Daily Comment (September 16, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. It looks like an “everything down day” so far, although the retail sales data (see below) offered some relief. U.S. equity futures currently are mixed after opening lower. Treasury prices are down a bit, and commodities are weaker as well. The dollar is higher, which is likely behind the weakness. Our coverage starts with China news. Australia will join the U.S. and the U.K. in sharing nuclear submarine technology, and Beijing is going after gaming. Up next is economics and policy; the budget and debt ceiling turmoil continues. The international roundup follows. The EU discussed its state of the union, and PM Johnson shuffled his cabinet. We close with pandemic news.

China: Australia will acquire U.S. nuclear sub technology, and Chinese gambling takes a drubbing.

- The U.K., U.S., and Australia have agreed to cooperate on several defense initiatives, including AI and cyber, but the item catching headlines is that the U.S. will assist Australia in acquiring nuclear submarines. This decision was something of a surprise—Canberra had already agreed to acquire these subs from France. Paris was, in a word, “displeased,” although the program was struggling to work. This decision is monumental. Until yesterday, only the U.K. shared in U.S. nuclear propulsion technology. Obviously, this decision won’t make anyone happy in Beijing. Having nuclear subs will make Australia a potent military power in the region. The following are a couple of takeaways:

- By stiffing France, the U.S. is adding evidence that the EU simply isn’t that important anymore. This outcome was probably inevitable after the fall of the Soviet Union, but this action is just one in a growing list that shows Washington really doesn’t care all that much about the EU’s concerns.

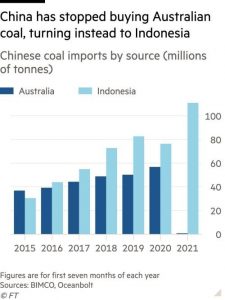

- Australia’s decision to take this step reflects its poisoned relations with Beijing. This chart shows the drift.

Australia was once a major supplier of coal to China but has been losing share to Indonesia. Obviously, this year, the changes are stark.

- Macau is one of the world’s gambling hubs. By some accounts, it’s second only to Las Vegas. After Beijing announced new rules and regulatory oversight, gaming equities tied to the former colony plunged 23%, the largest negative one-day performance in history. Regulators announced a 45-day consultation period, during which they will take public comments related to revising its gaming laws. We suspect there at two themes tied to this announcement. First, General Secretary Xi has been implementing social control measures. He has attempted to limit children’s video play and has pressed against excessive wealth. Pushing back against gaming would fit into that policy trend. Second, Macau has been a conduit for capital flight and money laundering. As Beijing cracks down on the wealthy, limiting their ability to move money offshore would be expected. The aggressive closing of bitcoin mining was likely part of this goal as well.

- The property market remains in turmoil. Evergrande (EGRNF, USD, 0.40) is essentially in default after failing to make some debt payments. The firm has hired advisors who have previously worked on notorious failures. Other real estate developers are suffering along with Evergrande, and there appear to be spillover effects to other parts of the economy.

- One interesting sidelight—in a recent Odd Lots podcast[1], Dan Wang made an interesting comment, suggesting Beijing is adopting the German business model for development. Although he didn’t develop the thought, the German model relies on two factors. First, it is heavily dependent on manufacturing; the recent crackdown on social media firms dovetails into that idea. Beijing wants to promote making things, not talking about them. Second, the model heavily depends on exports (read: the U.S. buys your stuff). Although China potentially has a large internal market and may try to use the Belt and Road project to colonize nations and dump exports on them, the German model only truly works if you have an accommodating hegemon. China doesn’t have that.

- Taiwan is boosting its military spending on items better designed to fend off a mainland attack.

- Ximalaya, a Chinese podcast platform, is canceling its U.S. IPO and will list in Hong Kong.

Economics and policy: Budget and debt ceiling matters continue, and the Treasury is looking at stablecoins.

- The Democratic Congressional leadership is trying to figure out a way to raise the debt ceiling by month’s end as the GOP refuses to participate. Although we expect something to be done at the 11th hour, there is a possibility of a government shutdown.

- Regarding the budget, centrist Democrats have scuttled the leadership’s goal of increasing government control over drug pricing. Although this isn’t the last word on the subject, it shows how difficult it will be to meet the goals of centrists and progressives.

- We doubt this bill will gain traction, but there is a measure that would force the Fed to restrict the ability of banks to fund the fossil fuel industry. The bill itself may be a messaging device. As we noted yesterday, Sen Warren’s (D-MA) call to break up Wells Fargo (WFC, USD, 46.64) could be used as a litmus test for Chair Powell’s renomination. This bill might be seen as “see what we could do if we had a different Fed Chair.” In other words, a sympathetic Fed Chair might enforce the goals of this bill without the bill even being passed.

- The Treasury is looking into the run risks of stablecoins, the crypto that acts like money markets. We view this as a serious risk. It is always difficult to know in advance the fount of a financial crisis, but our best guess is that these products are the most likely to foster the next one.

- It turns out that the greatest risk for New Orleans from Hurricane Ida wasn’t the storm, but the loss of electricity after the storm was over. Heat-related deaths were the leading cause of fatalities.

- The “buy now, pay later” cards are becoming popular. To us, it looks like a way to charge more interest and fees than one can get from credit cards.

- The WSJ has been investigating Facebook (FB, USD, 373.92). Earlier reports showed how its subsidiaries were dangerous for teenage girls. The most recent one shows how the company facilitates societal anger.

International roundup: The EU held its State of the Union address, and PM Johnson changes his cabinet.

- European Commission President Ursula von der Leyen gave her State of the Union address Although such speeches are mostly a wish list of policies a leader wants, we saw two as notable. First, the EU appears to want a self-contained semiconductor industry. If there was ever evidence that deglobalization was accelerating, this is it. Second, the EU wants to build a foreign investment platform similar to the Belt and Road project. We don’t see how that would work, but it does suggest the leadership is worried about China’s inroads into Eastern Europe.

- PM Johnson announced a cabinet reshuffling yesterday. For the U.K., there are many interesting stories, but for those outside the U.K., it doesn’t mean a whole lot. The most interesting to us was the demotion of Dominic Raab from the position of foreign minister, who was likely hurt by the exit from Afghanistan.

- France claims it has killed the head of Islamic State in the Sahara.

- The Shanghai Cooperation Organization will hold meetings this weekend. Although China dominates this organization, India is also a counterweight.

- North Korea tested a couple of ballistic missiles yesterday. It appears Kim wants some attention. It should be noted that South Korea also did.

- The South African government was hit with a large ransomware attack.

- Japan is conducting military exercises designed to prepare for the defense of its smaller islands. These islands would be particularly vulnerable if Taiwan fell under China’s direct control.

- There is great fear that Afghanistan may spiral into civil war. It appears that even the Taliban are fighting each other.

COVID-19: The number of reported cases is 226,453,332, with 4,661,290 fatalities. In the U.S., there are 4,323,121 confirmed cases with 666,627 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 461,117,525 doses of the vaccine have been distributed, with 382,294,795 doses injected. The number receiving at least one dose is 210,361,099, while the number receiving second doses, which would grant the highest level of immunity, is 179,695,287. For the population older than 18, 65.2% have been vaccinated. The FT has a page on global vaccine distribution. The Axios COVID-19 map shows some improvement, although as the weather cools, we are seeing an uptick in cases in the northern part of the nation.

- The booster shot debate is heating up. The drug companies seem keen on supporting another round of shots, but researchers say the data isn’t all that compelling. For politicians, there is always a goal of doing something, but there isn’t a preponderance of opinion. Some FDA scientists have resigned recently due to pressure to approve boosters.

[1] IOHO, one of the top 5 financial podcasts out there, only topped by the Confluence of Ideas and the Asset Allocation Weekly Podcast.