Daily Comment (September 15, 2021)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. U.S. equity futures are exhibiting a familiar pattern of being stronger overnight and fading into the opening. It is clear that market momentum is waning. We think this action is a correction of sorts, but it will be difficult to push the market much lower with so much liquidity available. Our coverage begins with a look at China, focusing on the continuing financial situation. We then have a few political notes. Economics and policy are up next, followed by the international roundup, and we close with the pandemic update.

China: Evergrande (EGRNF, USD, 0.40) remains in the news.

- Is Evergrande going to trigger a Minsky moment in China (and elsewhere)? The shadow of default is looming ever greater. We have learned over the past 25 years that when financial systems are deregulated, the debt of a troubled company can end up in places regulators and market participants don’t expect. U.S. regulators loath to bail out Lehman because they had already rescued Bear Stearns and thought other firms would take that experience as a warning. However, bailouts create a moral hazard, and China has mostly avoided defaults. Thus, investors really don’t take credit quality into account.

- So how bad could it get? In reality, as one of my undergrad professors used to say, “it’s an empirical problem,” which is a polite way of saying, “hold my beer.” Until we actually see default, we won’t know how bad it can get. We know the company has over $300 billion in debt. We are watching the following:

- What has the debt been used for? We know Chinese banks hold much of the debt, meaning the government has mechanisms to manage a default. The banks can restructure the debt over time. A bigger concern is whether bonds and commercial paper are held in other non-bank entities. Given the high yield on the paper, it is possible that other shadow banking entities hold it as an asset. In that case, a default could ripple into other parts of the economy (including outside China). There are rumors in financial, social media that Tether, the stablecoin, has Evergrande commercial paper as an asset. This allegation is not confirmed, but if true, it could have widespread effects on crypto assets.

- Another rumor is that more than 128 banks and 121 non-banks have some degree of exposure to Evergrande’s debt.

- The problems of Evergrande could trigger similar concerns among other Chinese real estate developers.

- “Behind every great fortune is a crime”—Balzac. Since Deng, there has been an undercurrent of corruption in China. We have seen it described as “good” corruption, which includes bribes and gifts designed to overcome the web of regulation. We have also seen “bad” corruption, which is doing, well, bad things. Most in business have likely relied on some form of corruption. Xu Jiayin, the chair of Evergrande, is known for his “gifts.” If he goes down, he very well may take a large number of officials with him.

- Yesterday, we showed clips of civil disorder among the holders of wealth management products. If Evergrande fails, not only will these holders become upset, but owners of real estate could as well. Beijing is really good at quelling unrest, but this might be a challenge.

- To conclude, we don’t know how this will play out, but there is the potential for dislocation. The dollar and Treasuries will likely benefit the most.

- So how bad could it get? In reality, as one of my undergrad professors used to say, “it’s an empirical problem,” which is a polite way of saying, “hold my beer.” Until we actually see default, we won’t know how bad it can get. We know the company has over $300 billion in debt. We are watching the following:

- As we note below, China’s economic data released overnight was weak. Spending activity slowed, perhaps due to the recent outbreaks of COVID-19. Industrial output was also slow. Under normal circumstances, we would expect the PBOC to start stimulating, but if Xi has decided to attack the bad debt problem, the response might be slow.

- It is reported that President Biden suggested a summit with General Secretary Xi. Xi demurred.

- According to reports, Chinese hackers attacked Israeli tech companies and the government. They took pains to masquerade as Iranian, even using Farsi in their coding.

- Over the past 18 months, we have noted the swings in China’s hog market, which was hit hard by the African Swine fever virus. As prices rose, new entrants entered the market, lured by low-interest rates and government subsidies. U.S. microeconomic textbooks used to have a section on the “hog cycle,” describing how the price would rise, leading to herd expansion and resulting in lower prices. That is what is happening in China; hog prices have plunged, and deeply indebted ranchers are in trouble.

Political notes: Here are a couple of items that caught our attention.

- In Woodward and Costa’s new book, it is reported that SoS Blinken and SoD Austin tried to extend the U.S. presence in Afghanistan. It is clear the exit from Afghanistan was chaotic and poorly planned. The opposition to exit from Austin and Blinken may have led to less than diligent efforts to exit on the assumption that there would be more time.

- One undercurrent we watch in American politics is gerrymandering, the process of shaping Congressional districts for a party’s advantage. Good government would argue that non-partisan allocation would offer better representation, but political parties exist for the sole purpose of winning elections. Although the GOP is widely accused of gerrymandering, we note that Democratic leaders in New York appear poised to use the practice to their advantage.

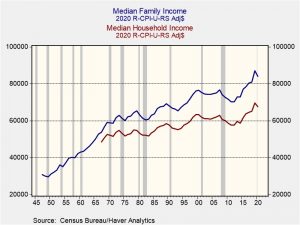

Economics and policy: Real household income declined last year, and there is a threat to banks.

Household income measures all household groups, including those who are unrelated. Family income measures incomes of households where the members are related by kinship or marriage.

- The tax proposal churn continues. There is an apparent proposal to apply the wash sale rules to crypto, currencies, and commodities. The wash sale rule currently applies to equities. Although the goal is to apply the rule to crypto, catching currencies and commodities is a new twist. This action doesn’t make much sense for commodities. Tax rules require the payment on unrealized gains at year’s end and making a trader wait would be a severe disadvantage. We doubt this rule will be included, but it bears watching.

- Meanwhile, progressives are starting to realize that most of their goals for taxes are not going to make it into the final legislation.

- Elizabeth Warren wants the Fed to break up Wells Fargo (WFC, USD, 46.05). It appears she wants to return to a Glass-Steagall world. Under normal circumstances, we wouldn’t comment on such things, as the request would fall on deaf ears. However, progressives want to oust Chair Powell, and this request could be a litmus test. If he agrees with the proposal, she will support his renomination. If he rejects or ignores it, she will oppose it. We doubt we can return to a Glass-Steagall world, but this might be an interesting test case.

- Former intelligence officials argue that using anti-trust against tech firms will hurt the U.S. in the race against Chinese tech. We are not surprised to see such sentiment; the political establishment benefits from tech and doesn’t want to see it disturbed. We are not sure this makes sense for either regulators or the firms themselves. If it is imperative they be allowed to hold near-monopoly positions, it makes sense to regulate them similar to utilities. It is not necessarily the case that breaking them up would hurt the U.S. technology effort. It might hurt the companies but make the industry stronger (e.g., the breakup of Standard Oil).

- Apparently, Facebook’s (FB, USD, 376.53) Instagram is bad for teen girls, and the company knows it. The Senate has questions.

International roundup: We get the State of the EU today, and Russia holds legislative elections over the weekend.

- European Commission President Ursula von der Leyen will hold her State of the Union address today.

- Catalan independence has been on the backburner due to the pandemic. But the issue returns as talks begin today.

- The most recent Eurobond was oversubscribed 11 times.

- Russia will hold the State Duma elections this weekend. We see an aggressive crackdown on opposition parties, and it is unclear what Putin is worried about.

- The army in Myanmar is continuing its war against former protesters, which is evolving into a low-grade civil war.

- Lithuanian angered Beijing by effectively giving Taiwan an embassy. Slovenia says the EU should support Vilnius. Germany would not likely help this effort.

- Islamic State is returning to Syria.

COVID-19: The number of reported cases is 225,924,019, with 4,651,193 fatalities. In the U.S., there are 41,367,771 confirmed cases with 663,963 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 458,771,465 doses of the vaccine have been distributed with 381,453,265 doses injected. The number receiving at least one dose is 209,982,936, while the number receiving second doses, which would grant the highest level of immunity, is 179,289,983. For the population older than 18, 65.1% have been vaccinated. The FT has a page on global vaccine distribution.

- When India had a massive rise in cases earlier this year, it suspended vaccine exports. Now that its cases have declined, there is pressure on Delhi to resume exports. India is a major exporter of drugs and vaccines.

- The U.K. will begin distributing booster shots next week.

- President Putin is in quarantine after being exposed to the virus by a member of his court.