Daily Comment (September 21, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

In today’s Comment, we open with a discussion of new global inflation forecasts from the OECD and include some notes on monetary policy and inflation. We next turn to a range of U.S. and international developments that could impact the financial markets today. We close with the latest news on the coronavirus pandemic.

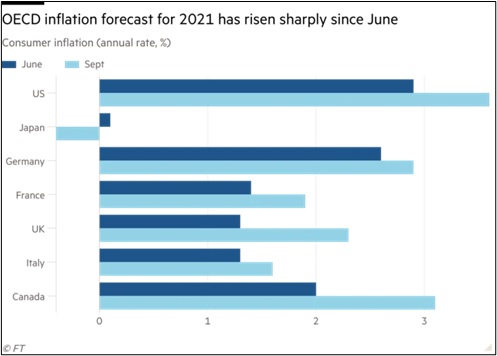

Global Inflation: In updated forecasts that will likely bolster concerns about consumer price growth, the OECD said it now expects inflation to be significantly higher in 2021 and 2022 than it had previously forecast for most G20 countries.

- The OECD economists now think the average inflation rate across the G20 economies will hit 4.5% in the fourth quarter of the year, with 1.5% of that caused by the effects of higher shipping costs and commodity prices.

- Separately, the U.K. reported that its public-sector net borrowing in August came in far above expectations, driven in part by higher interest payments on inflation-indexed borrowings. We’ve seen little discussion of this issue, but we think it is a notable risk. Traditional nominal bonds still account for the bulk of the debt issued by governments worldwide, but obligations that have their interest payments indexed to inflation are not insignificant. As inflation rises, the interest payments on those existing obligations will go up, no matter what happens with the interest rate on new issuances.

European Energy Market: As natural gas prices continue to surge in response to rising demand and crimped supply, the British government is reportedly considering state-backed loans to large utilities that take on customers from smaller energy companies that have collapsed. It may subsidize fertilizer production after rising gas prices forced two of the country’s major fertilizer plants to suspend production. On the Continent, several EU governments are being forced to discuss billions of euros in aid for households and stricken suppliers.

- The higher prices have already pushed four British energy suppliers, which buy wholesale and supply consumers, out of business.

- Many gas customers are on fixed tariffs, meaning their supplier must absorb the higher price. The U.K. government also has imposed a cap on energy prices for 15 million households, limiting the extent to which suppliers can feed higher wholesale prices through to customers.

United States-European Union: The rift between the U.S. and Continental Europe continues to widen following the chaotic U.S. withdrawal from Afghanistan and the signing of the AUKUS submarine deal in abrogation of a French-Australian agreement. It now appears that France tried to push Brussels to postpone the high-level U.S.-EU trade and technology council meeting due to take place in Pittsburgh later this month. That’s on top of France recalling its ambassadors to the U.S. and Australia and the EU calling off free-trade negotiations with Australia. In the words of Thierry Breton, EU commissioner for internal markets, “There is of course in Europe a growing feeling that something is broken in our transatlantic relations.”

U.S. Monetary Policy: The Federal Reserve begins its latest two-day policy meeting today, with a decision on interest rates and asset purchases due tomorrow. Many observers expect the policymakers to signal they will begin to taper the Fed’s bond purchases in the next few months. However, Chair Powell has stressed that the move would not necessarily point to any hike in the benchmark fed funds interest rate in the near term. The problem is that the committee will also release its latest “dot plot” of economic forecasts tomorrow. If the dot plots indicate rates will be hiked earlier than anticipated, it would likely spark a renewed bout of volatility in the financial markets.

Canada: Prime Minister Trudeau and his Liberal Party won yesterday’s elections, giving Trudeau a new mandate as leader of the country, but he fell short of his goal of securing an outright majority in parliament. The Canadian Broadcasting Corporation projects the Liberals will win 156 seats, just one more than the 155 it had since the last election in 2019 and well short of the 170 needed for an outright majority.

- Meanwhile, the Conservative Party is projected to win 122 seats, up from 119.

- As they have over the last two years, Trudeau and the Liberals will probably rely on backing from the New Democrats, a socialist party to the left of the Liberals, on important legislation.

China Evergrande: Even as risk markets today are recovering a bit from their plunge yesterday, which was driven in part by concerns that major Chinese developer Evergrande might default on its debts, the company still isn’t out of the woods. Reporting today indicates Evergrande used billions of dollars raised by selling wealth management products to retail investors to plug funding gaps and even pay back other wealth management investors.

- Evergrande financial advisers marketed the products widely, including homeowners in its apartment blocks, while its managers persuaded subordinates to invest, the executives of Evergrande’s wealth management division said. One executive suggested the products were too high-risk for ordinary retail investors and should not have been offered to them.

- The recent development will make authorities even less likely to save the firm. However, it also means the government will face a costlier, more complex job in mitigating the impact of the firm’s collapse on homebuyers and other clients of the firm. More broadly, the resulting slowdown in the property sector will likely have a significant slowing impact on the overall economy, which could put further downward pressure on Chinese assets.

Russia: Preliminary results show the Kremlin-backed United Russia party maintained its constitutional majority in the lower house of parliament in elections last weekend. United Russia candidates took 112 seats in the State Duma along with 198 single-mandate constituencies across the country. That gives the party a comfortable two-thirds majority in the Duma’s 450 seats needed to make changes to the constitution. The election was denounced by the West and described by an independent monitoring agency as “one of the dirtiest” in Russian history.

Digital Currencies: Coinbase (COIN, 236.53) has dropped its plans to launch a new digital asset lending product, bowing to pressure from U.S. securities regulators, who had warned that it constituted an unregistered security that would have prompted them to take legal action.

COVID-19: Official data show confirmed cases have risen to 229,170,561 worldwide, with 4,702,286 deaths. In the United States, confirmed cases rose to 42,291,718, with 676,268 deaths. Vaccine doses delivered in the U.S. now total 466,535,855, while the number of people who have received at least their first shot totals 212,035,328. Finally, here is the interactive chart from the Financial Times that allows you to compare cases and deaths among countries, scaled by population.

- According to the latest CDC data, 63.9% of the U.S. population has now received at least one dose of a vaccine, and 54.7% of the population is fully vaccinated.

- Johnson & Johnson (JNJ, 163.81) said a late-stage clinical trial has indicated that a booster dose of its vaccine administered two months after the first shot increased protection against symptomatic illness to 75% effectiveness. In addition, the company said a double dose of the vaccine provided participants with 100% protection against severe or critical COVID-19 at least two weeks after the second shot. The results could not only set up the approval of booster shots for the Johnson & Johnson vaccine, but it could also buttress the argument for boosters among the broader population.

- The Indian government said it would resume exports of COVID-19 vaccines starting next month, in a move likely to aid developing nations that have struggled to vaccinate their populations after New Delhi restricted shipments amid a resurgence of cases at home.

- COVID-19 deaths in the U.S. yesterday surpassed the number of fatalities in the country during the 1918-19 flu pandemic.

- The Biden administration said yesterday it would dismantle the Trump administration’s outright travel ban for people from a range of foreign countries but keep in place the requirement to show proof of vaccination or a recent test showing they aren’t infected.

- Officials admitted the modest easing of restrictions was partly to assuage foreign leaders angered by the chaotic U.S. exit from Afghanistan and last week’s abrupt breaking of a submarine contract between France and Australia.

- The change is due to take effect in November.