Daily Comment (October 12, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

Good morning. It’s Columbus Day, so commercial bank operations are partially closed. There is no official market for Treasuries today, although you can still trade Treasury futures. Equity markets are working higher this morning. Judge Barrett’s confirmation process begins this morning and will dominate the media. We start today with China news; the Golden Week holiday is over, and China is heading back to work. EU policy toward American tech firms comes next. In U.S. policy news, current talks are at an impasse. Our ongoing coverage of the pandemic follows. In global news, we recap the North Korean military parade, the 10th week of protests in Belarus, and the IMF/World Bank meetings that are starting in Washington. Here are the details:

BREAKING: The BOE is discussing the potential impact of negative policy rates on the banking system. No details are available, but the news adds to evidence that the U.K. central bank is considering negative policy rates.

China news: One of the important insights during Golden Week was that internal travel returned. Domestic flights rose 13% from last year, further evidence of China’s economic recovery from the pandemic.

- Although it is clear that relations between the U.S. and China are cooling rapidly, apparently the financial industry hasn’t taken notice. During the Trump administration, 102 Chinese companies have listed on U.S. exchanges compared to 105 during the last administration’s two terms. Some of this growth may be tied to fears that this avenue of financing is closing, and Chinese firms want to tap U.S. markets while they still can.

- Last week we noted that the CNY had been appreciating. Right on schedule, the PBOC has eased financing costs to short the currency in an attempt to slow the currency’s rise.

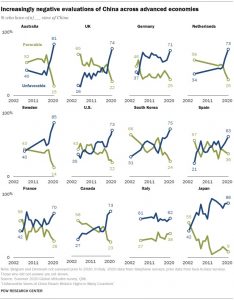

- Pew has issued a survey showing that there has been a sharp rise in unfavorable views toward China.

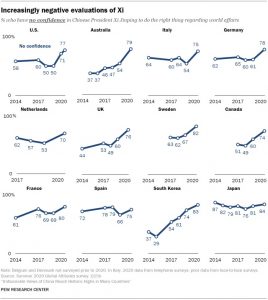

This clear rise in negative views is seen in attitudes toward Xi Jinping.

Coupled with falling U.S. ratings, the trend toward a leaderless world does seem to be accelerating.

- National Security Advisor O’Brien, in a speech at UNLV, warned China that a military takeover of Taiwan would be difficult and maintained the U.S. policy of strategic ambiguity regarding the possible U.S. reaction to military action against the island. The policy of ambiguity is designed to keep both sides unsure of what the U.S. would do; by not being explicit, it keeps Taipei from acting boldly, assuming U.S. support, and keeps Beijing from believing it can act with impunity against Taiwan.

Technology: The EU is planning tougher regulation against large tech firms that are mostly based in the U.S. The goal of the EU is to curb the power of these firms. Although U.S. regulators are moving against some tech firms on antitrust grounds, we would not expect the U.S. to look favorably on Europe’s attempts to regulate these firms. And, in what looks like a PR mistake, Silicon Valley firms are said to be cutting salaries of workers who decamp to lower-cost areas to work.

U.S. Policy: Although talks continue, Congress and the White House remain at an impasse on fiscal stimulus. We suspect that nothing will be done before the election. Although the economic data does support the idea that the recession is over, there is a growing risk that the recovery will be sluggish. That outcome isn’t necessarily bad for financial markets as it extends the length of monetary policy accommodation. However, the economic and political fallout could be negative.

COVID-19: The number of reported cases is 37,575,402 with 1,077,629 deaths and 26,109,425 recoveries. In the U.S., there are 7,763,457 confirmed cases with 212,789 deaths and 3,075,077 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors.

Virology:

- Europe is rapidly losing control over the virus, and governments are trying to reimpose controls. However, a degree of pandemic fatigue has set in, and compliance has been spotty. The resurgence is likely tied to cooler weather, which is leading to people moving back inside, increasing the likelihood of infections.

- Europe isn’t the only place to see a faster pace of infections. India is also dealing with a rapid spread.

- As we have been reporting recently, New York is facing areas where the virus spread is accelerating. So far, the outbreaks have been localized, but there is fear of a new and wider surge in cases. Across the U.S., cases have been rising.

- Vaccines carry some degree of risk. Although they are generally safe for most people, there have been incidents of error that have harmed recipients. Because of this risk, the U.S. government has a program designed to compensate victims who have been harmed by a vaccine. However, for COVID-19, the U.S. is planning to use a program that is less generous to those harmed. We will be watching to see if this decision has any negative impact on acceptance.

- The debate over opening elementary and secondary schools has been heated. Many parents would like to see schools reopen; managing home learning is difficult for parents who have outside jobs. At the same time, teachers fear they will be at risk from their students. As some schools reopen, we are seeing the data come in and the indications are that these schools are not all that risky. In other words, the data suggest schools should reopen.

Restaurants and economics: The National Restaurant Association reports that 100,000 outlets have closed over the past six months due to the pandemic. That is about 17% of the total for the nation. Some of these closures are temporary, but for many the closures will likely be permanent. Another developing trend is that larger chains are better equipped to adapt to the pandemic. They have access to capital to restructure their businesses and can conduct regional or national ad campaigns to highlight their adaptations. Smaller restaurants often lack this capacity and are prone to failure. Although there is great fear that the post COVID-19 world could be one where there are few independent outlets, in reality, the restaurant industry is one that is characterized by easy entrance and exit. Therefore, the cost of starting a restaurant isn’t extreme, and the ability to close one, compared to a factory, is less onerous. For that reason, we would expect a recovery once the pandemic passes. That doesn’t mean there won’t be changes; the focus on takeout will still be elevated.

World news: Here is the recap of the weekend.

- As we noted last week, North Korea was celebrating the 75th anniversary of the founding of the Workers’ Party and with that featured a military parade. These are watched closely by analysts to monitor the Hermit Kingdom’s military progress. The parade didn’t disappoint. Two new missiles were unveiled, a Hwasong-16 and a Pukguksong-4. The former is a massive “mobile” ICBM. If operable, it would be the world’s largest. It isn’t apparent why Pyongyang wants such a large missile. The Hwasong-15 is more than capable of reaching the U.S. and is easier to launch. The Hwasong-16 is so big that (a) it would be easy for the U.S. to track its movements, and (b) it would take so much time to set up that it would risk destruction before launch. The Pukguksong-4 is a SLBM. As with the Hwasong-16, it is larger and has greater range than those North Korea has in its current arsenal. It should be noted that neither missile has been tested; in fact, it is possible they could be mock-ups. The news is not friendly but not overly threatening.

- The EU is calling on the U.S. to end tariffs on its commercial aircraft, warning it will escalate tariffs if it gets a favorable ruling from the WTO on October 15. The U.S. won the right to retaliate against EU subsidies for its aircraft manufacturing. The EU is seeking similar rights in its countersuit.

- Although Russia was able to negotiate a ceasefire in the Armenia/Azerbaijan conflict, it doesn’t seem to be holding. Russia is usually able to bring these tensions under control, but with Turkey’s overt support of Azerbaijan, it may take more aggressive action by Moscow to freeze this conflict.

- The IMF/World Bank meetings are occurring this week in Washington. Emerging economies are using the event to press for additional debt relief.

- A group of militias with ties to Iran have offered the U.S. a conditional ceasefire if the U.S. presents a timetable for leaving. We doubt the U.S. will take up the offer; first, it makes the U.S. look weak to accept such terms, and second, it isn’t obvious if the group represents the majority of militias. At the same time, U.S. troop levels are falling to a point where keeping them in Iraq is becoming a problem. There are probably too few now to be a deterrent, but they remain attractive targets.

- The Belarus protests continued this weekend.