Daily Comment (October 1, 2020)

by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EDT] | PDF

It’s the first day of the fourth quarter and the start of China’s “Golden week.” The EU begins its summit today. U.S. equity markets continue their rally this morning; Tokyo markets were affected by a technical glitch. We begin our comments with policy news, discussing the chances for a stimulus bill, with economic news to follow. China news comes next followed by our regular pandemic update. A comment on technology and Russian tax policy closes out our discussion. Being Thursday, the Weekly Energy Update is available. Here are the details:

BREAKING: Negotiators between the EU and U.K. appear to be making significant progress on an exit agreement. The GBP has lifted on the reports. Fishing rights are said to be the last sticking point.

Policy news: Some of the recent rally seems to be tied to hopes for a stimulus package, although steadily improving earnings outlook is part of the lift as well. House Democrats have proposed a $2.2 trillion package; Speaker Pelosi and Treasury Secretary Mnuchin have been in talks. The two sides are still negotiating and, so far, the speaker hasn’t called a vote on the Democrats’ package, which is good news. That means there is still hope for talks. Our position is that a deal is unlikely. Here’s why. First, the White House still seems to think that $2.2 trillion is too much spending; we suspect this position is being driven by Chief of Staff Meadows, who represents the austerity coalition of the GOP. Second, it doesn’t look like there is any appetite for more spending among Senate Republicans. Recent economic data has been pretty good, although a few of the high frequency numbers suggest some softening is developing. We remain surprised that the president hasn’t pushed harder for more spending, but he may have concluded that looking like he “caved” to the opposition is more costly to his re-election than a slowing economy. In reality, given the lags in data reporting, if we are weakening, the data won’t clearly show it until after the election.

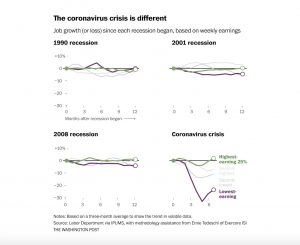

- One characteristic of this recovery has been its bifurcated nature. Less affluent households have been hard hit, while the better off have managed rather well.

Although the lowest earning cohorts always tend to suffer more, this time around they have been especially hard hit. Meanwhile, the top quarter has fully recovered. What the political class may be missing is that the middle 50% suffered more than normal in this downturn. The other part they may be missing is that layoffs are starting to rise. Airlines are warning that they will start furloughs without further funding. Insurance companies announced layoffs. Energy companies, chemical firms, and financial firms did, too. Although layoff news is always anecdotal and may not reflect hiring elsewhere, it can also act as an early warning of future weakness.

We fully expect that further fiscal spending will be implemented regardless of who occupies the White House next year. Obviously, the priorities and levels may be different. If the recent rally in stocks is based on optimism over a fiscal package, we may be due for a pullback. The key item to watch for is if the House calls a vote without clear signals of support from the White House. That will mean the Democrats believe that a deal cannot be made, and they want it on the record that they offered a plan that was rejected. However, even if the White House is on board, we don’t expect the Senate to necessarily agree.

- The President has signed a spending bill that prevented a government closure.

- The Fed has announced its restrictions on bank buybacks, and dividends will remain in place for Q4.

- The ECB has indicated it might follow the Fed in allowing inflation to temporarily overshoot its target. The Fed’s mandate was less clear than the ECB’s, which has treated 2% as an inflation ceiling. We still have doubts that the ECB will, in practice, allow inflation to overshoot for any significant length of time.

Economic and market news:

- In a recent AAW, we noted the drop in 65-year-old+ labor participation. Since we wrote that report, there has been some recovery, but older workers have not fully returned, and we speculate that many of those who left the workforce due to the virus won’t be back. The disruptions to daycare may lead to lasting changes in the female workforce as well. As schools close and daycares are affected, parents are being forced to stay home and, in some professions, this means underemployment or unemployment. The effect may be magnified for African-American women.

- Although the overall economy is clearly recovering, the pandemic is accelerating changes in the economy. One area being especially affected is retailing. Store closures are rising rapidly as consumers opt for home delivery and people are reducing their shopping trips. We expect this trend to have an adverse effect on commercial real estate as well.

- The backbone of the shadow banking system is the money market. In fact, Perry Mehrling, a leading economist on the shadow banking system, defines it as “the money market funding of capital market lending.” The problem from this structure for the financial system is that there is no “deposit insurance” for money markets. Before deposit insurance, bank liabilities were “runnable,” meaning that if depositors demanded their cash, the bank can’t meet its obligations and can fail. In theory, money markets shouldn’t need insurance. Since they don’t guarantee a stable NAV, a fund under pressure should simply “break the buck.” But in reality, the industry has always sold itself as a high-yielding alternative to bank deposits, so a NAV of less than $1 leads to a cascade of trouble. Regulators are starting to realize that the reforms put in place after the Great Financial crisis probably failed to fully protect the system. It looks to us like there are two alternatives; the first is to create deposit insurance for the money market, likely ending its yield advantage, or, second, make it abundantly clear to investors that the NAV isn’t set at $1 per share.

- Another issue lurking on the policy front is the potential for asset inflation. Monetary policy works through the financial system; until the Fed is directly sending money to households and businesses, the way monetary policy works is to lift asset prices. We constantly respond to questions about inflation; rising price levels is a legitimate concern, but it is misplaced in the near term. Monetary policy stimulus under conditions of high inequality tends to lead to asset, not goods, inflation. One way of thinking about inflation is that it is a measure of the relative power of capital compared to labor. When capital dominates, inflation tends to be tame. We have been arguing, for some time, that a flip from efficiency to equality is on the horizon. But, until it actually arrives, policy stimulus is bullish for financial assets, which creates its own problems. Since we view it as politically impossible for the Fed to raise rates because the P/E is too high, asset markets will likely remain well supported.

- One factor that may accelerate the equality trend is the political discussion of income taxes.

- The Fed’s Main Street lending program has the potential to facilitate direct lending to the economy. However, it hasn’t exactly been rapidly adopted yet. Banks are blaming the Fed’s credit conditions for the lack of lending.

China news:

- A House report indicates that U.S. spy agencies are still focusing on counterterrorism instead of great power competition with China. This has been an issue for the military as well. After 9/11, the efforts of security forces were on preventing terrorist acts. With the rise of China, we have seen the military shift its posture; this is why the Middle East will soon be on its own. The House GOP has released its own recommendations to oppose China, although it is notable that there is a high level of bipartisanship on this issue. As a side note, there is clear evidence that having an external enemy tends to lead to bipartisanship. Perhaps the path out of our current political turmoil is tensions with China.

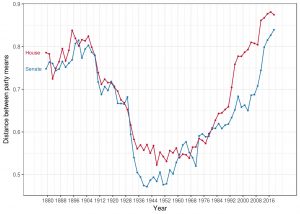

(Source: Rosenthal and Poole)

This chart shows the degree of partisanship in Congress. The higher the reading, the greater the level of partisanship. Although partisanship began to fall during the Progressive Era and the Great Depression, it remained low for most of the Cold War. The end of the Cold War saw a rapid rise.

- As the U.S. continues its withdrawal from the world, China is steadily increasing its influence. This influence has started to emerge at the U.N. Beijing has steadily increased its participation at the U.N., putting its bureaucrats in more positions. Essentially, the U.N. is morphing from a body designed to promote democracy and human rights to one doing the bidding of China.

- SoS Pompeo is traveling to the Far East beginning October 4. Although it is not on his official agenda, a detour to Taiwan would trigger a major backlash from Beijing. China has been increasing tensions with Taiwan for much of the past two years.

- China has also been steadily acquiring companies in Europe. Beijing has successfully disguised state involvement in these purchases, increasing China’s influence in Europe.

- Commentators are noting that surveillance in China has reached the point where comparisons to North Korea are being made. This situation is especially true in areas like Xinjiang.

- China’s Semiconductor Manufacturing International (SMICY, USD 11.68) is stockpiling chip equipment in response to U.S. export restrictions.

COVID-19: The number of reported cases is 34,010,539 with 1,014,995 deaths and 23,671,237 recoveries. In the U.S., there are 7,234,327 confirmed cases with 206,963 deaths and 2,840,688 recoveries. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high frequency data on various factors. The weekly Axios state infection map shows an increasing number of states reporting rising cases.

Virology:

- Scientists have been gathering information about COVID-19 since it arrived in January. As data is being gathered and analyzed, one of the factors that has emerged is how broadly the virus affects some of those infected.

- Some patients exhibit symptoms of malaise that endure, such as fatigue, a lingering cough, shortness of breath, headaches, etc. Damage to the heart, lungs, and brain have been reported across all age brackets. Blood clotting has been common, especially micro-clotting of capillaries. Myocarditis, inflammation of the heart muscle, has been reported in patients even with mild cases. This means the medical system may have to deal with longer-lasting effects from the virus.

- The virus tends to be most deadly for the elderly, who often have comorbidities. One of the more intriguing developments is that genetic abnormalities appear to affect how patients react. Some people have genetic defects that restrict interferons, which is part of the immune response. COVID-19 appears to be more lethal for these patients. If there turns out to be a genetic marker that could easily be identified, it could allow for governments to more easily protect those most vulnerable and, at the same time, avoid broader lockdowns.

- At the same time, there is growing speculation we may be closer to herd immunity than initially suspected. The basic math of epidemics suggests that herd immunity isn’t achieved until 60-70% of the population is infected. But that calculation assumes a homogenous population and random contacts. In a heterogeneous population, there may be some degree of innate immunity, meaning that the population is probably not homogenous. Broad surveys of blood samples suggest that some people may already have some degree of immunity due to exposure to other coronaviruses. These developments are potentially good news It doesn’t mean the virus will no longer be with us, but it will likely become more manageable over time even before a vaccine is developed.

- Nursing homes have been an epicenter of fatalities. A government program is now helping these facilities by providing rapid rapid test equipment.

- Although governments began the process of reshoring due to the pandemic, progress on this front has been remarkably slow.

- Russia is close to approving a second vaccine.

Odds and ends: Technology regulation is another bipartisan issue. Although the issues are somewhat different for the right and left, both agree that the sector needs to be regulated more strictly. The left is a greater threat to investors in technology, as its regulation looks to break up the sector through antitrust.[1] Google (GOOG, USD 1465.60) says it will spend $1.0 billion to pay news providers, with the preliminary focus on Europe. Tech news aggregators have tended to oppose paying providers, but they may have realized that (a) the providers may cease to exist because the tech firms have mostly destroyed their business model, and (b) the media can affect sentiment and giving money to the providers may lead to more friendly coverage at some point. Putin has decided to close Russia’s budget gap by taxing the country’s oligarchs. The leaders of Russia’s major firms are not taking the decision well.

[1] Actually, the history of antitrust actions breaking up large firms for the most part turns out to be favorable to investors. Large firms are hard to manage well, and when a big firm is broken up, the resulting companies often do very well, unlocking shareholder value. The breakup of Standard Oil is a classic example.

[1] Actually, the history of antitrust actions breaking up large firms for the most part turns out to be favorable to investors. Large firms are hard to manage well, and when a big firm is broken up, the resulting companies often do very well, unlocking shareholder value. The breakup of Standard Oil is a classic example.