Daily Comment (September 8, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will be broken down into three sections: 1) Why more central banks are signaling an end to their tightening cycle; 2) How the no-shows by the U.S. and China reflect the waning relevance of multilateral organizations; and 3) Our thoughts on the leader widely expected to succeed AMLO as the president of Mexico.

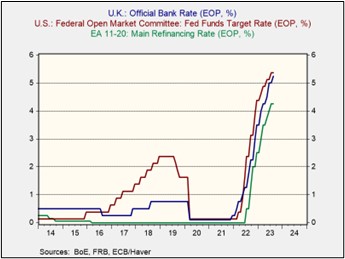

Peaking Trend: The Bank of Canada has become the first G-7 central bank to signal that it may be nearing the end of its hiking cycle.

- Bank of Canada Governor Tiff Macklem said that policymakers are nearing success in their battle against inflation. The dovish comments come a day after Canadian policymakers agreed to hold rates steady at 5%. Although inflation remains well above the central bank’s 2% target at 3.3%, the bank’s governor’s change in tone suggests that the policymakers are shifting their stance. This comes amid signs that the labor market is easing, with the unemployment rate increasing for four consecutive months from 5.0% to 5.5%. The bank has said that it is willing to take further action if needed to bring inflation under control.

- His remarks come as other G-7 central banks are set to meet to discuss their latest policy decisions. The European Central Bank (ECB) has signaled that it is prepared to raise its benchmark interest rate one last time this year, possibly in September, while the Bank of England (BOE) has said that its policy rate is “near the top of the cycle.” Meanwhile, the Federal Reserve is divided on whether more needs to be done to combat inflation, with some officials advocating for one more hike and others hinting that rates are high enough.

- The world is witnessing a change in monetary policy, with central banks potentially opting for holding rates steady or even cutting them. The Central Bank of Brazil has become the first notable central bank to reverse course on interest rates, cutting them in August for the first time since 2020. This move is likely to be followed by other central banks in the coming months, as global growth shows signs of slowing down. Nevertheless, inflation still remains significantly higher than the targets set by central banks. As a result, the process of easing policy may be more gradual than what investors are accustomed to, as central banks strive to strike a delicate balance between managing the risks of inflation and recession.

Choosing Sides: The G20 and ASEAN summits wrap up this week with key absences, as prominent world leaders chose not to attend.

- Chinese President Xi Jinping’s absence from the ASEAN and G20 summits is a notable snub, suggesting that he is becoming increasingly disinclined to engage with countries that do not share China’s worldview. His absence from the G20 is particularly significant, as he has not missed a meeting of the group in over 10 years. This suggests that Xi is cooling on the G20, or at least on the current format of the group. Xi’s replacement at the ASEAN summit, Premier Li Qiang, used the platform to warn countries against taking sides in what he described as a “new Cold War.” China’s recent actions are a clear sign that it is concerned about the growing international pressure and is seeking to isolate itself from groups that do not support its policies.

- Meanwhile, U.S. President Joe Biden’s absence from the ASEAN summit unnerved some countries and is likely a reflection of his view that the group has not been effective in achieving its goals. The ASEAN declaration states that the group strives to ensure “durable peace, stability, and shared prosperity” in Southeast Asia. However, Myanmar’s military coup and its continued participation in the ASEAN summit are in direct contradiction to this aim. Instead of traveling to Jakarta for the ASEAN summit, Biden will travel to Hanoi, Vietnam, to sign a “comprehensive strategic partnership.” The President’s decision to travel to Vietnam instead of attending the ASEAN summit suggests that he is more interested in building closer relationships with individual countries than with large groups of nations.

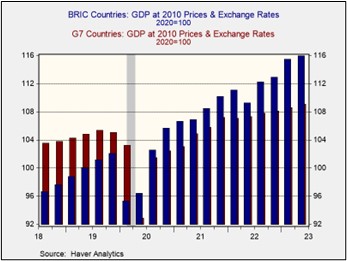

- We believe the world will be split into two camps: the BRICS countries and the G7 countries. The chart above shows that the BRICS countries have been growing at a faster rate than their G7 counterparts since the onset of the pandemic.

- The decision by the two leaders to skip summits could be seen as a sign of the declining relevance of multilateral organizations. These organizations have often been used to get countries together to resolve their differences. However, recently, they have been seen as being biased towards either the United States or China. The lack of a neutral forum for countries to have dialogue and to prevent the further deterioration of relations raises the likelihood of conflict in the future. At this time, we do not believe that tensions have reached a level that warrants serious concern, but we are monitoring tensions between the U.S. and China closely.

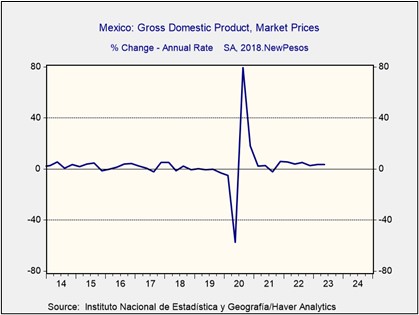

AMLO’s Successor: The Mexican president has chosen his replacement for after his tenure ends in 2024.

- Mexico’s ruling party, the National Regeneration Movement (MORENA), has nominated Claudia Sheinbaum, the former mayor of Mexico City, as its candidate for the 2024 presidential election. Sheinbaum’s close relationship with current President Andrés Manuel López Obrador (AMLO) makes her a strong contender to become the country’s first female president. The opposition coalition Frente Amplio por México has chosen Xóchitl Gálvez as its candidate. Current polls show that Sheinbaum leads Gálvez by 17 percentage points, making her the heavy favorite to win the presidency. Sheinbaum has promoted herself as a continuity candidate of her predecessor and has promised to crack down on corruption, increase cash transfers to the poor, and improve the country’s energy sovereignty.

- Despite the global slowdown, Mexico’s economy has seen robust growth in recent months. In the first quarter of 2023, the country expanded at an annual rate of 3.4%, outpacing the growth rates of the United States (2.1%) and the European Area (0.5%). This impressive performance is due to a number of factors, including strong consumption, a surge in exports to the United States, and an inflow of investment from companies looking to build supply chains closer to the U.S. to mitigate disruptions from abroad. Additionally, the Mexican peso (MXN) has been one of the best-performing currencies in the world, which has mitigated inflationary pressures within the region.

- The biggest question about a Sheinbaum presidency is whether she will be able to establish herself as her own political figure, independent of Andrés Manuel López Obrador. With approval ratings above 60%, it is widely believed that AMLO will try to maintain his influence on the party behind the scenes. The main difference between Sheinbaum and her predecessor is that she supports a transition to nationally subsidized renewable energy, while AMLO favors propping up Mexico’s oil industry. That said, they both agree on the need to protect Mexico’s lithium resources from privatization.