Daily Comment (October 5, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning and happy Monday! Equity markets continue to work higher this morning. We lead off with the president’s condition. Policy news follows, which will focus on the potential for further stimulus. There are three international areas of concern this morning—Brexit, Belarus, and Armenia/Azerbaijan—we summarize the latest. China news is next, with a recap of economic news. We close with the pandemic update. Let’s get after it:

The President and COVID-19: Commentary and speculation continue to swirl around the president’s medical condition. It does appear he is getting aggressive treatment; for example, he reportedly has been given the steroid dexamethasone. Normal protocols usually deploy this drug when a patient is severely affected by this virus. That may not be the case this time, but if it is, it would suggest the president is rather ill because dexamethasone does carry significant side effects.

- One of the questions we have been getting is what happens if the president’s condition becomes grave. VP Pence would, at some point, take over his duties. What happens for the election if the president can’t run? The GOP leadership will convene and select a candidate. The party’s 168 national members (three from each state and territory) meet to determine a candidate. However, who gets on the ballot would be up to the states. Given that voting is already underway in some states via mail-in ballots, the election would likely be decided by Congress. In other words, if the president becomes incapacitated at this late date, the situation will become quite messy.

- National Security Advisor O’Brien warned America’s enemies that they should not entertain aggression due to the president’s illness.

- History shows that presidents have hidden their medical conditions. Grover Cleveland had surgery on his jaw to remove a tumor on a yacht anchored offshore to hide the situation. Woodrow Wilson suffered a severe case of Spanish influenza and had a stroke; his wife mostly performed the functions of the president. Franklin Roosevelt’s medical condition in his fourth term was grave; it was generally expected by his doctors that he would not survive the term, but he ran for office anyway. President Kennedy hid his numerous maladies, including Addison’s disease. Full transparency would be unusual.

Stimulus in parts? President Trump has indicated he would like to see another round of fiscal stimulus. In an interesting development, Speaker Pelosi has indicated she would support separate aid for the airline industry. If true, this path would undermine her desire for a larger package and suggests she sees her negotiating position as weak. We suspect the speaker is trying to placate moderate representatives who want to show they will able to bring home fiscal support for their districts. Other policy news:

- The Treasury has opened an investigation on whether or not Vietnam is manipulating its currency.

- The U.S. is preparing an antitrust suit against Google (GOOGL, USD 1455.60).

Belarus: The EU has sanctioned 40 members of the government, but, interestingly enough, not Lukashenko. Belarus has withdrawn foreign media accreditation, meaning foreign journalists will be forced to leave the country.

Brexit: Although Chancellor Merkel remains optimistic, the broader EU is concluding that the likelihood of a hard Brexit is high. A no-deal Brexit would, no doubt, be disruptive, affecting the trade in medical goods, causing border snags, and raising uncertainty.

Nagorno-Karabakh: Fighting continued over the weekend between Azerbaijan and Armenia. Turkey has aligned with the former, and Armenia is in a difficult position given that Azerbaijan has a much better funded military due to its oil industry. Turkey’s F-16s reportedly attacked Armenian positions. Armenian artillery attacked the Azerbaijan city of Ganja over the weekend; the city is the nation’s second largest. In previous flare-ups, Russia has eventually intervened and restored a cold peace. However, Russia, dealing with the economic blowback of the pandemic and weak oil prices, appears less willing to race in this time. And, the U.S. is obviously distracted. Thus, Turkey may view this situation as an opportunity. There is the potential for a disruption of oil supplies from the Baku region, but given global oversupply we doubt it would have a lasting bullish impact on prices.

China: Fifty senators have sent a letter to USTR Lighthizer urging him to make a trade deal with Taiwan. We doubt the USTR will be likely to do this, as making such an arrangement would end any future negotiations with Beijing. However, the letter does highlight the fact that Congress is becoming increasingly anti-China. China has developed a dominant market position in various key metals; as relations deteriorate, the West will need to develop these resources itself. China can easily manipulate prices of these metals, making private investment too risky. Thus, the government is stepping in to provide support. China’s largest chipmaker, Semiconductor Manufacturing International Corp (USD SMICY 11.77), has been informed by U.S. suppliers that export restrictions may prevent them from selling goods to the company.

Economic news: Some states apparently overpaid laid-off workers. They want their money back, and it is unlikely these recipients have the savings to pay the states back. Congress may deliver relief at some point, but, given how slow the states were to meet the demands for unemployment insurance, the mere news of this situation could crimp spending.

- Due to delays in movie releases, Regal Entertainment (CNWGY, USD 2.20) is shutting down its theaters.

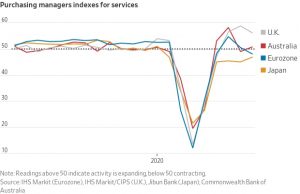

- Eurozone services PMI data shows a definite softening, raising concerns that the recent rise in COVID-19 cases may be weakening the economy.

(Source: WSJ)

COVID-19: The number of reported cases is 35,231,182 with 1,037,914 deaths and 24,539,096 recoveries. In the U.S., there are 7,418,836 confirmed cases with 209,734 deaths and 2,911,699 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors.

Virology:

- Although we don’t expect statewide or national lockdowns to return, localized lockdowns remain likely. A rise in cases is prompting NYC to consider localized restraints to slow infections.