Daily Comment (October 6, 2023)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Our Comment begins with a discussion about whether the Fed can deliver a soft landing, Russia’s decision to reverse course on oil exports, and why investors should pay attention to Mexican politics. As usual, our report also provides an overview of the latest domestic and international data releases.

Landing in Limbo: Investors are divided on whether the economy will achieve a soft or hard landing, but they agree that the labor market will be a key factor in determining the outcome.

- A week after the Federal Open Market Committee (FOMC) released its economic projections which showed upward revisions to GDP and interest rates, investors have expressed skepticism about the FOMC’s optimistic outlook. The FOMC’s forecast contrasts starkly with CEO and consumer predictions of an 84% and 69% chance of a U.S. recession in 2024, respectively. The uncertainty has rattled financial markets, with the S&P 500 falling nearly 5.0% since September 1, as investors lock in gains and position themselves for a possible correction. This cautiousness may persist until investors see clearer signs of the U.S. economy’s direction.

- The labor market is the biggest source of contention, as it has remained stable despite other signs of economic weakness. Employment levels are high, and initial claims and unemployment have remained near historic lows, even as the Federal Reserve has raised interest rates to their highest level since 2007. This strong labor market has fed optimism that a recession is unlikely in the near term. However, below-trend growth in labor force participation from workers over the age of 55 has led to concerns that the data is still being impacted by pandemic distortions.

- Recessions are notoriously difficult to predict because economic conditions can change rapidly and without warning. This uncertainty explains why investors have cooled on government bonds, as mixed data has complicated efforts to price in risk. Next year will be another test of forecasters’ accuracy, as many still believe the country will enter a recession in the first half of 2024. That said, despite evidence of decelerating economic activity, especially in consumer spending, we remain optimistic that the expansion still has a lot of gas left in the tank.

Trouble in Moscow? Russia has begun to ease some of its oil export restrictions in a sign that the government is seeking to increase its revenue.

- The Kremlin announced that domestic producers would resume seaborne exports of diesel on Thursday, reversing a three-week ban imposed due to domestic supply concerns. The decision was likely an attempt to prevent rising fuel prices from becoming a political liability ahead of the March 2024 elections. The U-turn comes days after a report showed that Saudi Arabia and Russia, the leaders of the OPEC+ oil production cuts, increased crude exports last month, allowing Moscow to inflate its profit margins at a time when it is seeking to increase its military spending in Ukraine.

- The increased availability of Russian oil should help relieve some of the tightness in the crude market. Over the past few months, fuel prices have risen as refiners struggled to make up for the shortfall created by Russia and Saudi Arabia’s decision to cut crude production. This has led to a strain in crude inventories in many countries, including the United States. In August, global commercial inventories declined by 60 million barrels, with the U.S. seeing a drawdown in Cushing for 12 out of the previous 13 weeks. Diesel prices in Europe fell 3.0% after reports of Russia’s policy shift.

- That said, a potential economic slowdown may have bolstered Russia’s decision to reverse course. Oil prices were approaching $100 a barrel a few weeks ago, but anxiety about future demand due to growth concerns has caused prices to fall. This week, Brent prices fell below $85 a barrel, erasing the gains made in September. The price slump will likely hurt Russian efforts to increase the budget by 26% in its next fiscal year. Last month, it was able to run a surplus in oil sales, but it is unclear whether this will persist if prices continue to fall.

AMLO Is Not Your Friend: With a little over a year left in his presidency, President Andrés Manuel López Obrador (AMLO) continues to rattle investors.

- Mexican President AMLO surprised investors with an unexpected change to airport concession agreements. The new arrangement changes the tariff system which affects passenger fees, airport services for the use of runways, and leasing spaces to airlines and suppliers. The move appears to be driven by AMLO’s long-running feud with the airline industry and his desire to nationalize the sector. In 2018, AMLO canceled the construction of a new airport, only to reopen an alternative hub in a former military air base three years later. Earlier this year, he announced the revival of the state-run airline Mexicana de Aviación and transferred the operations of Benito Juarez International Airport to the Navy.

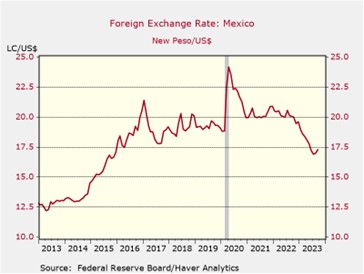

- Mexican assets tumbled after the surprise change to airport concession agreements, as investors were shocked by the government’s decision to challenge previous agreements and feared that other industries could be next. The country’s benchmark stock index fell 4.4% on Thursday, and the Mexican peso (MXN), one of the world’s best-performing currencies, fell 1.7% against the dollar. The sell-off reflects uncertainty about AMLO’s next moves before he leaves office. Last month, the president spooked markets by submitting a budget proposal that would triple the current year’s outlays to their largest level since 1988. As a result, investors offloaded bonds across the various maturities, fearing that AMLO was no longer committed to fiscal conservatism.

- Mexico’s situation illustrates the political risks associated with reshoring manufacturing. AMLO’s efforts to rein in wasteful spending and inefficiencies were widely viewed as positive by investors, and his reputation as a fiscal hawk has contributed to investor optimism that the business environment may improve once he leaves office. However, recent initiatives and AMLO’s political influence suggest that his draconian measures may have been a ruse to usher in a new era of Cardenismo (Mexican nationalist populism), rather than any desire to promote government soundness. Investors should, therefore, pay close attention to Mexico’s elections next year, as AMLO’s successor will likely be pressured to continue his policies.

Ins and Outs: The U.S. shot down a Turkish drone in Syria after military officials believed it posed a threat to American forces. While it is unclear whether this will rupture U.S.-Turkey relations, it does highlight the two countries’ disagreement over Syrian Kurds, whom Ankara views as a threat. President Trump’s influence in Congress is growing after he endorsed Jim Jordan (R-OH) to take over as House Speaker. Jordan’s selection could raise the likelihood of a government shutdown in November. Workers at an LNG plant in Australia will resume their strike, which poses a threat to energy markets, particularly in Europe where Australia is the third largest supplier.