Daily Comment (September 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with key news on the US-China and US-Russia relationships that could affect US technology companies and global energy supplies. We next review several other international and US developments with the potential to affect the financial markets today, including a further slowdown in Chinese economic growth and signs that the European Central Bank is close to ending its campaign of interest rate cuts.

United States-China: In a report on the first day of its pre-orders for the new Series 17 iPhone on Saturday, technology giant Apple said Chinese pre-orders were even stronger than for the Series 16 last year, even though its ultra-thin model is still unavailable because of regulatory issues. The strong Chinese orders came despite the worsening of US-Chinese geopolitical and economic tensions. They therefore highlight how top US brands retain significant loyalty in China, which may limit Beijing’s ability to target them as part of the US-China rivalry.

- On the other hand, Beijing today said US artificial intelligence giant Nvidia was found to have violated Chinese antitrust law. The announcement didn’t lay out any punishment for Nvidia, but it did say the company would be subject to further probes, which will likely weigh on the firm’s stock price. In pre-market trading, Nvidia’s stock was down 1.4%.

- Separately, Beijing on Saturday announced that it has opened an anti-dumping probe into US analog computer chips and initiated an anti-discrimination investigation over Washington’s handling of Chinese chips.

- The Chinese probes could well lead to tariffs or other trade barriers against US chips, so they could serve as a threat ahead of the new round of US-China trade talks in Spain this week. If such tariffs or trade barriers are eventually implemented, US chip firms could lose access to the large, important Chinese market, especially if they don’t enjoy strong brand loyalty like Apple does. That could lead to further bifurcation of the global tech industry and hurt the profits and value of US chip firms.

United States-Russia: Politico over the weekend said Sen. Lindsey Graham (R-SC) and Rep. Brian Fitzpatrick (R-PA) will try to attach their bill imposing major economic sanctions against Russia to the upcoming legislation to keep the US government funded. Senate Majority Leader Thune is reportedly supportive of the idea, and it seems consistent with President Trump’s pledge this weekend to level “major sanctions on Russia” when NATO countries stop buying Russian oil and levy tariffs on China.

- The effort by Graham and Fitzpatrick probably raises the possibility of major new US sanctions against Russia.

- The result could be new geopolitical tensions between the US and NATO versus China and Russia and possible disruptions in global energy markets. However, the moves may not be enough to convince Russia to stop its war against Ukraine.

US Monetary Policy: Mortgage-related documents seen by media sources appear to show that Fed board member Lisa Cook properly listed her Atlanta condominium as a vacation property, contradicting allegations of mortgage fraud by Federal Housing Finance Agency Director Bill Pulte. Those allegations, apparently based on other documents, were the basis for President Trump’s effort to fire Cook. The effort to fire Cook is now mired in judicial proceedings, but the new documentary evidence suggests she may have a fighting chance to stay in her position.

US Stock Market: President Trump this morning threw his support behind the idea of allowing companies listed in the US to issue their earnings reports every six months, rather than quarterly. In a social media post, Trump wrote that, “This will save money, and allow managers to focus on properly running their companies.” Such a change would require action by the Securities and Exchange Commission, which has required quarterly reporting since 1970.

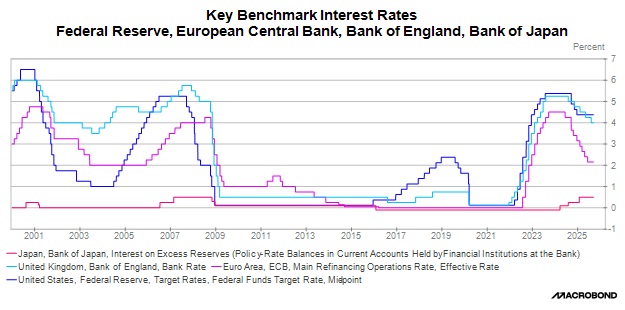

Eurozone: In an interview with the Financial Times, Martin Kocher, the newly appointed governor of Austria’s central bank, said the European Central Bank’s monetary easing has now essentially ended, leaving the benchmark interest rate at 2.00% or slightly lower for the time being. If Kocher is right, the differential between US and eurozone interest rates could finally begin to narrow as the Fed re-starts its rate-cutting campaign this week.

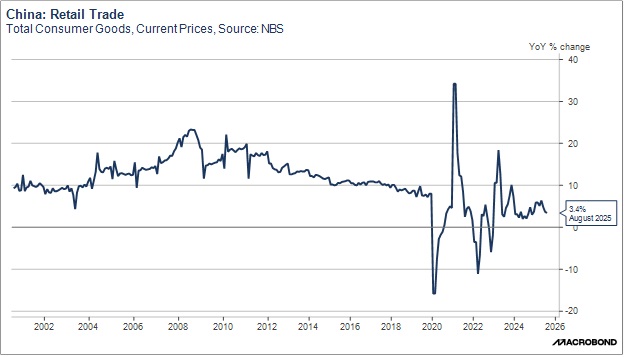

China: As a reminder that the US-China tensions are occurring against a backdrop of slowing economic growth, Beijing today said August retail sales were up just 3.4% from the same month one year earlier. That was much weaker than expected and significantly slower than the increase of 3.7% in the year to July. Other data showed slowing growth in fixed investment and industrial production as well, at least in part reflecting the government’s effort to rein in excess capacity and untenable price competition.

Russia-Romania: Bucharest over the weekend said one Russian drone had entered and exited Romanian airspace, marking the second time Russian drones have violated NATO territorial skies in the last week. The Romanian air force monitored the drone but didn’t take it down. The incidents suggest Russia is taunting NATO, testing its defenses, and gauging its willingness to respond to Russian aggression. The incidents point to a growing risk that the Kremlin will go too far and spark a kinetic conflict with NATO that would likely be negative for global financial markets.

Turkey: A judge today postponed a decision on ousting Özgür Özel as chair of the opposition Republican People’s Party over allegations of vote-rigging at a 2023 party congress. Since the effort to force out Özel has been seen as a ploy by President Erdogan to weaken the opposition and stay in power beyond the end of his current term in 2028, the postponement has raised hopes that the judiciary is pushing back against Erdogan’s authoritarian approach to governance. Turkish stock prices have therefore jumped about 4.5% today.

Global Critical Minerals Supply: New reporting by the Financial Times shows that global supplies of germanium, which is critical for high-technology military products such as thermal imaging systems, have practically dried up in response to a recent export ban by China. Although the US convinced China to quickly reverse a separate clampdown on rare earths earlier this year, it appears the restrictions on germanium and related minerals remain in place, driving global prices higher and threatening to disrupt high-tech manufacturing around the world.