Daily Comment (September 9, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity futures are under pressure again this morning as equity markets grapple with the ongoing pandemic, the uncertainty around the budget process, and the potential for a debt ceiling standoff. The ECB and the Fed kick off our coverage. Today’s ECB meeting showed no rate changes, but there is a modest slowing of asset purchases. The Fed Beige Book was released; we comment on the report and other Fed issues. Remarks on distributed finance follow. Our regular coverage begins with China news, as investors and analysts try to determine how much policy will change. Economics and policy follow, with a look at the budget talks and the debt limit. The international roundup is next, and we close with pandemic coverage.

ECB: For the most part, the ECB stays accommodative. There were no changes in policy rates, as expected, but there will be a slowing of the Pandemic Emergency Purchase Program (PEPP) bond-buying. It may not be an actual taper. We could see the reduced buying in PEPP shifted to the overall buying program. This change was mostly signaled, so market action has been modest. By the way, the ECB also describes the rise in inflation as “transitory,” keeping in line with the Fed. In the press conference, the tone was generally more dovish than the statement, leading to a weakening EUR and stronger European equities.

Beige Book: The keyword is “moderation” in the Beige Book. This report, which is compiled by the regional FRBs, gives an insight into regional conditions. In most districts, the common theme was that growth has slowed but remains positive; the weakness is driven by the ongoing pandemic and supply-side shortages, including both materials and labor. These shortages are leading to inflation concerns.

- Jim Bullard, president of the St. Louis FRB, is pressing forward with calls for tapering, despite last week’s lackluster labor market report. He is arguing that the high level of labor demand will allow the Fed to start withdrawing stimulus.

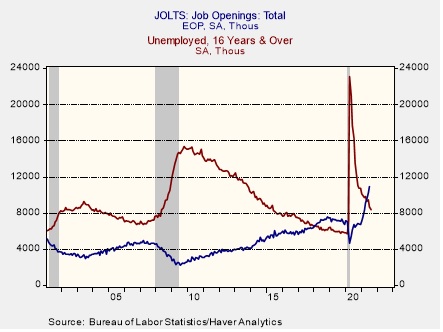

This chart shows the job openings from yesterday’s JOLTS report regarding the level of the unemployed. In the 2001-07 expansion, this level was never achieved. In the 2009-20 cycle, this level wasn’t achieved until February 2018. We crossed the lines in May, showing a rapid recovery.[1]

- Democrats remain split over Chair Powell’s reappointment (the topic of tomorrow’s Asset Allocation Weekly)

Crypto: The SEC is investigating Coinbase Global (COIN, USD, 258.20) over its lending program using crypto assets as collateral. This prompted the CEO of the company to criticize regulators in a series of tweets. The SEC is arguing that this proposed lending activity is potentially violating securities laws. The government is also investigating Uniswap. Much of what these firms are doing in decentralized finance is consistent with lending and trading in the regulated world, but these crypto firms want to do it in an unregulated environment (who wouldn’t?). History shows that, eventually, leverage leads to bad debt and the potential of a crisis. The fact that the firm was advertising 4% deposit rates is a clear warning. The SEC and others are trying to prevent this. We note that over the weekend, the NYT reported on the “boom” in crypto lending that has caught the attention of regulators.

- The mainstream media have discovered that central bank digital currencies are programmable, meaning negative nominal interest rates could become operable.

China: China’s financial markets remain a concern, and the confusion surrounding what exactly Xi means by common prosperity is beginning to look like a mess.

- Evergrande (EGRNF, USD, 0.50) continues to be a concern. Moody’s (MCO, USD, 382.37), along with Fitch, has downgraded the company again, leading to the suspended trading of the company’s bonds. There are reports that suppliers are being paid in undeveloped property, a sign of illiquidity.

- One way for parents to improve their children’s education is to buy apartments in good districts, allowing them to claim residency. It has led to soaring prices in these select districts. But recently, Beijing is fostering policies to break the link between home ownership and schools, leading to a decline in prices for apartments in these districts.

- In the past, Beijing regulators have moved to constrain the real estate market but would tend to back off on worries over triggering a financial crisis due to the concentration of debt in this sector. There are concerns that regulators may be serious this time about following through on addressing this sector.

- We have been watching with great interest a growing tension between what appears to be a conservative social trend of reining in capitalism along with other activities against those who suggest that the core regulation isn’t changing. Our view is that the conservative shift is likely the trend in place, but the fact that Xi is allowing this editorial battle to occur suggests the policy might not be fully developed.

- Tencent (TCEHY, USD, 65.23) is calling out a “gray” industry that has emerged to give gamers more playing time. The government recently moved to limit gaming to three hours a week. New services are appearing that create profiles for players who either don’t exist or for people who don’t play, allowing a gamer to purchase more time. If Beijing is serious about limiting time, it will need to implement some sort of identification, such as facial recognition.

- Regulators called in gaming companies for yet another meeting, described as an “ear-bashing.” However, it is notable that China has not moved to what some would suggest is the nuclear option, which would be to ban ads on gaming sites. The fact that regulators haven’t taken that step, which would hurt the gaming companies, suggests they don’t want to crush these companies, at least not yet.

- The growing esports industry in China is under threat from new rules on gaming.

- The increased regulation on technology appears to be a building block of data accumulation, with the goal of controlling the population and the economy. General Secretary Xi has discussed data as bringing the “fifth factor of production.” If anything, we expect Beijing to continue to expand its control over data, including taking it from China’s tech firms.

- Blackrock (BLK, USD, 924.93) has raised $1.0 billion for the first Chinese mutual fund to be run by a foreign firm. This expansion of participation in China is running against geopolitical trends and has been criticized in some circles.

- China’s PPI rose sharply in August to a 13-year high. In response, China announced it would release oil from its strategic reserve.

- In criminal law, there is often a decision about who bears the responsibility for the wrongdoing. For example, drug dealers often face harsher penalties compared to consumers. China has tended to severely punish bribe takers, who are usually government officials; there has been less focus on those making bribes. It appears that new regulations consider upping the punishments on the bribers.

- Brazil has suspended beef exports to China after finding two cases of bovine spongiform encephalopathy, commonly known as “mad cow disease.” Brazil is the largest supplier of beef to China. If the suspension persists, it will lead to reduced supplies in China. However, it is unknown whether Chinese consumers will balk at buying beef due to the risk of the disease.

- China is increasing funding for agriculture in what appears to be a move toward self-sufficiency. The country has a water problem. It has been said that grain imports are effectively water imports, allowing China to use its scarce water for industry (which tends to have a higher value added) than agriculture. However, in a world of economic warfare, the inability to feed oneself becomes a vulnerability. It appears China is moving to address that problem. However, it isn’t clear whether Beijing is willing to accept the lower economic value of diverting water to agriculture.

- China continues to crack down on the private tutor industry, now banning online classes.

- In Hong Kong, Tiananmen Square anniversary protestors were arrested.

- China is using fake social media accounts to spur protests abroad.

Economics and policy: Budget negotiations accelerate, and debt limit concerns are higher.

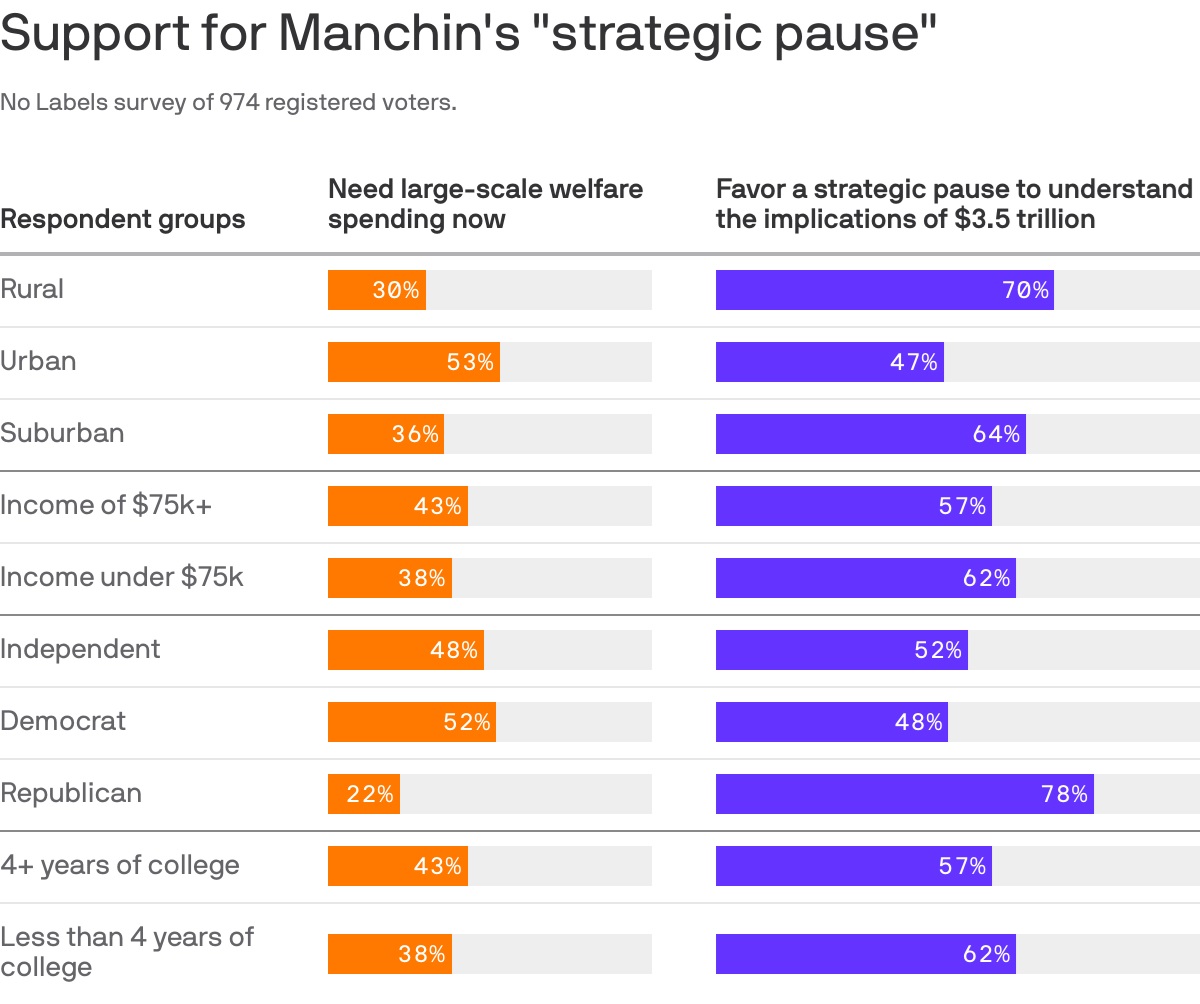

- As serious budget negotiations begin, lobbyists are preparing to attempt to shape taxes and spending for their clients. Industries targeted for tax increases are pushing back hard to avoid this outcome[2]. The White House has been moving at a fast pace to push through these changes. However, the past few weeks have drained the president’s political capital, putting the budget goals at risk. Currently, the most potent hurdle is the centrist Democrat senators. Senator Manchin signaled he would only support less than a third of the current proposals. Polling suggests Americans are siding with the West Virginian.

(Source: No Labels)

- Revenue increases are part of this package, and we note a report yesterday suggesting that the highest-income households have “evaded” $163 billion in taxes. The article didn’t make it completely clear this was all evasion or avoidance. The former is illegal; the latter is not.

- The White House wants to allow the government to negotiate Medicare drug prices; the pharma industry clearly opposes.

- Yesterday, Treasury Secretary Yellen warned that the U.S. would hit its debt ceiling next month and urged Congress to approve a higher borrowing limit. This issue is currently at an impasse. The Congressional GOP wants the Democrats to make the debt ceiling part of the budget process, which would allow the increase to pass with a simple majority. The Democrats don’t want to do that, knowing the GOP will use the issue as an election talking point. It doesn’t appear to us that there are 10 GOP Senate votes to increase the ceiling without changes to the budget. We expect some sort of deal to be made, but only at the brink of default. However, the curtailment of the T-bill supply is already affecting money market funds, reducing the supply of short-term paper these funds use.

- The FTC is deciding on a merger of Amazon (AMZN, USD, 3525.50) and MGM (MGM, USD, 42.44). In general, progressives, increasingly dominating the FTC, look askance at all mergers. Arguably this merger won’t lead Amazon to dominate the streaming industry. If anything, if Amazon doesn’t buy MGM, someone else might. So, the decision on this merger could signal just how aggressive the FTC will be regarding future mergers.

- In the 1980s, there was a time when the land under the Imperial Palace in Tokyo was worth more than all the land in California. Now, five U.S. tech stocks are worth more than the entire TOPIX stock index.

- Artificial intelligence is one of the potentially groundbreaking technologies that would allow greater machine independence from human oversight. We are observing that the race to develop this technology isn’t distributed widely on a geographic basis, which could lead to some cities gaining major advantages.

International roundup: Will the Eurobond become a permanent feature, and PM Johnson hikes taxes.

- The issuance of a Eurobond earlier this year was a significant change, allowing the EUR to have a full faith and credit bond tied to it, which should improve its attractiveness to foreign reserve management. Although this issuance was said to be a “one-off” when it occurred, as we expected, there is growing pressure to make Eurobonds a permanent fixture.

- PM Johnson passed a significant tax hike to fund social and health legislation.

- North Korea holds a modest military parade; Kim Jong-un was described as “looking fit.”

COVID-19: The number of reported cases is 222,650,255, with 4,598,278 fatalities. In the U.S., there are 40,266,505 confirmed cases with 652,930 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 450,584,465 doses of the vaccine have been distributed, with 376,955,132 doses injected. The number receiving at least one dose is 208,024,209, while the number receiving second doses, which would grant the highest level of immunity, is 177,104,652. For the population older than 18, 64.4% of the population has been vaccinated. The FT has a page on global vaccine distribution. For the most part, cases are stabilizing, although a few central U.S. states are showing a noticeable rise.

- There are new details emerging on coronavirus research being done in Chinese labs. The new reporting suggests the funding from the U.S. facilitated research into creating novel coronavirus strains. Although this new evidence doesn’t prove the lab leak hypothesis, it raises serious concerns that this research, which reports describe as “risky,” could have facilitated the spread of disease if it left the lab.

- As COVID-19 continues to circulate, we are moving into flu season, and there are rising concerns that the medical system, already under strain, could buckle if this year’s influenza year is a bad one. There are worries that this year’s flu strains will be more virulent than last year.

- As the Delta strain of COVID-19 circulates, researchers are watching the newest strain, dubbed “mu.” It has caused about 40% of cases in Colombia.

- Breakthrough cases of COVID-19, infections that occur in a vaccinated person, do happen, but rarely do they lead to a severe case. Current data suggest there is a 1/13,000 chance of a fully vaccinated person becoming seriously ill. Of those breakthrough cases triggering hospitalization, about 70% occur in adults over age 65.

- The WHO-sponsored global vaccine program has cut its delivery forecasts by 25% due to manufacturing and approval delays. The total doses to be delivered this year will be 1.4 billion.

[1] One interesting sidelight is that companies have become increasingly reliant on algorithms to screen job applicants. Large companies often receive thousands of applications, and using human resource professionals to review and screen would be cost-prohibitive. However, these algorithms are mostly designed to eliminate, not find, candidates. It might be the case where these screening tools may be eliminating candidates who could meet the job requirements. It may be a function of the programs being written in a time of looser labor markets. Simply put, firms may have lots of openings but lack the ability to find workers. A recent Harvard Business Review article examines this problem.

[2] In tomorrow’s Weekly Energy Update we will comment on the energy industry’s opposition to methane taxes.