Daily Comment (October 6, 2022)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s Comment begins with a discussion about the Federal Reserve’s insistence on raising its benchmark interest rate despite the global outcry. Next, we discuss the impact that Ukraine’s successes in the south have had on Russian sentiment. We end the report with an overview of how foreign governments are looking to calm discontent within their countries.

The Fed Marches On: Despite calls for the central bank to rethink its policy stance, the Federal Reserve is poised to keep raising rates until it sees trouble.

- The Fed may not be finished tightening, but officials are looking toward the horizon for a potential end date. On Wednesday, San Francisco Fed President Mary Daly pushed back against the suggestion that the Fed will wait until something breaks before it acts. During an interview on BloombergTV, Daly hinted that central bank officials are monitoring economic signals that would suggest it had gone too far. Her remarks indicated that some Fed officials are uncomfortable raising rates in a recession.

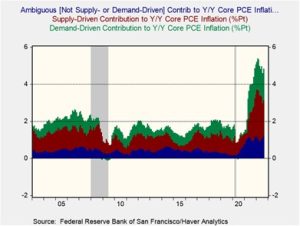

- A possible end to the interest rate hikes explains the rise in gold and equity prices throughout the week. The ISM Supplier Delivery Index, a proxy tool to gauge supply chain efficiency, fell to a post-pandemic low. The improvement in manufacturing deliveries suggests that supply-driven inflation may be on the decline, paving the way for a possible Fed pivot. Investors responded to the report by piling into gold which is now hovering around $1700 an ounce. Additionally, equities mounted a two-day rally that ended after a positive jobs report from ADP signaled that the labor market remains tight.

- At this time, the Fed is on track to continue raising rates until inflation slows to the central bank’s 2% target. The latest CME FedWatch Tool forecast shows a 67.3% chance that the Fed will raise its benchmark interest-rate range of 3.75% to 4.00% and a 32.7% chance of an interest-hike range of 3.50% to 3.75%. The recent movement in the market indicates that many investors believe that the Fed will not be able to keep raising rates for much longer without triggering a recession. As a result, many market participants likely have yet to offload some of their poor-performing financial assets. This scenario suggests that the market may still have a ways to go before it hits bottom if the Fed proceeds with its tightening cycle.

Ukraine update: As Russian losses continue to pile up, Moscow learns to accept some hard truths.

- This war is becoming increasingly unpopular. After Putin’s call for “partial mobilization,” Russian protests have become louder and more widespread. Although most of the pushback initially came from major cities such as St. Petersburg and Moscow, there are now signs of resistance in poorer areas such as Dagestan. The sustainability of this war hinges on the Kremlin’s ability to maintain popular support. Unfortunately for Putin, time may not be on his side as he would like to secure a decisive victory in Ukraine before he begins his presidential campaign late next year. Putin is unlikely to lose any election, but the lack of turnout could dent his political clout. Although we are not forecasting his ousting, we would like to remind our readers that his exit would likely be sudden.

- The removal of Putin would lead to much uncertainty as it is unclear who would be his replacement. Additionally, his transition from power may not be peaceful as Putin has many supporters in the military. As a result, Putin’s removal could lead to a rush toward safe-haven assets in the short run as events played out.

- Low morale among Russian troops is a core reason why Ukraine has been so effective in their campaigns. The Ukrainian offensive in the southern part of the country has led to a series of Russian retreats, and although the mobilization effort will likely provide the army with more manpower, it also has the potential to lead to more disobedience. The lack of support among Russian soldiers may have contributed to Putin’s decision to promote the controversial Chechen leader Ramzan Kadyrov to Colonel Leader on Wednesday. Additionally, Russia could look to push for Belarus to become involved in the war. As Ukraine’s forces continue to stack up successes in the south, Russia is likely to take more extreme actions.

- The longer the war rages on, the more isolated Russia will become from Europe. In 2021, the EU accounted for 36.5% of its imports and 37.9% of its exports. Its deep trade ties with Russia have made the two sides somewhat dependent on each other for critical resources and revenue. However, this dynamic is on the verge of changing following Russia’s invasion of Ukraine. On Thursday, U.S. exporter of LNG Venture Global signed a contract to provide Germany with liquified natural gas. This is the only deal thus far between Germany and the U.S., but it is unlikely to be the last.

- The disentanglement between Europe and Russia will likely favor Western energy companies as countries look to prioritize the security of resources over convenience.

Global discontent: The slowdown in growth and inflation has led to political backlash worldwide, and governments are starting to respond.

- China has ramped up its corruption crackdowns in the run-up to the country’s Communist Party Congress later this month. Although Chinese President Xi Jinping has made fighting corruption a central theme of his leadership, some of these investigations appear to target mainly potential rivals and critics. We suspect that the crackdowns are a way to make it easier for Xi to push through policies that may not be growth friendly. This shift is designed to help China decouple from the West and become more self-sufficient. As a result, investment opportunities in China may not be as plentiful in the future.

- The White House is preparing to punish OPEC+ for its decision to cut its oil output by 2 mbpd. The Biden administration is working with Congress on legislation reducing the oil cartel’s control over energy prices. Introduced in May, the aptly named NOPEC bill seeks to expose countries to anti-trust lawsuits from the U.S. government. However, it is unclear how the U.S. could enforce a ruling against a foreign country. These countries’ dependency on the American financial system could be a target. If we are correct, the weaponization of the dollar will likely encourage countries to diversify their currency holdings away from the U.S dollar.

- Prime Minister Liz Truss failed to quell criticism of her tax policies from fellow Tories. Truss was heckled at the Conservative Party Conference after members were displeased with her bold fiscal plan that rattled markets and temporarily tanked the British pound. Although she vowed to plow ahead with her agenda, the conference showed that she might be losing support from members of her party. The latest polls show that the Labour Party would win if elections were held today. Although elections are not until January 23, 2025, Labour’s lead is not a good sign for the Tory leadership. Hence, Truss could be pushed out if she cannot regain support for her policies.