Daily Comment (September 3, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning! U.S. equity futures are signaling a higher open this morning. Today’s report begins with a discussion about the labor shortage and an update on Hurricane Ida. International news is up next. We cover U.S. economics and policy news, including details about the spending bill. China news follows, and we end the report with our pandemic coverage.

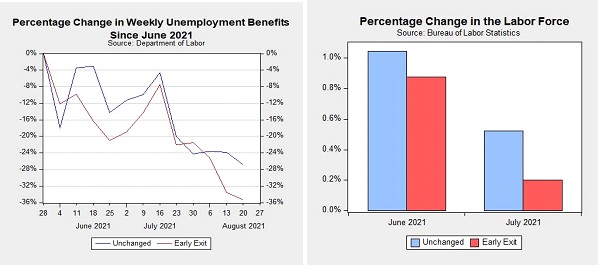

Labor shortage: Next week, the enhanced unemployment benefits are set to expire nationwide. A massive labor shortage has led many to suspect that ending these benefits could lead to a surge of new entrants into the labor market. However, data released from the Bureau of Labor of Statistics suggests that this expectation may not happen. In June and July, roughly half of the states in the country exited the program that funded the enhanced unemployment benefits. Although the exiting states saw a sharper decline in the number of initial claims filed compared to the states that remained in the program, these states also had a slower increase in the number of workers entering the labor force.

It should be worth noting that the time frame is too short to make any concrete conclusions. However, if the trend holds, it will likely mean that firms may have to increase their wages in order to attract more talent. In fact, there is growing evidence that firms have already begun to do so. Some firms that have been reluctant to raise wages have pressured the government to relax visa requirements to help resolve the worker shortage. Recently, fleet operators have petitioned Washington to allow more foreign operators into the country in order to resolve the shortage of truck drivers. If labor market conditions continue to show evidence of being rigid and tight, it will support the possibility of longer-term inflation. In this event, the Federal Reserve could become more assertive as it attempts to remove policy accommodation.

Hurricane Ida: Hurricane Ida continues to cause damages throughout the country. In the Northeast, there were over 45 deaths due to floods related to the storm. In response to the mounting damages to property as well as temporary disruptions to businesses, the government has offered some support. The U.S. Energy Department announced that it will release 1.5 billion barrels of crude oil from the Strategic Petroleum Reserve to mediate price pressures. Meanwhile, the Federal Emergency Management Agency (FEMA) is expected to use funds to help local victims of the disaster. As of right now, departments have been able to meet the needs of regions impacted by the storm. However, as the costs of damages become more apparent, Congress will likely fight over additional assistance which could lead to further delays in President Biden’s economic agenda.

International news:

- Japanese Prime Minister Yoshihide Suga announced that he will not run for reelection as party leader for the Liberal Democratic Party, effectively ending his term a year after he took office. Suga’s popularity took a hit due to his handling of a recent wave of coronavirus cases and the Olympics. Two recent polls showed that support for the prime minister had fallen to historic lows, likely playing a part in his decision to step down. Following his departure, elections will be held sometime before November 28. At this time, his party is expected to maintain its majority. Suga’s expected predecessor is unlikely to drastically alter the country’s foreign policy, such as its relationship with the U.S. That being said, his departure is reminiscent of a period throughout the 1990s and late aught years when prime ministers in Japan changed nearly every year. If this were to happen again, it will likely weaken Japan’s presence on the world stage at the exact time that its chief rival, China, grows in prominence.

- Poland declared a state of emergency along two of its borders following a series of border crossings by Belarusian immigrants. The spike in migration comes as Belarus attempts to use the threat of mass migration as a way to put pressure on the European Union to lift sanctions imposed on Minsk.

- Mexican President Andres Manuel Lopez Obrador is trying to work out a deal with President Biden that will help ease the migrant crisis both countries are experiencing. The deal will involve providing work visas for these immigrants to help with reforestation efforts in the U.S.

- Russian regulators threatened to fine Apple (AAPL, $153.65) and Google (GOOGL, $2,865.74) if the companies do not remove an app that is associated with jailed opposition leader Alexei Navalny. The crackdown represents the growing pushback the tech industry is facing globally as governments seek to reduce tech companies’ influence throughout their respective countries.

- The Scottish National Party has announced that it will not allow the U.K. to keep its nuclear arsenal in Scotland if the country votes to secede. The announcement means the U.K. will have to find a new location for its weapons. Australia, the U.S., and France are all being considered.

- The Pentagon announced on Friday that it is possible the U.S. may work with the Taliban in the fight against ISIS-K. It is also believed to be pressuring Pakistan to support the cause as well.

- Italian Prime Minister Mario Draghi has stated that he is not interested in running for president.

Economics and policy:

- The Democrats are struggling to come to terms with the $3.5 billion spending bill. Key vote and notable moderate Senator Joe Manchin (D-WV) has pushed for the party to “hit the pause button” on the spending bill as the government deals with inflation and the Afghan evacuation crisis.

- Fifty percent of small business firms have reported that they are having trouble filling open positions, according to the National Federation of Independent Business. Many of these firms have opted to raise wages in order to lure workers.

- Approval of labor unions rose to a nearly sixty-year high, according to the Gallup poll released on Thursday. The poll showed that 68% of Americans approve of unions, the highest recorded since 1965 when 71% of Americans approved of them. The growing popularity of unions highlights the increasing frustration with rising income inequality.

China:

- Chinese President Xi Jinping announced a proposal for a new stock exchange in Beijing designed to help small businesses. The measure will attempt to reduce the country’s dependence on debt for financing by encouraging firms to rely more on their equity.

- China’s media regulator has announced a boycott of what it referred to as “sissy idols” in favor of celebrities who exhibit more traditional “macho” stereotypes. The change comes as regulators are pushing the country’s entertainment industry to emphasize more traditional Chinese culture.

COVID-19: The number of reported cases is 219,126,141 with 4,542,726 fatalities. In the U.S. there are 39,550,163 confirmed cases with 643,683 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 445,672,595 doses of the vaccine have been distributed with 372,116,617 doses injected. The number receiving at least one dose is 205,911,640, while the number of second doses, which would grant the highest level of immunity, is 174,973,937. The FT has a page on global vaccine distribution.

- The World Health Organization is tracking a new coronavirus strain called Mu. The variant was first discovered in Colombia in January. Preliminary data collected by the WHO suggest the vaccines may not be as strong against the Mu variant.

- The White House’s plan to have the third vaccine shot approved by September 20 has been met with resistance from the Food and Drug Administration and Centers for Disease Control and Prevention. The two departments overseeing the approval process have accused the Biden administration of placing politics over process in its push to have a vaccine ready by its self-imposed deadline.

- Hospitals are struggling to deal with critical patients due to a surge in COVID cases.

- The rise in COVID cases has led to an oxygen shortage. Firms have had to curtail production as a result, including a Texas oil refinery that was forced to restrict operations.