Daily Comment (September 15, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment will be broken into three sections: 1) Why unions are starting to grow in popularity; 2) Why long-duration Treasury yields are likely to rise over the next few years; and 3) Why the market should be cautiously optimistic about the data coming out of China.

Labor Fights Back: Unions are back in fashion as more workers demand higher wages and better terms.

- The United Auto Workers (UAW) announced a strike against the Big Three automakers in one of the biggest labor disputes in recent memory. The strike could weigh on economic growth if it lasts long enough. The union rejected the carmakers’ last-minute bids to end the impasse, with the most significant sticking points being the UAW’s demands for defined-benefit pension plans, a 32-hour workweek, and other work incentives. The automakers have rejected these demands, believing that they would hurt business profitability. Ford (F, $12.62) estimates that the proposal could push it into bankruptcy.

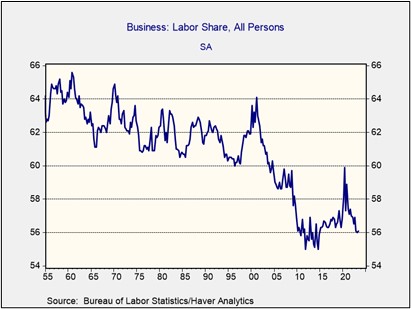

- The long-simmering tension between unions and firms is likely to continue, as firms have been reluctant to share more of their profits with workers. Although most of the pushback against labor unions is coming from industries that are already unionized, there is growing support for labor unions overall. Recent Gallup polling data shows that approval ratings for labor unions have reached their highest point since 1965. This evolving sentiment is exemplified by the recent actions of basketball players at Dartmouth College, who have initiated proceedings to establish a local union. This shift in perspective comes amid a significant decline in labor’s share of economic output from its pandemic peak.

- Over the next thirty years, the bargaining power of unions is likely to weigh on company margins, as labor groups gain influence and extract more concessions from firms, such as higher wages, better benefits, and more job security. These concessions could reduce company efficiency, leading to lower productivity and greater inflation volatility. In this environment, large companies are typically better positioned to absorb losses and capitalize on technological substitutes such as artificial intelligence. However, the trend will likely be drawn out and bumpy, so there is no immediate cause for action.

Bond Bears Return: Long-term Treasury yields hit a post-GFC high as traders weigh hawkish Fed policy and government budget wrangling.

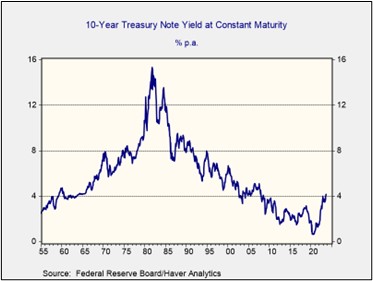

- Bond yields have risen due to uncertainty over fiscal and monetary policy. President Biden warned on Thursday that the government could shut down at the end of September if Congress doesn’t reach an agreement on a new budget. House Speaker Kevin McCarthy (R-CA) has struggled to convince fellow Republicans to keep the government funded. Meanwhile, stronger-than-expected retail sales data and a steady decline in jobless claims have added to speculation that the Federal Reserve may pursue a hawkish pause at its next meeting. The FOMC is expected to leave rates unchanged next week but signal its readiness to raise them further in the future.

- Ten-year Treasury yields have risen over 100 basis points since April, to levels not seen since 2006. This massive jump in interest rates reflects investor concerns about the Federal Reserve’s ability to maintain price stability and the government’s ability to meet its debt obligations. Although the recent CPI report showed signs of improvement in underlying price pressures, rising energy prices have raised concerns that some of this progress will be reversed. Additionally, growing partisanship prevents Congress from passing legislation to address the growing government deficit. As a result, investors are demanding higher yields to compensate for the increased risk.

- Long-duration bond prices are likely to face significant headwinds due to structural shifts in the global economy, particularly the transition from an economy that favors efficiency to one that favors resilience. This transition could lead to increased inflation volatility and supply chain disruptions, as the lack of imports makes it more difficult to meet domestic demand. Additionally, the growing government debt burden will continue to raise concerns about the sustainability of public finances. However, this transition will be uneven, with periods of fluctuating yields.

Chinese Surprise: Beijing received some welcome news, as economic data showed that the economy is starting to rebound.

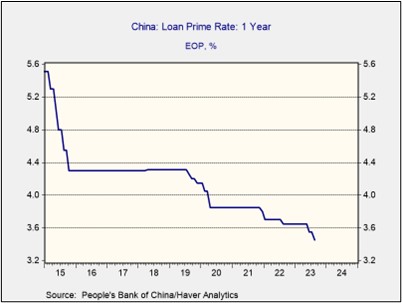

- Industrial production and retail sales figures beat expectations in August, showing that the limited policy stimulus is having an impact on the economy. Factory output increased by 4.5% year-over-year, well above expectations of 3.9% and the previous month’s increase of 3.7%. Retail receipts jumped 4.6% year-over-year, well above the July increase of 2.5% and the consensus estimate of 3.0%. This progress is likely to boost optimism among investors who feared that the country was in a prolonged slump, which could persuade some that the worst is likely behind. As a result, the Chinese yuan (CNY) gained on the U.S. dollar.

- The positive economic reports show that China’s pro-growth initiatives are working. In recent weeks, Beijing has implemented measures to boost consumer and investor sentiment, including the People’s Bank of China’s most significant rate cut in three years, a slash in stamp duties on stock transactions, and a cut in the reserve requirement ratio to free up liquidity for lending. The measures follow statements made by Beijing officials in July that the government would provide stimulus to help support the economy following years of COVID restrictions. That said, there is still concern that Beijing’s work isn’t finished.

- It is never a good idea to read too deeply into a single month of economic data, and this is no different. China is still working its way through a property meltdown and a municipal debt problem. Additionally, not all of the economic data coming out of China is rosy. For example, the housing price index was down 0.1% from the prior year, and urban youth unemployment has risen above 21%. Thus, China is far from being out of the woods. However, if the growth in consumption does start to pick up, this should aid equities in countries with exposure to the second-largest economy.