power, but we believe his son, Crown Prince Salman, will likely agree once he becomes king.

- What is behind all this? The U.S. is making it unambiguously clear that it is reducing its footprint in the region. Troop levels in both Afghanistan and Iraq are down to the point where it is becoming dangerous to keep them in place (too small to retaliate or intimidate, but too large of a target), and it is obvious that the U.S. actions since the Bush administration have less to do with the region. That doesn’t mean complete withdrawal, but it does mean the U.S. will have less involvement. Whenever a hegemon leaves, it raises the question of how the area will function. Optimists argue that when the hegemon leaves, the remaining nations must figure out how to get along. Pessimists simply wait for the region to deteriorate. To some extent, we are seeing both; Iraq remains unsettled and Syria is very unstable. The Arab states, facing a hostile Iran and a disinterested U.S., have concluded that making peace with Israel and forming alliances is the best way to protect themselves. Israel has a formidable military; alliances with the Arab states give Israel strategic depth.

- It’s not just Iran. Turkey has shown signs of wanting to expand its influence. For the Arab states, Turkey is a problem. It is pushing for a form of democratic Islam and has been supportive of the Muslim Brotherhood, an anathema to the royalist Arab nations. Although Israel and Turkey were once allies, relations have deteriorated; thus, Israel and the Arab states can make common cause to contain Turkey’s influence.

- The Arab states have already made it clear they want improved weapons systems. The U.S. has always given Israel technological advantages in arms, selling systems to others in the region that are not the “latest and greatest.” Israel is not all that comfortable with this part of a deal, but this may be its “give up.”

- Israel has not promised to never annex parts of the West Bank but will refrain for now. Essentially, by teaming up with Israel, the UAE traded a possible short-term postponement of annexation for improved security. Simply put, with a less involved U.S., the Palestinians and their cause were secondary to the security needs of the Arab states.

- In the end, we see this agreement as part of the evolution of the region as the U.S. begins to shift its focus to the Far East. Ironically, integrating Israel into the region seems to have required the U.S. to show less interest; as long as the U.S. was there to manage security, the Arab nations could hold up the symbol of the Palestinian cause. But, left to their own devices, the Arab nations have come to realize that Israel as an ally is probably necessary. The Trump administration did achieve a breakthrough here by making the parties realize their own interests. We will have more to say on this topic in a future WGR; if you are interested in further background, we would recommend this podcast.

Brexit: PM Johnson conceded some power in the controversial withdrawal bill, agreeing that MPs must approve additional powers to override the treaty with the EU. This concession would create an “emergency power box” that only MPs could open if they wanted to break the EU withdrawal treaty. It is unlikely this concession will be enough to satisfy the EU. In a long interview with the Sun, Johnson argued that the EU was being “abusive” to the U.K. and thus needed this new legislation. Meanwhile, the EU appears it will extend access to London clearing houses until mid-2022 to prevent financial market disruption.

China News:

- The TikTok saga continues. The current arrangement allows China to maintain a majority stake in the company, which may not fly with the White House. Senate opposition is growing as well. The fact that Beijing appears ready to approve the current deal suggests it isn’t structured to favor the U.S.

- CPC leaders have been holding talks and giving speeches about the role of the private sector in China. The evolving discussion suggests the government is planning a larger role in guiding the private sector. The CPC under Xi is focused on control; thus, a free private sector isn’t consistent with control, and therefore the private sector will likely be forced to work under state guidance.

- In the state media, we are seeing rather hawkish op-eds, urging China to prepare for war. Although such commentaries in this media are not all that uncommon, here is an example of what is being said.

- A company called Shenzhen Zhenhua Data Technology has been gathering massive amounts of data on foreigners, apparently for the Chinese military. It is not exactly clear what is happening; the level of capture is so large that it would be difficult to manage. In addition, much of the data is mere social media “scrapings” that don’t appear to have much value. Perhaps China intends to use AI to analyze this data at some point. However, the very fact that it is being gathered raises concerns.

- Although relations between the U.S. and China are deteriorating, that isn’t stopping Chinese companies with ties to the Chinese military from borrowing in dollars and U.S. financial firms from facilitating the transactions.

- It appears the U.S. is planning on increasing sales of military equipment to Taiwan, a move likely to upset the Xi regime. Meanwhile, U.S. Undersecretary for Economic Affairs Keith Krach is scheduled to visit Taiwan; China tends to get upset when U.S. officials visit Taiwan.

- As the new administration takes over in Japan, China has noted that the younger brother of the outgoing PM is to be the new defense minister. Nobur Kishi, Abe Shinzo’s younger brother, is said to have close ties to Taiwan.

COVID-19: The number of reported cases is 29,897,412 with 941,363 deaths and 20,337,872 recoveries. In the U.S., there are 6,631,568 confirmed cases with 196,831 deaths and 2,525,573 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The weekly state Axios chart has been updated.

Virology:

- The CDC caused a stir yesterday by suggesting that a COVID-19 vaccine would not be widely available until next summer. The U.S. is planning on a massive distribution program that will make a vaccine available for free. Although we hope for faster dispersion, our reading on the topic suggests that the summer of 2021 is probably about right; there are a lot of pieces that are part of a vaccine distribution chain, including vials for the vaccine, syringes, transportation (it may need to be refrigerated) and public acceptance. Overall, if a successful vaccine emerges, we may be back to normal by H2 2021.

- Meanwhile, on the treatment front, Eli Lilly (LLY, 150.96) reports it has an experimental drug that protects those infected with COVID-19, reducing hospitalizations.

- Europe is facing outbreaks; governments are resisting widespread lockdowns. Instead, they are pushing personal responsibility and more targeted measures. We suspect the era of widespread lockdowns is over in the developed world.

- The UAE has approved China’s vaccine for emergency use, the first country outside of China to make such approval.

- A home test for COVID-19 has been developed; it has not yet been approved by the FDA.

EU state of the union: EU President von der Leyen delivered her first state of the EU speech yesterday. The talk was generally well received; she warned Russia about its actions against the EU. She also criticized China for its human rights abuses. The problem with EU/China relations, to a great extent, comes down to Germany’s deep ties to China. Berlin is clearly trying to avoid a confrontation with Beijing, fearing it will lose its investments in China.

Economy and Markets:

- High frequency data is suggesting a slowing recovery. There is a high degree of business churn; permanent closures are rising, while new business formation has jumped, although recent data is showing a slowing there as well.

- The lack of child care is hampering workers from going back to the job.

- Despite assistance, homeowners have failed to apply for help, putting their mortgages at risk. Rent delinquencies are also rising.

- At the same time, the residential real estate market is doing exceptionally well. The NAHB home builder confidence index for September reached a new all-time high.

- On a longer-term basis, the majority of young adults between the ages of 19-29 are now living with their parents. This is the highest reading since the onset of WWII.