Daily Comment (September 23, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment starts with a discussion about the U.S. dollar’s impact on equities. Next, we give an overview of the upcoming Italian election over the weekend. Finally, we conclude with an update on the Ukraine war.

Fed Hangover: All focus seems to be on the dollar after the Fed lifted its policy rate by 75 bps. Here are our thoughts regarding the greenback’s impact on equities.

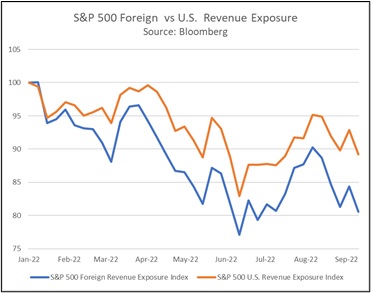

- The U.S. dollar index rose to its highest level in over 20 years due to the Fed’s tightening cycle and the Russian war in Ukraine. The greenback’s strength hurt firms with substantial overseas sales as these companies receive a weaker currency for payment for their goods and services. An index that tracks the S&P 500 performance of firms based on revenue exposure shows how the lack of dollar exposure may have led to worse performance this year.

- Although eye-catching, the chart above does not explain the complete picture of how dollar exposure impacts equities. Most of the decline in the foreign revenue exposure index was driven by tech. Weakening overseas sales hurt the sector’s performance, but the rise in borrowing costs is also an important factor. Additionally, the Real Estate sector, whose U.S. revenue exposure is only surpassed by Utilities and Telecommunication Services, has underperformed the aggregate S&P 500 Index. Thus, dollar impact on equity performance may be ambiguous at best.

- More hawkish policy from non-U.S. central banks is a possible cure to the dollar’s rise. However, it does come with risks as political backlash could pressure governments to support dovish fiscal and monetary policy as economies barrel into recession. We are seeing this situation play out in the U.K. The Truss administration plans to implement the largest tax cut in the country’s history since 1972. The pound sank to a 37-year low against the dollar following the report as investors fear that the Bank of England will not be able to contain inflation. The political ramifications of a recession will likely mean the BOE may not be the only central bank hesitant to raise rates. Thus, the dollar’s surge should continue if other central banks abandon or slow their monetary policy tightening prematurely to the Fed. In short, we would like to remind our readers not to put too much emphasis on one parameter when making allocation decisions. Although the U.S. dollar’s impact on revenue provides insight into firm profitability, it is essential to consider the broader macroeconomic environment when making investment decisions.

Italian Elections: The right-wing bloc is expected to take over the Italian parliament; however, there are concerns that the coalition may not hold together.

- Italian voters are set to pave the way for right-wing populists to take over parliament. Led by the historically Eurosceptic Brothers of Italy party, the new government will potentially include the League, Forza Italia, and Noi Moderati. Unlike in 2018, the differences between these parties are not significant enough to prevent the formation of a government. The leader of the Brothers of Italy, Giorgia Meloni, will take over as prime minister. Although she is known for being a nationalist on the campaign trail, she has openly supported keeping Italy in the EU and NATO.

- Meloni might not struggle to form a government, but that does not mean there isn’t friction within the coalition. Right-wing bloc leaders Meloni and Matteo Salvini both share a dislike for immigration, support law and order, and promote conservative family values. However, the two have differing views on Russia and government spending. Although the pair get along on the surface, there are rumors that their relationship is far from amicable. The Italian parliament could fall if the rivalry gets out of hand.

- The rise of a right-wing populist coalition in parliament does not seem to be startling Italian bond investors as much as we once feared. Despite desires from members within the coalition for household subsidies to curtail inflation, Meloni has assured Brussels that Italy will be fiscally responsible under her control. At 150.8% of GDP, Italy has the second highest debt burden in the EU. Meloni’s commitment to sound fiscal policy has likely calmed concerns over a potential EU-Italy clash. As a result, the yield gap between Italian and German 10-years bonds has narrowed from 2.40% in June to 2.27% as of September 22.

Ukraine Update: Everyone is looking for an off-ramp from the Ukraine war; however, political pressure is forcing the West and Russia to make uncomfortable decisions.

- Russia is threatening to use nuclear weapons as it grows desperate to consolidate its territorial gains in Ukraine. Despite not fully controlling any of the four regions it is attempting to annex, Moscow wants to give the illusion that it has made progress in its mission to protect separatists in the Donbas and Luhansk regions. However, recent setbacks from the Ukraine counteroffensive and political backlash due to partial mobilization has forced the Kremlin to double down on its claim that the war was necessary. Although the fight is far from over, recent moves from Russia suggest that hardline nationalists may pressure the ruling party to secure a victory at all costs.

- The European Union faces resistance as it gears up to impose another round of sanctions and place price caps on Russian oil. Hungarian President, and Putin ally, Viktor Orban called on the EU to scrap sanctions altogether over concerns that they are worsening the energy crisis in Europe. His remarks come as officials look to dissuade Russia from using nuclear weapons in Ukraine. That said, Viktor Orban is not alone; disputes over sanctions have led to party infighting in Italy and Germany. The disunity has added to speculation that the energy crisis could lead to a break-up of the EU.

- The European energy crisis has contributed to the decline in the euro against the U.S. dollar as it will likely tip the continent into recession. However, if the winter is mild and energy supplies prove sufficient, the euro could rebound.

- Neutral countries India and Turkey are not pleased with Russia’s referendums to annex parts of Ukraine and mass mobilization efforts. Turkish President Recep Tayyip Erdoğan called the elections illegal, and Indian Prime Minister Narendra Modi demanded the war come to a stop. These leaders’ comments signal that countries may be concerned that non-alignment will hurt them in the long run as Russia ramps up its war efforts. Although we do not believe India or Turkey will jump ship, it is becoming clear that the countries are hedging their bets. In a speech at Columbia University, India’s external affairs minister admitted that his government is starting to rethink its suspicions of the U.S.

- The gestures from Turkey and India suggest that Russia faces further isolation as it intensifies its operations in Ukraine. Although this does not necessarily pave the way for an end to the conflict, this could prevent Moscow from taking its most extreme action in the war.