Daily Comment (September 2, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Note: the markets and our office are closed on Monday, September 5, in observance of the Labor Day holiday. Our next report will be published on Tuesday, September 6.

Today’s Comment begins with a focus on how hawkish Fed policy has pushed the value of the dollar higher. Next, we review the latest developments in the Russia-Ukraine conflict, which includes our thoughts on a possible price cap on Russian commodities. The report concludes with an examination of China related risk and its potential impact on the global economy.

Strong Dollar: A possible 75 bps rate hike by the Federal Reserve at its next meeting has pushed the dollar to a 20-year high against global currencies.

- Fed officials this week hinted that the Fed would raise interest rates even if the country falls into recession. Cleveland Fed President and voting FOMC member Loretta Mester said that she expects rates to rise above 4% and stay at the level throughout 2023. On Thursday, Atlanta Fed President Raphael Bostic mirrored Mester’s sentiment and alluded to the bank possibly offloading mortgage-backed securities from its balance sheets. As the Fed continues to fight inflation, other central banks will face pressure to follow its lead.

- The yen sank below 140 for the first time in a quarter century. The currency’s drop against the dollar adds to speculation that the Bank of Japan will eventually tighten monetary policy. The currency’s depreciation against the dollar has contributed to the surge in Japan’s cost of living expenses due to the country’s heavy reliance on imports. Despite investors’ concerns, BOJ Governor Haruhiko Kuroda has not indicated that he is ready to reverse course on central bank policy. His reluctance is likely related to the country’s heavy government debt burden. Japan’s government debt is 266% of GDP and is the highest among developed countries. The lack of BOJ action suggests that the yen will continue to drop against the dollar, especially as the Fed raises rates.

- Slow economic activity and tighter U.S. monetary policy have also tumbled the pound. The currency has depreciated 14% against the U.S. dollar this year and dipped below $1.15 for the first time since March 2020. We predict that the depreciation in the currency will continue as the economy heads into recession. It is unclear as to whether it will continue to raise rates in a downturn, but the recent comments from the Bank of England suggest it might. On Thursday, the BOE announced that it intends to cap yields on its bonds to prevent financial market disruptions and likely to prevent surging borrowing costs. By restricting the interest rate on the long duration while it already has control over its short end through its policy rate, the bank would effectively embrace yield curve control. The move to control yields would mean that the bank would have less control over its exchange rates, therefore leading to further depreciation. As a result, we agree with Capital Economics’ forecast that the pound will fall to $1.05 by the middle of 2023.

- The country’s spat with the European Union also threatens the currency. The two sides are at loggerheads over the Northern Ireland Protocol. On Thursday, Brussels warned U.K. Foreign Secretary and prime minister frontrunner Liz Truss that the EU will not engage in Brexit negotiations unless it removes a bill allowing London to scrap the NI protocol unilaterally. Although a complete break between the EU and U.K. will hurt both parties, the latter will feel the brunt of the damage.

Russia- Ukraine Update: The war in Ukraine continues to show that the world is starting to form regional blocs.

- G-7 countries have moved one step closer to a formal agreement to cap Russian oil The deal is designed to keep oil available while also slashing Russia’s export revenue. That said, there is still a hurdle which the group needs to overcome before the agreement is official. The EU would have to amend its sixth round of sanctions prohibiting oil purchases after December 5. In response to the deal, Russia has vowed not to sell its commodities to countries that impose price controls. Assuming Russia does not stop oil deliveries, the agreement should be bearish for commodity prices as it would expand the oil supply.

- European Commission president Ursula von der Leyen has hinted that Europe could also entertain a price cap on Russian gas.

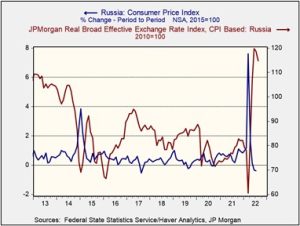

- Russia is exploring the purchase of $70 billion in yuan and other “friendly” currencies to prevent the ruble’s appreciation. The surge in the currency’s value was fueled by government measures to limit its sales and the increased demand for Russian commodities. The currency’s recent strength has been a double-edged sword. It has provided some price stability while making Russian exports relatively more expensive. The war in Ukraine has shown how dangerous it is for rival countries to hold U.S. dollars as foreign reserves. Thus, we expect more countries will follow Russia’s lead and begin to diversify their respective holdings of FX reserves.

- Despite concerns of a nuclear catastrophe, fighting continues to occur near the Zaporizhzhia nuclear power plant. The UN nuclear agency chief warned that the physical integrity of the site was violated due to frequent attacks around the area. Russia has controlled the site since March, but both sides have accused the other of possibly triggering a nuclear disaster in Europe. A potential accident at the power plant is a significant global risk as it could threaten the food supply, contaminate water, and lead to many civilian deaths.

China Risks: New lockdowns and friction with the West will make the China a difficult place to invest.

- The lockdown in Chengdu has sparked concerns that the Chinese economy will weigh on global growth. The lockdown in a city of over 21 million has led to a panic in nearby areas. In Shenzhen, there were reports of frantic buying as locals feared their city could be next. Despite reassurances from government officials in Shenzhen that it will not impose a lockdown, the rise in cases has already led to new restrictions. Additional COVID restrictions will likely weigh on the Chinese economy and make it more difficult for companies to sell to consumers within the country.

- S. Senators have proposed a bill that will make it harder for Chinese firms to raise capital on American exchanges. The proposal would target Variable Interest Entities (VEI) used by Chinese companies to list abroad. If passed, the bill would be the latest salvo launched at American investors that fund Chinese companies and would reinforce our view that the two major economies are decoupling. The lack of U.S. investment suggests that Chinese firms could struggle to find outside financing, which may prevent its economy from growing. Although it is unclear how much support the bill has in Congress, the legislation does support our thesis that U.S. policymakers are becoming more hawkish toward China. Hence, companies with exposure to the region may be less attractive.

- American support for Taiwan is another example of this decoupling trend continuing. On Thursday, China sent 23 military aircraft across the median line of the Taiwan Strait. Chinese intimidation tactics suggest that Beijing is less tolerant of the West’s interaction with the island democracy. We believe that China will likely take a tougher stance against countries interacting with Taiwan after the National Congress of the Chinese Communist Party which begins on October 16.