Daily Comment (September 6, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning. Risk markets are under pressure again this morning, with rising Treasury yields raising investor fears. Rising interest rates are also lifting the dollar. The JPY is challenging recent lows, and traders are watching for central bank intervention.

In today’s Comment, we start our coverage with a roundup of economic factors. Up next is our international overview, followed by news on the war in Ukraine.

Economic Roundup: The Fed looks set to pause, and a government shutdown may be looming.

- Fed Governor Waller was on CNBC yesterday and signaled that the FOMC was likely to “proceed carefully,” suggesting the committee will stand pat at the next meetings, scheduled for September 19 and 20. Currently, fed funds futures are projecting with near certainty that the policy rate will be held steady. We also note these futures are leaning toward steady policy from here, although with much less conviction. Waller tends to lean hawkish, so his remarks are probably a solid signal of steady policy.

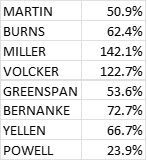

- Although there is ample evidence that the FOMC isn’t united on the future path of policy, Chair Powell has a remarkable ability to forge a consensus on policy. In fact, he has the best track record for the fewest dissents of all the Fed chairs in the post-Treasury agreement era. The table below shows the chairs since 1951 and the number of dissents divided by the number of meetings over which each chair presided. By far and away, Powell has been able to create consensus on the FOMC when compared to his predecessors. It’s hard to know his secret; it’s possible that the members during his tenure have been simply less combative, although that would be hard to determine. We will have a better understanding five years from now when the full meeting transcripts are released. In general, policy dissents would be expected to increase volatility. So, in this regard, Powell is probably, in a small way, holding down market uncertainty.

- Congress is set to name Phillip Jefferson as vice-chair of the Federal Reserve. Although widely expected, Jefferson is likely to lean dovish and thus will give the dovish members of the FOMC more influence.

- Congress averted a shutdown last spring, but it’s starting to look like it will be hard to avoid one later this month. Speaker McCarthy is struggling to move his caucus to a budget deal and probably can’t pass a budget without Democratic support. McCarthy is trying to keep the government open, and hold his position as speaker, a pair of goals that is looking increasingly tenuous. Government shutdowns tend to lower bond yields as spending stops and the Treasury reduces its borrowing. However, coming on the back of recent downgrades, a shutdown now might have a different outcome.

- This has been the summer of labor unrest, as several large companies are either facing the threat of strikes or have decided to capitulate to their unions. The Biden administration finds itself in a difficult spot as these negotiations unfold. On the one hand, the president fashions himself as a friend of labor, but on the other, strikes in key industries will hurt the economy and massive contract gains could spark inflation. The president is running for re-election and wants to avoid both a downturn and another spike in price levels. Thus, the White House is mostly staying out of the contract fights. Although this is one way to avoid the dilemma we outlined above, it won’t necessarily help him with union voters.

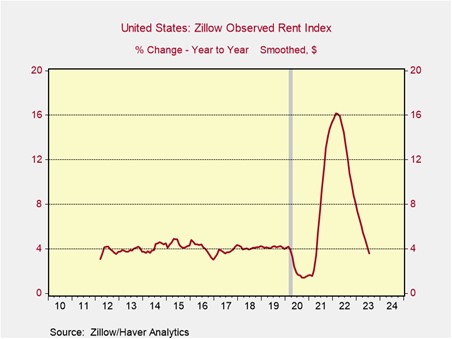

- Although yearly apartment rental rates are in a clear downtrend, the overall number doesn’t capture suburban versus city costs. Reports suggest that suburban rental rates are soaring.

- Announcements from Saudi Arabia and Russia indicating that they will maintain production cuts through year’s end sent oil prices higher. The rise in oil prices, coupled with lingering logistical issues caused by the war in Ukraine, are raising diesel prices which then tend to filter into goods prices.

- As U.S. bank regulators are spinning out new regulations, especially on bank capital, American lenders are looking with envy at Europe. European regulators are taking a lighter touch with their banking system.

- As pandemic savings are exhausted, households are increasing their use of credit cards. Delinquencies on credit cards and auto loans are moving higher. The expected recession from policy tightening has been avoided so far, in part, because the economy has become less sensitive to interest rates. However, we may be starting to see evidence that elevated interest rates are having a detrimental effect.

- Japanese investors, fearful of inflation, are increasing gold purchases.

- Europe is implementing new regulations on technology platform providers. The Digital Markets Act will force tech providers to allow more competition on their platforms, reduce data collection by the platforms, and provide companies operating on the platforms easier access to their customer’s data. The tech firms are not pleased.

International Roundup: The defense industry is globalizing and there is a race to gain access to Pacific islands.

- With the growing U.S. aversion to free trade deals, there is a concern that it may be difficult for Washington to build alliances to isolate the Russia/China/Iran axis. Allowing allies to run trade surpluses with the U.S. was a key element in America’s alliance system that isolated the Soviet bloc during the Cold War. Because such policies are politically untenable at present, we have been closely watching to see if policymakers can create an alternative to trade. It appears that globalizing supply chains for military spending is becoming one substitute. As nations begin to rebuild their militaries, the U.S. is “friend-shoring” production to create a broader supply chain.

- China’s anti-access/area denial (A2/AD) strategy is designed to prevent the U.S from moving expensive naval assets into close proximity to a military theater. China has designed missiles and expanded its submarine force to counter U.S. aircraft carriers as part of this strategy. One way to respond to China’s strategy is to put bases on islands and other land masses around China. Last week, we noted that the U.S. was recommissioning mothballed facilities in Asia for this purpose. At the same time, Beijing won’t passively allow the U.S. to engage in this policy. On Monday, Vanuatu established a new government following a no-confidence vote. The new PM, Sato Kilman, replaces Ishmael Kalsakau, and is thought to be more friendly to China than his predecessor. We expect China and the U.S. to actively woo these Pacific nations for defense purposes.

- As Commerce Secretary Raimondo began her visit to China, Huawei (002502, CNY, 2.65) unveiled its new 5G smart phone, a device that apparently houses semiconductor chips that the U.S. is trying to prevent China from acquiring. The announcement was pointed, suggesting that U.S. efforts to restrict China’s access had failed. In the wake of this announcement, the U.S. is “seeking information” and may add new sanctions.

- In what is being called a mistake, President Biden is not going to the ASEAN meetings next week, sending VP Harris instead as his replacement. If Washington’s goal is to woo Asian nations to the U.S.’s “side,” such no-shows make little sense. What hurts the optics is that the president is making visits to Vietnam and India. However, we also note that President Xi is not going to the G-20 meeting in New Delhi, so perhaps we are seeing unforced errors on both sides.

- Southern Europe is facing a deluge, with record rains causing widespread flooding.

War in Ukraine: The slow offensive may be gathering speed and Russia “woos” Cubans.

- Ukrainian sources suggest that the entrenchments the Ukrainian military is facing are not as strong as what they dealt with initially. The Russians, in anticipation of the offensive, built extensive fortifications, but these comments indicate that progress may be underway. SoS Blinken is traveling to Kyiv this week and is expected to offer an additional $1.0 billion in aid.

- Cuba has uncovered a trafficking ring, where Russians are trying to encourage Cubans to fight in Ukraine. Havana is not pleased with this development.

- Oil and gas rigs in the Black Sea are becoming targets in the conflict. Given the already tight supplies, this development is another bullish factor for oil and gas prices.

- Kim Jong-un is visiting Russia, with the expectation that Moscow wants to source military equipment from the Hermit Kingdom. Pyongyang is said to be seeking missile and nuclear warhead technology. Washington has warned North Korea that it will “pay a price” for cooperating with Russia. However, given how heavily sanctioned Pyongyang is already, it’s hard to see what additional measures could be implemented.