Daily Comment (October 19, 2018)

by Bill O’Grady and Thomas Wash

[Posted: 9:30 AM EDT] Global equities are mixed this morning due to concerns about a possible stand-off between the EU and Rome along with slower than expected GDP growth in China. Here are the stories we are following today:

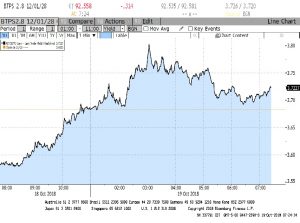

Italy budget: In a rebuke to Rome, the European Commission (EC) presented the Italian government with a letter stating its budget was in breach of EU budget rules. The EC’s comments suggest it will likely take the unprecedented step of rejecting the budget proposal. The Italian government was given until Monday to issue an official response. Concerns of escalating tensions between Rome and the EU are likely overblown as Italy has suggested it is unwilling to entertain discussions of an EU exit. Following the report, 10-year Italian bond yields rose about 20 bps and then saw a slight retreat.

Chinese economy: Chinese officials were forced to offer reassurances to financial markets after the GDP report showed the economy has slowed more than expected. In response to the GDP report, Vice Premier Liu He stated that the impact of the trade war with the U.S. is more psychological than actual and that the two countries plan to meet during the G20 summit. Nevertheless, the National Bureau of Statistics of China warned that the economy could experience “greater downward pressure” in the future. In response, Chinese regulators stated the Chinese government is willing to facilitate private equity investments, speed up merger approvals and support bond prices. Chinese equity markets rebounded as a result of the news of additional government support.

Gibraltar agreement: In a rare win for UK Prime Minister Theresa May, the UK was able to broker a deal with Spain regarding Gibraltar. Although the details of the arrangement have not been released, the deal is believed to alleviate worries of ongoing disputes between the two nations following Brexit. Gibraltar, which was ceded to Britain under the 1713 Treaty of Utrecht, has been a source of tension between the two countries as both believe they have ownership over the sovereign territory. Following the UK’s decision to exit the EU, tensions over Gibraltar escalated when the former Spanish foreign minister, Jose Manuel Garcia-Margallo, vowed to plant the Spanish flag in the territory after the Brexit vote and a former Conservative party leader, Michael Howard, claimed PM May was willing to go to war over the region. With this agreement in hand, PM May still needs to find a reasonable solution for the North Ireland border, which has proven to be a sticking point in Brexit negotiations.

WTO dispute: The U.S. has requested the World Trade Organization’s dispute panel to review the legality of retaliatory trade tariffs imposed by China, Mexico, Canada and the EU. Earlier in the year, China, Mexico and Canada filed a suit questioning the legality of the U.S.-imposed steel and aluminum tariffs. Although the WTO does not have any enforcement powers, disputes regarding tariffs will likely test the agency’s ability to mediate rising trade concerns. The U.S. has called out the organization for not doing enough to address growing trade imbalances. If the WTO’s decision is unfavorable to the U.S., we expect it to withdraw from the organization.