Daily Comment (September 12, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Today’s Comment opens with a discussion of new irritants in the China-India relationship and what they mean for investors. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including indications that the Bank of Japan could end its negative interest-rate policy by year’s end and signs of progress in the negotiations for new labor contracts in the U.S. auto industry.

India-China: India yesterday imposed anti-dumping tariffs on some Chinese steel imports, responding to a flood of foreign steel and complaints from local producers in recent months. From April through July, government data shows steel imports into India were up 23% from the same period one year earlier, with imports from China alone up 63%. The anti-dumping duties are scheduled to last for five years.

- From China’s perspective, India’s new tariffs will only add to the growing list of irritants in the countries’ bilateral relationship. Some other irritants on that list include:

- Territorial disputes, including fatal clashes, in the Himalaya mountains;

- Increasing Indian support for the Philippines in its territorial dispute with China in the South China Sea;

- Indian pressure on Sri Lanka to avoid allying too closely with China;

- India’s growing participation in the U.S.-led “Quad” security grouping;

- Indian restrictions on Chinese social media apps based on national security concerns; and

- Recent efforts by Prime Minister Modi to establish India as the leader of the “Global South,” i.e., poorer countries in South Asia, South America, and Africa.

- Along with the recent reprimand that Chinese President Xi received from senior Communist Party leaders over his domestic and international performance, these irritants probably help explain why Xi declined to attend last weekend’s G20 meeting, which Modi hosted in New Delhi.

- In any case, it is clear that the China-India relationship is souring. To further peel India away from China and bring it closer to the U.S.-led bloc, Washington is likely to encourage that estrangement, including with economic incentives that could help make India more attractive for investors. Nevertheless, our quantitative, objective methodology for assigning countries to the world’s evolving geopolitical and economic camps currently puts India in the “Leaning China” bloc, mostly because of India’s membership in the China-led Shanghai Cooperation Organization and its relatively modest trade relationship with the U.S. versus China. India’s continued presence in our “Leaning China” bloc, at least for now, serves as a reminder that there could be delays and speed bumps before India swings more fully into the U.S.-led bloc.

Chinese Economy: Two of the largest cities in Shandong province, China’s second-most populous region, said they have lifted their restrictions on home purchases. That adds to the list of major local governments in China that have taken steps to boost their housing markets after being encouraged to do so by the central government. Nevertheless, the piecemeal regulatory moves are widely viewed as insufficient to spark a significant improvement in home purchases or general economic growth.

Chinese Military: Satellite imagery and social media posts show a large, nearly completed new drydock and basin at a major shipyard known for producing China’s top amphibious assault vessels. The new facilities suggest Beijing has given the order to move forward with the construction of its massive, new Type 076 “landing helicopter docks.” The new LHDs will be able to launch both helicopters and drones, aided by state-of-the-art electromagnetic catapults like those on China’s newest aircraft carrier and the U.S.’s new Gerald Ford-class carriers.

- Even though China already has the world’s largest navy, the new LHD program shows that Beijing intends to expand it further and increase its capabilities in preparation for a potential takeover of Taiwan and/or war with the U.S. On a related note, the Chinese navy today is launching its biggest-ever exercise with an aircraft carrier in the waters around Taiwan, the Philippines, and Guam.

- We continue to believe that China’s unceasing military buildup and modernization program will spark ever-greater concerns among Western officials, drowning out those business elites who argue for maintaining trade and investment ties with China. The result will be further risk for those who invest in companies based in China or who are dependent on the Chinese market.

Japan: In a recent press interview, Bank of Japan Governor Ueda said his policymakers could be in a position to end their negative interest-rate policy by the end of the year, so long as there is continued growth in the country’s consumer prices and wage rates. Coupled with the BOJ’s recent decision to allow longer-term bond yields to fluctuate more widely, the statement provides further confirmation that the policymakers are edging toward tighter monetary policy after years of extraordinarily loose policy.

- In response, the yield on longer-term Japanese government bonds has climbed smartly in recent days. The yield on the benchmark 10-year JGB yesterday closed at 0.705%, up from 0.589% one month ago and 0.251% one year ago.

- The value of the Japanese currency has also sharply appreciated. The JPY yesterday closed at 146.51 per dollar ($0.0068), for an appreciation of almost 1.0% from its level just one week ago.

United Kingdom: In the three months ended in July, average wages excluding bonuses were up a record 7.8% year-over-year, while average total pay was up 8.5%. The figures show British pay has now grown faster than the 6.8% rise in the consumer price index over the last year, which should boost consumer purchasing power and tempt the Bank of England to hike interest rates further. On the other hand, the monetary policymakers will be concerned about a separate report today showing that in the three months to June, the value of residential mortgage in arrears was up a full 28.8% year-over-year, as rising interest rates put pressure on homeowners with floating-rate mortgages.

Libya: Mediterranean Cyclone Daniel has devastated areas of coastal Libya, causing massive flooding and at least 5,000 deaths. Libya is not a major economy, but the destruction could drive more Libyans toward migrating to Europe, potentially causing a new, politically divisive migration crisis in that important economy.

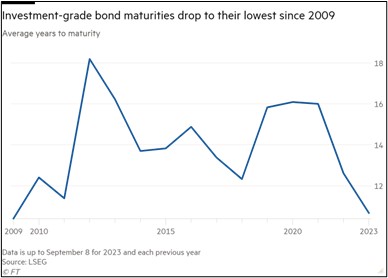

U.S. Bond Market: New data from LSEG shows corporate bonds issued so far in 2023 will come due in an average of 10.0 years, marking the shortest average maturity in more than a decade. The average maturity for investment-grade bonds has fallen to about 10.5 years, while the average for junk bonds has fallen to 6.0 years. The shorter maturities suggest firms are betting that the Federal Reserve will soon be cutting interest rates.

U.S. Defense Industry: As we’ve tracked rising U.S.-China tensions and resulting growth in U.S. defense budgets, we’ve noted that the relatively small, post-Cold War defense industrial base is bumping up against capacity constraints that are slowing the effort to rebuild allied defenses. However, recent articles in Defense News illustrate how the Defense Department is helping address those problems.

- To accelerate the output of submarines, for example, the Navy since 2018 has spent some $2.3 billion on initiatives such as:

- Promoting “strategic outsourcing,” which removes bottlenecks by shifting heavy subcomponent manufacturing out of the shipyards, and with those modules produced elsewhere, the shipyards can focus on final assembly, outfitting, and testing;

- Providing funds to help expand and modernize the two existing shipyards that produce ballistic missile submarines and attack submarines; and

- Expanding the supplier base by providing capital investment funds to smaller private firms so they can begin producing submarine-certified components.

- As these examples illustrate, the effort to expand the defense industrial base will help feed the re-industrialization of the U.S. economy that we’ve been writing about. As we’ve argued, re-industrialization will likely boost investment prospects in the industrial sector.

U.S. Auto Industry: Automaker Stellantis (STLA, $18.69) said it has made progress in its negotiations for a new labor contract with the United Auto Workers, just days before the Thursday expiration of the current contract and the potential start of a disruptive strike. The referenced progress probably relates, at least in part, to the company’s industry-leading offer of a 14.5% pay raise and the UAW’s modest cut in its demands to a pay hike of about 35%. Still, UAW chief Shawn Fain complained that Stellantis and the other major automakers have waited until the last moment to make their economic offers, indicating he will keep up pressure on the firms in the hope of extracting large pay increases and other benefits.

Global Oil Market: Fatih Birol, chief of the International Energy Agency, argues in an opinion article today that the world is coming to the end of the fossil fuel era, as the agency for the first time forecasts that global demand for petroleum oil, natural gas, and coal will peak before 2030. According to Birol, the new, earlier forecast for peak consumption of fossil fuels can be attributed to the greater-than-expected investments in renewable energy projects over the last year.